Renewed unease gripped world markets on Wednesday as news of Credit Suisse’s largest investor declining to provide more financial assistance to the Swiss bank sent its shares sliding. The yield on two-year US Treasury notes fell to its lowest since September. Gold prices renewed their recent rally and oil prices pared losses after dropping to their lowest in more than a year.

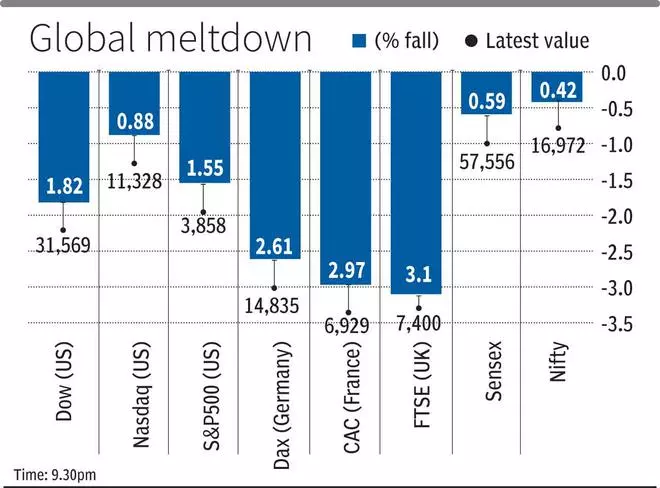

Concerns over further banking sector instability and closely watched inflation data published on Wednesday raised expectations that the Federal Reserve may pause or slow down hiking rates. The Dow Jones Industrial Average fell 509.01 points or 1.58 per cent while the S&P 500 index lost 54.49 points or 1.39 per cent and the Nasdaq Composite was down 111.12 points or 0.97 per cent at around 9 pm IST.

Europe bleeds

Signs of calm and stability in banking stocks, which tanked in the past week following the collapse of Silicon Valley Bank (SVB), soon paved way for renewed selling as Credit Suisse shares fell around 24 per cent to 1.70 Swiss franc at close. The STOXX 600 index fell 1.29 per cent, while Europe’s broad FTSEurofirst 300 index fell 44.48 points, or 2.51 per cent.

The yield on benchmark 10-year Treasury notes fell to 3.4249 per cent from its US close of 3.636 per cent on Tuesday. Spot gold prices rose 1.11 per cent to $1,923.19 an ounce. “The Credit Suisse share price is falling and government bonds are rallying on the back of that. Still very much driven by the perceived health of the banking sector, but this time in Europe,” said Antoine Bouvet, senior rates strategist at ING.

The European Central Bank is still leaning towards a half percentage point rate hike on Thursday, despite turmoil in the banking sector, given high inflation, a source close to its Governing Council told Reuters.

The euro was down 1.7 per cent at $1.0544, while the dollar index was up at 104.86.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest For Top Stories News Click Here