“Now we have to go at it again. We are very much a mature company from that perspective,” said the Co-Founder and COO of Mobikwik on the company’s IPO plans, the approval for which lapsed in November last year.

But the company is optimistic of getting back on track after nearly two years of tough spells, including getting on the wrong side of the regulator. What’s fuelling Upasana Taku’s confidence is the transition that the company has been through.

“We want to be able to present at least 2-3 profitable quarters consecutively so that we can build confidence with the investor base, that there is a way to scale business in digital financial services and be profitable,” said Taku.

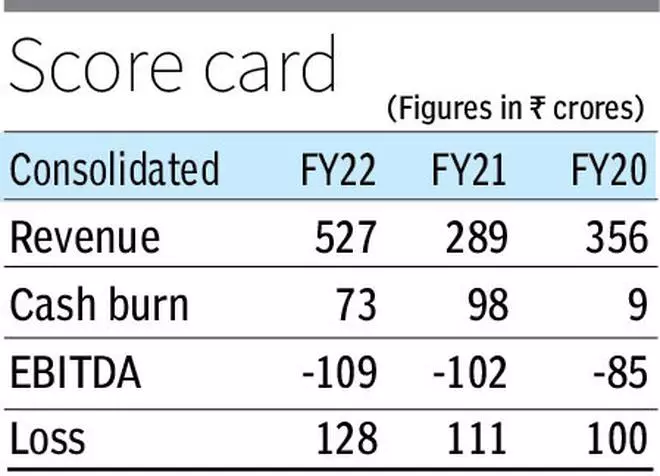

A profitable growth story is indeed unique in the fintech ecosystem. But the picture for Mobikwik hasn’t been rosy either. The company’s consolidated loss widened 15 per cent to ₹128 crore in FY22, but it is confident of at least one quarter of profit in FY23 and full-year profitability in FY24.

The fintech major is backed by marquee names such as Sequoia Capital India, Bajaj Finance, American Express, Net1, Cisco System and Treeline Asia, who aren’t going to be perennially patient. That seems to be the current top brass’ challenge – win back investors’ confidence, get its team back in order, being on the right side of regulations, and making MobiKwik IPO-ready once again.

Coming out of the pandemic, sentiment for the start-up ecosystem improved on economic recovery. With capital markets on a bull run, Mobikwik set its sight on equity raising like many of its peers, and started making internal changes.

Though not a part of the founding team, Chandan Joshi was named co-founder and appointed CEO of the payments business. It also raised $35 million in 2021 from Abu Dhabi Investment Authority and several family offices.

By the time Mobikwik got SEBI’s go ahead for its ₹1,900-crore IPO in October 2021, however, investor appetite had turned due to the dismal listing of rival Paytm’s owner One 97Communications and the barrage of other IPOs hitting the market. But unlike Paytm’s largely offer for sale, MobiKwik’s IPO comprised a ₹1,500-crore fresh issue, meant to support growth for 3-4 years.

Valued at $1.5-1.7 billion, Mobikwik had by then landed in the ‘unicorn’ club. But thinning interest in the grey market for its unlisted shares prompted investment bankers to advise the company against listing, and the plan was shelved.

Mobikwik then turned to VC fund BlockSoil and AIF Karnation to raise ₹55 crore in H2 FY23. Meanwhile, IndusInd Bank’s former head of payments, Mukul Saxena, was appointed CEO of Zaakpay, MobiKwik’s financial services and payment gateway platform, replacing Chandan Joshi. Joshi was reappointed as the director.

MobiKwik’s bad patch dates to the pandemic, with the company having posted losses since FY20 due to continued struggles with increasing expenses and regulatory compliance. The first regulatory blow came in December 2021 when RBI fined the company ₹1 crore for violating net worth requirement norms for Bharat Bill Payment Operating Units. While it has been remedied, the series of regulatory guidelines on prepaid wallets and digital lending also caused significant disruptions in terms of work flow and back-end operations.

With the cash burn now slowing down due to lower cost of acquisition and cross-selling of products to existing users, incremental fund requirements are expected to be lower. 90 per cent of Mobikwik’s incremental customer onboarding is organic, with the company having acquired 23 million customers in 2022. As such, fixed costs could increase by 5-10 per cent as the company looks to add 80-100 people to its workforce for new business verticals and to replace vacant positions. But revenue is also seen growing, led by the lending business, where Mobikwik has 5-6 bank and NBFC partners. It disbursed ₹8,000-9,000 crore of loans in FY23 so far, a significant jump from ₹1,500 crore in FY22.

At present, about 55 per cent of the revenue comes from payments. The remaining comes from the high margin business of financial services distribution, the share of which has risen from 25 per cent in FY22, and is expected to grow to over 50 per cent in the coming years.

Mobikwik has a user base of over 4 million merchants and 135 million customers, and has evolved as a multi-product platform offering digital loans, insurance, gold investment and mutual funds. The focus is now on customer engagement, user loyalty, cross-selling of products, and growing the merchant business.

Having positioned itself as a retail-oriented platform, Mobikwik believes its strength lies in volumes rather than quantum of transactions, where its gives small ticket loans through a variety of channels such as PoS or BNPL.

“Not too many platforms can today claim they have 4 million active customers using credit products. While the amount in terms of disbursals might be higher for a few players, the absolute number of customers would be lower,” said Taku.

With Taku hopeful of turning things around and growing the business sustainability, MobiKwik’s renewed strategy may help find its footing again. But these positives remain jaded by the prolonged bad patch that’s etched in our minds. Can Mobikwik right the wrong?

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest For Top Stories News Click Here