Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

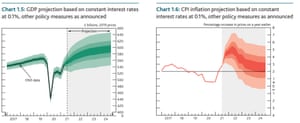

The UK is facing a painful cost of living squeeze after the Bank of England predicted that inflation will peak at 5% early next year, the highest in a decade.

Under the Bank’s new forecasts, released yesterday, wages after tax will not keep pace with inflation over the next two years – a blow to households across the country.

Real post-tax labour incomes are expected to fall by 1.25% in 2022, and by another 0.75% in 2023, worse than previously expected — with the energy crunch and supply chain disruption driving up prices.

Bank of England governor Andrew Bailey has warned that people are already feeling the impact of rising prices, telling the BBC.

“I’m very sorry that’s happening,”

“None of us want to see that happen.”

Bailey acknowledged that people are already feeling the impact of recent price rises:

Inflation is clearly something that bites on people’s household income. I’m sure they’re already feeling that in terms of prices that are going up.”

More here: Bank of England ‘sorry’ for rising cost of living

The governor will be discussing the issue on Radio 4’s Today programme this morning.

This squeeze undermines the government’s claims to be building a high-wage economy, as the jump in wholesale energy costs and supply chain frictions continue to hit businesses and households.

Faisal Islam

(@faisalislam)Coming up on #BBCNewsSix I ask the Governor of the Bank of England if there is any evidence in his new forecast of the “PM’s new economy” of rising wages and productivity…

He says 2 year squeeze on real post tax incomes is result of higher inflation that “no one wants to see” pic.twitter.com/4cuZo1A7Fi

Faisal Islam

(@faisalislam)NB “normal” on this chart would be the two decade pre financial crisis average of + 3.25% not less than 1%, let alone actual negative forecasts for two years… it is some considerable distance from rhetoric about a high wage “new economy” pic.twitter.com/YbDw4zI3eg

Controlling inflation is the Bank’s job – but Bailey argues that lifting interest rates won’t get more gas into the pipes, or more semiconductor chips to manufacturers, for example.

Sky News

(@SkyNews)“Many of the causes of inflation would not be tackled directly by raising interest rates.”

Bank of England Governor Andrew Bailey says rates were not increased from 0.1% as it would ‘slow down the economy’ and “probably cause unemployment to rise”.https://t.co/13JpjKYolB pic.twitter.com/KBv2d4X53f

Yesterday the Bank surprised the markets by leaving interest rates on hold – startling some investors, sending the pound plunging by almost two cents yesterday.

Bailey was among those voting to leave borrowing costs at 0.1% – despite having previously suggested the Bank would have to act over inflation.

The confusion risks undermining the Bank’s credibility – as communicating to the markets is another crucial part of its remit.

As Oliver Blackbourn, multi-asset portfolio manager at Janus Henderson Investors, put it:

It had seemed in recent weeks that the Governor and Chief Economist were going out of their way to make sure that there was to be no surprise if interest rates rose.

Former governor, Mark Carney, was labelled the ‘unreliable boyfriend’ over his confusing communication, and there is a risk that the new governor inherits this moniker following his public statements ahead of today’s announcement. After taking time to seemingly warn markets about potential lift off, it may be particularly perplexing for many that the Bank then chose to push against markets that had priced in a steeper path for interest rates.

However, the Bank pointed to its estimates that such a path would take inflation back below target by the end of the forecast period, something that markets seem less convinced of given the inflation outlook being expressed by 10-year breakeven rates.

Neil Henderson

(@hendopolis)FT: BoE sends investors scrambling by keeping interest rates on hold #TomorrowsPapersToday pic.twitter.com/OSmu8HvSVF

The agenda

- 7am GMT: Halifax house price index for October

- 8.10am GMT: BoE governor Andrew Bailey interview on the Today Programme

- 8.30am GMT: Eurozone construction PMI for

- 10am GMT: Eurozone retail sales for September

- 12.30pm GMT: US Non-Farm Payroll jobs report for October

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here