This article is an on-site version of our #techFT newsletter. Sign up here to get the complete newsletter sent straight to your inbox every weekday

Netflix’s shares lost as much as a quarter of their value today, after the streaming service disappointed on subscriber numbers and investors continued to bail out of stocks that have prospered in the pandemic.

The company predicted it would add just 2.5m subscribers in the first three months of this year, far fewer than the 4m additions that analysts expected it to repeat from the first quarter of 2021. Its shares fell more than 24 per cent in early trading on the Nasdaq, wiping about $55bn from the group’s market value.

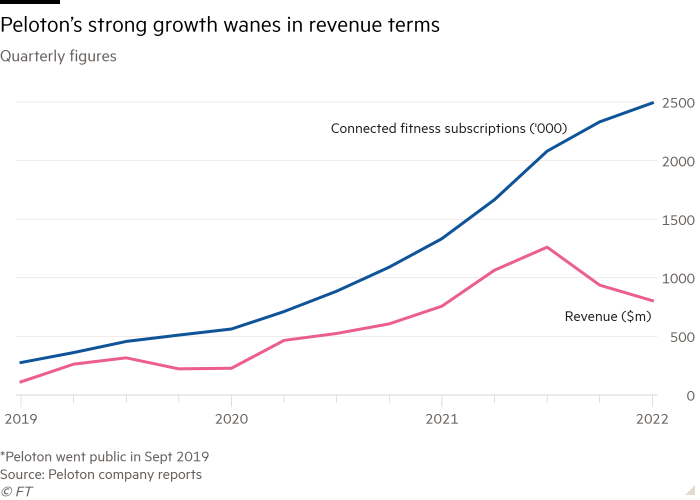

Shares in networked fitness provider Peloton had fallen by about a quarter following a report on Thursday that it was temporarily halting production of its bikes and treadmills. Another stay-at-home stock, video conferencing service Zoom, is trading at its lowest level since May 2020.

Growth stocks in general have been under pressure, with the tech-heavy Nasdaq on Wednesday closing more than 10 per cent below its all-time high hit in November, putting it in correction territory.

The index will be tested again next week when the tech earnings season begins in earnest. On deck are IBM (Monday), Microsoft (Tuesday), Intel (Wednesday) and Apple (Thursday).

The Internet of (Five) Things

1. DeepMind co-founder quits

Mustafa Suleyman, co-founder of AI pioneer DeepMind, has quit Google after seven years to join a VC firm. His tenure had been controversial, including complaints from staff of an aggressive management style. Elsewhere, Peiter Zatko, head of security, and Rinki Sethi, the chief information security officer, are both leaving Twitter.

2. Jack Ma under fresh scrutiny in China

China’s state broadcaster has implicated Jack Ma’s Ant Group in a corruption scandal, ratcheting up pressure on the billionaire following a crackdown that has wiped billions of dollars from his internet empire.

Daily newsletter

#techFT brings you news, comment and analysis on the big companies, technologies and issues shaping this fastest moving of sectors from specialists based around the world. Click here to get #techFT in your inbox.

3. Moment of truth to act on Big Tech

This week’s $75bn deal by Microsoft to buy Activision Blizzard has again raised fears about the powers of trillion-dollar tech companies. We’ve an analysis of Microsoft’s target, while Richard Waters says the stage is set for a final push for legislation to rein in Big Tech, following a Senate vote on Thursday.

4. Intel breaks new ground in Ohio

Intel has announced its first new manufacturing location in 40 years in the US, with plans to invest more than $20bn in two chip factories near Columbus, Ohio. The “mega-site” in the Midwestern state will be able to accommodate up to eight fabs across nearly 1,000 acres, although the chipmaker is counting on government subsidies.

5. Fed opens crypto debate

The Federal Reserve has for the first time launched a period of debate and public comment on the introduction of a central bank digital currency, as it seeks to keep pace with global financial innovation and maintain the supremacy of the dollar. After months of anticipation, the Fed on Thursday released a lengthy discussion paper. Meanwhile, in Asia, Thailand’s biggest cryptocurrency trading company Bitkub plans to expand its operations across the region this year.

Tech tools — Hydrow rowing machine

Patrick McGee (pictured with one of his daughters) does not own a Peloton, but in November 2019, he bought a Hydrow, a rowing machine that connects users with instructors filmed daily on the river Thames, Lake Lucerne and up and down the California coast. The videos — live or on-demand — are presented on a 22-inch screen, where he competes against thousands of others with every stroke uploaded in real time. He looks at the costs of being addicted to connected fitness equipment, in this FT Weekend essay.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Technology News Click Here