Berkshire Hathaway also owns $328 billion of stocks of Apple Inc., which is close to half of the world’s most valuable company.

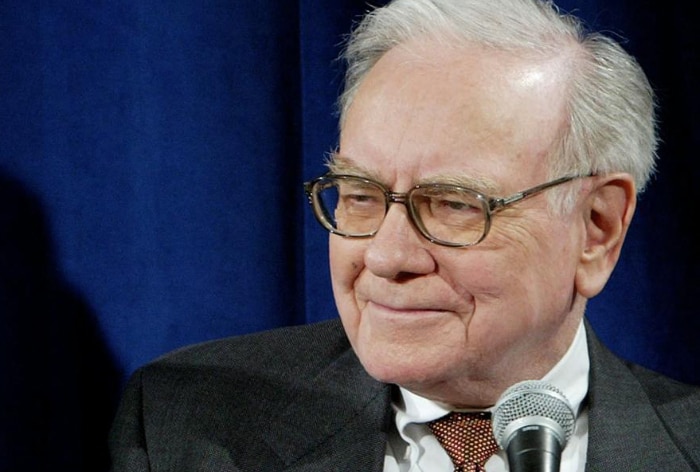

New Delhi: After Berkshire Hathaway reported a whopping $35.5 billion quarterly profit, Warren Buffett on Sunday addressed investors. The multinational conglomerate’s shareholder meeting always attracts throngs of people who admire Buffett and his longtime investing partner Charlie Munger.

Warren Buffet, the world’s sixth-richest person, Buffett has taken over the charge of Berkshire since 1965. Berkshire’s businesses include Geico car insurance, the BNSF railroad, and consumer names such as Dairy Queen and Fruit of the Loom.

Berkshire Hathaway also owns $328 billion of stocks of Apple Inc., which is close to half of the world’s most valuable company.

Key Takeaways From Warren Buffett’s Speech at Berkshire’s Shareholders Meet

In his speech, Warren Buffet criticised the handling of the recent tumult in the US banking sector. He said the debt ceiling showdown could bring “turmoil” to the financial system. The billionaire investor blamed politicians, regulators, and the press over the handling of the collapse of Silicon Valley Bank, Signature Bank, and First Republic Bank. Buffet pointed out that their “very poor” messaging has unnecessarily frightened depositors.

However, in his speech Buffett also said Berkshire is cautious about banks and sold some bank stocks in the past six months.

Speaking about the $151 billion investment in Apple Inc, Warren Buffet said that consumers are less likely to shed their $1,500 iPhones than, for example, their $35,000-second cars.

“Apple is different than the other businesses we own,” Buffett said. “It just happens to be a better business.” Berkshire has recently held a 5.6% stake in Apple, and Buffett said it could buy more.

Warren Buffett had named Greg Abel as heir apparent in 2021. During the speech on Sunday, he reaffirmed that he was “100% comfortable” with the decision and even indicated a largely business-as-usual transition, for whenever that could be.

On Occidental Petroleum, Buffett said that he would not make an offer for full control of the company, tempering speculation he was seeking to own the energy producer after spending months snapping up its shares.

On Berkshire’s investment strategy, Buffett said he is more comfortable with Berkshire Hathaway Inc deploying capital in Japan than Taiwan due to the tension between US and China.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here