Key events:

Filters BETA

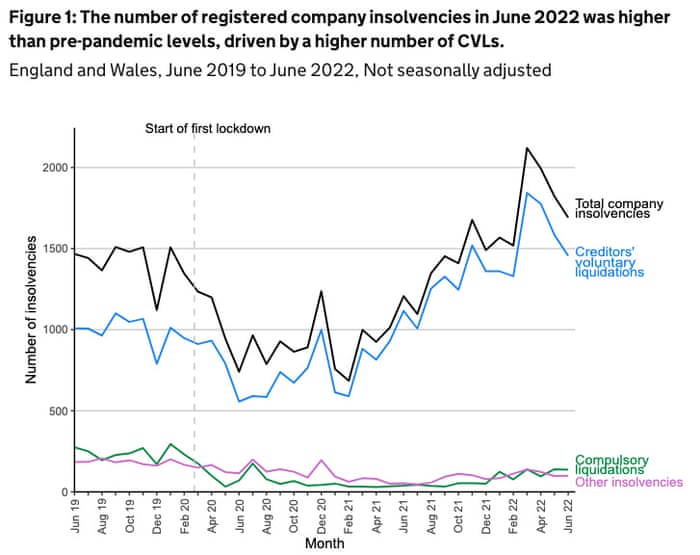

Company insolvencies jump 40% in England and Wales

The number of company insolvencies in England and Wales has risen by 40% year-on-year, as more firms are forced under by tough economic conditions.

There were 1,691 company insolvencies in June, the Insolvency Service reports, up from 1,207 in June 2021. That’s also 15% more than before the pandemic, although lower than in May.

Most of June’s insolvencies (1,456) were Creditors’ Voluntary Liquidations (CVLs), in which a firm takes the decision to be liquidated because it can’t pay its bills.

But there were also 3.6 times as many compulsory liquidations in June 2022 as in June 2021, and the number of administrations was 2.3 times higher than a year ago.

John Bell, director of licensed Insolvency Practitioners Clarke Bell, warned that the race to replace Boris Johnson will unsettle businesses:

The economy is in a state of flux as the Government goes into freefall and clamours to find a new leader and Prime Minister.

The uncertainty is set to stall the economy and unsettle UK plc.

Bell adds that companies have been hit by the pandemic, the economic uncertainty caused by Brexit, along with other current events such as the Ukraine war

Due to the heavy impact and persistence of these problems, it’s no surprise that many directors of struggling companies are facing compulsory liquidation. However, it is the worst type of liquidation, stripping directors of any control and often ending in personal consequences for directors.

As such, it should be avoided at all costs. My advice to struggling businesses is to confront your financial issues before liquidation is forced upon you. There are many methods and steps to take to close down a company before you reach compulsory liquidation stage.”

Nicky Fisher, Vice President of insolvency and restructuring trade body R3, says inflation is driving up company costs and adding to the strain on bosses:

Not only are directors facing immediate strain to deal with this inflationary pressure, but they will also be looking at re-evaluating investment decisions and wider business strategies in the medium-term. This is likely to act as a further drag on the economy in the months ahead.

“At the same time, consumer confidence has hit its lowest point since the start of the pandemic, bringing down consumer spending, which could mean that sectors such as travel, retail and hospitality could particularly struggle as these are the things people usually cut first.

China’s stock market has posted its biggest drop in eight weeks, as calls for a mortgage strike added to anxiety after the weak GDP report.

The CSI 300 closed down 1.7%, its biggest drop since 24th May.

Property developers and financial firms were hit by a growing number of homebuyers’ threats to stop mortgage payments on unfinished apartments.

Analysts have warned that growing protests over stalled construction projects could threaten any tentative recovery in China’s capital-starved property sector and leave banks with hefty writedowns on bad debts.

HSI Properties Index -2.15%

Hang Seng Mainland Properties index -4.44%

CSI 300 Properties -4.2%

CSI 300 BANKS -1.8%Almost every stock is down at least 1.2% worst is down 12.5%

— Sunil Beri (@sunchartist) July 15, 2022

Investors are offloading Chinese financial stocks at a pace unseen over concerns about the declining quality of home loans. Thursday’s 2% decline in the CSI 300 Financials Index was its 10th straight drop, the longest losing streak since the gauge was formed in 2005.1/2 pic.twitter.com/UDtqTlEdBs

— Jean-Charles GAND (@jeancharlesgand) July 15, 2022

The 2.6% drop in China’s GDP in the last quarter also weighed on sentiment.

For the week, the CSI 300 Index lost 4.1%, the biggest drop since April 22, while the Hang Seng Index saw its biggest slump since March 2020, down 6.6%.

Jasper Jolly

British luxury carmaker Aston Martin has turned to Saudi Arabia’s sovereign wealth fund to help fix its financial woes, sending its shares surging 20% back from record lows.

Aston Martin Lagonda has received a large investment from Saudi Arabia as part of raising £650m of capital to pay down the luxury sportscar maker’s large debts, my colleague Jasper Jolly reports.

The British manufacturer has not been able to generate cash needed to invest in new models and electric technology, and has also struggled with delays to its Valkyrie hypercar and its newest DBX 707 sports utility vehicle.

The Saudi Public Investment Fund (PIF), led by the controversial crown prince, Mohammed bin Salman, will buy shares worth £78m, and will take part in a £575m rights issue that will leave it as the second-largest investor after Yew Tree, the consortium led by the billionaire fashion mogul Lawrence Stroll that took over Aston Martin in early 2020 as it approached bankruptcy.

Here’s the full story:

Soaring energy costs have left the eurozone with another trade deficit in May.

Statistics body Eurostat reports that imports into the eurozone jumped by 52% in May compared with a year ago, to €274.8bn. That outpaced exports, which rose almost 29% to €248.5bn.

In the first five months of the year, imports from Norway have surged 147%, mainly due to higher expense on oil and gas goods.

The United States saw the biggest increase in exports, up 29.6%, lifted by chemicals, machinery and vehicles.

The Bloomberg Industrial metals index has slumped to a 17-month low, reports Ole Hansen, head of commodity strategy at Saxo:

The sell-off is led by copper which has suffered its worst weekly rout since the early stages of the pandemic in 2020 (see earlier post).

Hansen explains:

Since hitting a record high in March the price High Grade copper (HGc1) has slumped by 37% to levels last seen in late 2020. From a technical perspective, the price has reached support at $3.14, the 61.8% retracement of the 2020 to 2022 rally, and further weakness may trigger an additional selling response from traders

Rio Tinto Group, meanwhile, has issued a grim warning about the prospects for the global economy, pointing to war, inflation and tighter monetary policy, as well as coronavirus lockdowns in China.

Rio Tinto warns economic outlook is weakening

Mining giant Rio Tinto has warned that the economic outlook is weakening due to the Russia-Ukraine war, tighter monetary policy to curb rising inflation, and targeted COVID-19 restrictions in China.

In its latest production results, Rio Tinto flagged a range of headwinds, including shortages of workers, muted demand from Chinese manufacturers, falling commodity prices and the threat of recession.

Rio Tinto says:

Prices for our commodities decreased in the quarter, amidst growing recession fears and a decline in consumer confidence.

Trade disruptions, food protectionism and the global focus on securing energy supplies continue to put pressure on supply chains, which will need to be significantly eased before inflationary pressures subside.

On China, the company warns that Covid-19 restrictions are hampering activity:

China’s industrial activity troughed in May amid COVID-lockdowns. June recovered but uncertainties remain given the potential for ongoing outbreaks. Economic stability is a focus, but headwinds are considerable from restricted labour and goods movement and a slowing external environment.

Rio Tinto says there is an “increasing risk” that a rapid hike in US interest rates will subdue demand.

Conditions are worsening in Europe, it adds:

The Eurozone industrial sector has been impacted by supply bottlenecks, higher inputs costs and weakening consumer sentiment, even though the services sector has been positive. Energy security will be a key priority for the region, with measures taken to avert a potential shortfall in energy.

Rail, Maritime and Transport union (RMT) general secretary Mick Lynch says the public is “right behind” the latest wave of planned industrial walkouts.

Asked if public support could “evaporate” over planned strikes on July 27, August 18 and 20, he told BBC Radio 4’s Today programme:

“The public seem to be right behind us, many of the public are in the same position as our members.

“They have not had a pay rise, they feel they are being exploited by the employers and they feel that the Government is pushing down on wages in order to protect profits in this country, which are still at higher levels, and dividends are still being paid out.

“Corporate Britain is making plenty of money on the back of low-paid workers and our members feature in that, and we need to get a square deal for them so that they can face the cost-of-living challenge which is best addressed through their pay packets.”

Copper drops below $7,000 for first time since 2020 as selloff deepens

Copper prices are heading for the worst weekly loss since March 2020 on Friday, as fears of a global recesssion hit the commodities market.

Three-month copper on the London Metal Exchange has dropped over 10% so far this week.

It has fallen below $7,000 per tonne this morning for the first time since November 2020 (when the first successful Covid-19 vaccine trials triggered a global rally).

Copper prices in Shanghai have closed at their lowest since November 2020 too, weakening as China’s economy shrank by more than forecast in April-June (down 2.6% quarter-on-quarter).

‘Doctor Copper’, as it is known, is a good indicator of the health of the global economy, so this is a concern.

Prices have fallen around 35% in the last four months; it surged early in the Ukraine war as traders anticipated supply shortages, before recession fears pulled prices down.

Doctor Copper Signals Problems For The Global Economy As LME Copper Trades Below $7,000/T For First Time Since November 2020

— Trading Floor Audio (@TradeFloorAudio) July 15, 2022

Ongoing Covid-19 lockdowns in China will limit factory output, and thus demand for commodities such as metals.

The stronger US dollar has also pushed down commodity prices (which are priced in dollars), while higher interest rates in the US and Europe could also dent demand.

Energy rationing in Europe this winter could aldo hammer demand for metals, if Russia were to keep the Nord Stream 1 gas pipeline closed once its summer maintenance finishes.

Fevertree shares slide on profit warning

Things have turned sour in the swanky tonic market.

Fevertree, the premium carbonated mixer maker, has cut its profit forecasts and warned that logistic problems and rising costs have “significantly worsened in recent months”, including shortages of workers and glass bottles.

The news sent Fevertree’s shares tumbling by a quarter this morning to 900p.

Shares are down almost two-thirds so far this year, as inflationary pressures have pushed up costs and squeezed consumer spending.

Fevertree was a stock market darling up until 2018, as its high-end tonics proved a hit with drinkers.

The company insists that consumer demand remains strong, but now expects profits of £37.5m-£45m, down from an earlier forecast of £63m-£66m, adding:

- Labour shortages have impacted our US East Coast production ramp up, resulting in greater UK production required to fulfil against the strong demand in the US, and with it, more exposure to sea freight with rates increasing by up to 50% since the start of the year on key routes

- Glass availability has become severely restricted, which has limited the opportunity to deliver upside to revenue despite strong demand

- Further, industry-wide cost pressures have increased, most notably glass costs, where we will see double digit increases for H2 alongside continued logistics cost increases and disruption

Burberry are the top faller on the FTSE 100 share index, down 4%.

Overall, the market is recovering around half of its losses yesterday, with the blue-chip share index up 50 points at 7090.

European stocks are rallying too, with Germany’s DAX up 1.1%.

Burberry sales held back by China’s lockdown

China’s lockdowns have hit sales growth at Burberry.

The luxury fashion company has reported that sales in mainland China plunged by 35% in the last quarter, when Covid-19 lockdowns forced stores to close. That pulled sales across the Asia Pacific down by 16%.

Declines in Mainland China were partially offset by strong performances in recovering markets such as Japan, though.

Sales outside Mainland China were up 16%, as countries reopened from the pandemic, meaning total sales grew 1%.

Burberry has also suffered from the drop in Chinese tourists visiting Europe, due to zero-Covid policies, although a pick-up in American visitors may help.

Sales in the Europe, Middle East, India and Africa region rose 47%, with local sales exceeding pre-pandemic levels.

Richard Hunter, Head of Markets at interactive investor, explains:

“Burberry’s trading progress has been hampered by another China crisis resulting from the country’s zero tolerance policy on Covid-19.

The lack of Asian tourists coming to Europe in particular has been a bugbear for some considerable time, and the latest lockdowns in the region have inevitably had an impact. Asia Pacific sales overall declined by 16%, with sales in Mainland China dropping by 35% following store closures and lockdowns which also affected Burberry’s digital hub.

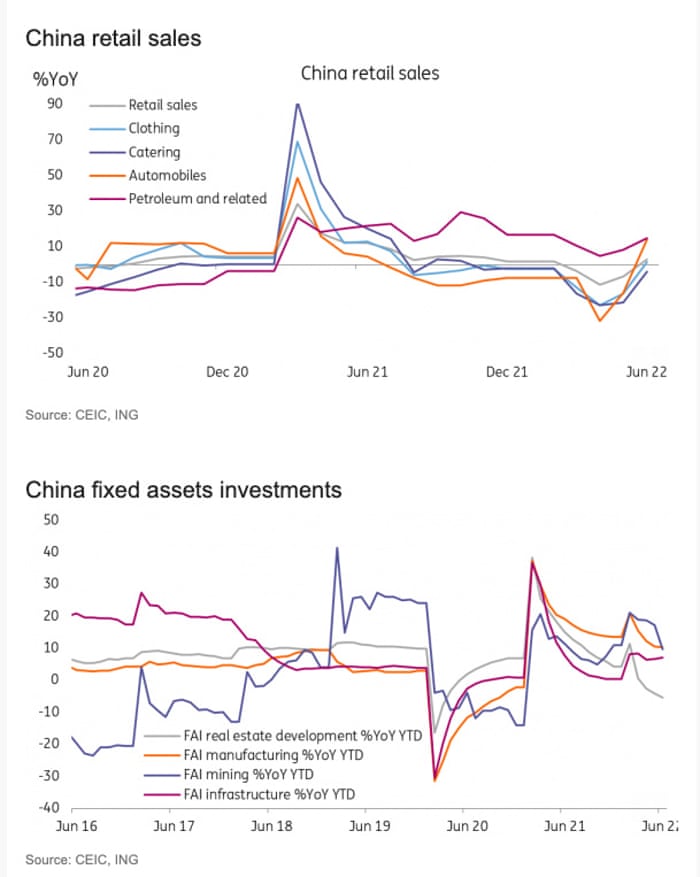

Interestingly, ING suspect China’s downturn may have bottomed out.

They’ve revised up their target for China’s GDP growth rate for 2022 to 4.4% from 3.6% previously, on the

It is still slower than the government target of 5.5% for this year, which ING believes will be hard to achieve unless a lot of investment goes into construction work.

Iris Pang, ING’s chief economist for Greater China, suspects China’s recovery could have begun, despite the 2.6% tumble in April-June.

We have seen a recovery in retail sales at 3.1%YoY in June from -6.7%YoY in May, with car sales increasing by 13.9%YoY in June from -5.9%YoY in May, mainly because of subsidies for the consumption of new energy cars. We expect strong retail sales to continue as some local governments have not completed their subsidy programmes.

Fixed assets investment data are even more forward-looking. Infrastructure investments grew 6.1%YoY year-to-date amounting to CNY 27.1 trillion. Manufacturing investments took the lead by growing 10.4%YoY YTD.

The data suggests companies are optimistic about their buisness prospects. Infrastructure investments rose 7.1%YoY YTD, and we believe they will speed up further in the third quarter.

Industrial production rose 3.9%YoY in June from 0.7% in May. New energy cars, solar power batteries and telecommunication stations grew 111.2%YoY, 31.8%YoY and 19.8%YoY, respectively. We believe that subsidies for consumption on new energy cars is one of the factors for such fast growth in production.

Faster growth in industrial production will typically push up PPI inflation later. The government is trying to curb inflation so that it can avoid the high readings seen in the US and other economies.

China’s economy faces a fog of uncertainty, warns Alvin Tan of Royal Bank of Canada:

China Q2 GDP growth at 0.4% y/y was lower than consensus expectations, but still better than the probable figure.

Growth for H1 2022 was just 2.5%, which suggests that the 5.5% target for the entire year is very unlikely to be reached. New build housing prices fell for a tenth consecutive month in June at 0.10% m/m, but the rate of decline is slowing.

Although the spring lockdown-driven downturn is now behind us, the path ahead for China’s economy is fogged by the uncertainties flowing from zero-Covid, the fragile property sector and the global growth slowdown.

China’s slowdown could prompt action by central bankers and Beijing’s government, says Stephen Innes of SPI Asset Management:

China data may look bad overall, but industrial output, retail sales, Fixed Asset Invement and jobless rates improved after a brief respite from the zero-covid policy in June.

China’s 5.5% 2022 GDP target now looks impossible to achieve, and we concur with the China experts forecasting 4% instead.

But we could easily read the big GDP miss as “bad news is good “as it should signal a call to action for both fiscal and monetary authorities.

Asia-Pacific stock markets are hovering around two-year lows, after China’s GDP report missed expectations.

China’s CSI 300 share index has dropped by 1.25% in late trading, while Hong Kong’s Hang Seng is down 2%, and Japan’s Topix is flat.

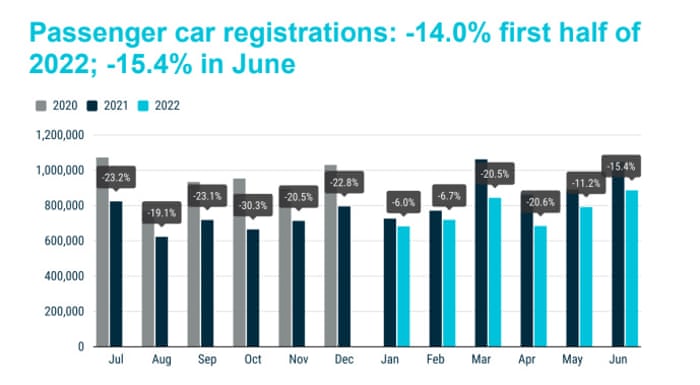

So far this year, new car registrations in the EU have shrunk by 14.0% compared with a year ago.

All of the region’s major markets have recorded double-digit drops, with Italy (-22.7%) worst hit, followed by France (-16.3%), Germany (-11.0%) and Spain (-10.7%).

Europe car sales slump to worst June in decades on supply issues

European car sales have tumbled to their lowest since 1996, as automakers are hit by persistent supply chain snarls and record inflation.

In another sign of economic problems, new car sales in the EU fell by 15.4% in June to just 886,510 units, the European Automobile Manufacturers’ Association reports.

That’s the worst June in 25 years, and means new car registrations have fallen for 12 months in a row.

All four of the major European Union markets – Spain, Italy, Germany and France – reported a decline in car registrations

Germany posted the strongest decline (-18.1%), followed by Italy (-15.0%) and France (-14.2%). Spain on the other hand saw a more modest fall (-7.8%).

Figures earlier this month showed that the UK also posted its worst June car sales since 1996.

Introduction: China’s economy shrank 2.6% in Q2, adding to slowdown fears

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

Fears over the global economy have been sharpened by the news that China’s growth took a shunt in the last quarter, as Covid-19 outbreaks and restrictions hit the economy.

China’s economy shrank by 2.6% in the April-June quarter, much worse than expected, as the lockdowns imposed in major cities this year hamstrung the economy.

On an annual basis, China’s GDP grew just 0.4%, the slowest since the first wave of the pandemic in 2020, and shy of forecasts of 1.2% growth.

The slowdown comes after Shanghai was sealed off for two months as it battled a Covid-19 resurgence, tangling supply chains and forcing factories to halt operations.

It means Beijing is likely to miss its goal of 5.5% growth during 2022 — probably by a wide margin — another blow to a global economy hit by recession fears.

But it could also spur policymakers into fresh stimulus measures to shore up growth, as multiple cities are currently facing some form of restrictions as officials try to stamp out Covid infections.

#China growth crashes, putting GDP target out of reach. GDP disappoints as growth weakens to 0.4% in Q2, slowest since Pandemic and way below forecast of 1.2%. That means Beijing will likely miss its goal of ~5.5% growth for the full year by a wide margin. https://t.co/RRAB2ykDat pic.twitter.com/NZgitEnELn

— Holger Zschaepitz (@Schuldensuehner) July 15, 2022

As my colleague Martin Farrer writes, signs have been mounting of a slowdown:

This week’s figures showed that imports for the second quarter grew by just 0.1%, called “staggeringly” low by one economist considering that prices for key imported commodities such as oil and food have rocketed since April.

The statistics bureau also said on Friday that youth unemployment has risen to 19.3%, a trend accelerated by the full or partial lockdowns imposed in major centres across China in March and April, including the commercial capital, Shanghai.

While many of those curbs have since been lifted, and June data offered signs of improvement, analysts do not expect a rapid economic recovery. China is sticking to its tough zero-Covid policy amid fresh flare-ups, the country’s property market is in a deep slump, and the global outlook is darkening.

We’ll have more reaction to the China slowdown shortly.

Also coming up today

UK travellers are facing more disruption this summer, after the RMT union announced last night that drivers at 14 train operating companies are to go on strike on two days next month, bringing many services to a halt.

The strike, on 18 and 20 August, is part of an ongoing dispute over jobs, pay and working conditions.

A separate UK-wide rail strike is set to take place on 30 July as train drivers across eight companies walk out for 24 hours, the ASLEF union announced yesterday.

Pressure is mounting on Heathrow boss John Holland-Kaye, after ministers gave him until noon today to provide a plan to resolve the airport’s staffing problems, the Daily Telegraph reported.

The move comes aftert Emirates refused its demand to cut flights to help address chaos at the airport.

Investors will be watching Italy, where a political crisis is bubbling away. Yesterday Italy’s prime minister Mario Draghi offered his resignation after the 5-Star Movement, a coalition party, failed to back him in a confidence vote — but the country’s president has rejected it.

And the latest US retail sales and industrial production data could influence how sharply the US Federal Reserve raises interest rates later this month.

The agenda

- 7am BST: European car sales for June

- 9am BST: Italian inflation report for June

- 10am BST: Eurozone trade balance for May

- 1.30pm BST: US retail sales for June

- 2.15pm BST: US industrial production for June

- 3pm BST: University of Michigan consumer sentiment index for July

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here