Key events

Filters BETA

Sale of Bulb to Octopus Energy faces further delays – Bloomberg

The sale of energy supplier Bulb to Octopus is facing further delays as rivals plan to challenge the UK government’s decision in court, Bloomberg reports.

We had been expecting a City court to approve the sale today. But lawyers for the bust supplier’s administrators say rival suppliers are pushing for a judicial review.

Bloomberg have the details:

Iberdrola’s Scottish Power, EON, and Centrica Plc’s British Gas are planning to take the deal to Judicial Review, a court process that looks at the legality of a government decision, Teneo Inc.’s lawyers said at a hearing in London on Tuesday.

“It is worth observing at the outset that the intervening energy companies each had an opportunity to participate in the sales process,” Richard Fisher, a lawyer representing Teneo who are overseeing the sale, said in court documents.

“All could have sought meetings with the administrators or government had they wished to investigate different funding options.

Bulb was the largest energy supplier to collapse as energy prices soared in 2021, and was too big to be rescued by a rival.

Instead, it entered a special administration overseen by the UK government and run by the restructuring firm Teneo.

The cost of bailing out Bulb, which has around 1.4m customers, has hit £6.5bn, according to the Office for Budget Responsibility. The cost escalated after the Ukraine war drove gas prices even higher this year.

Octopus sealed a deal to take on Bulb at the end of October. But, as we reported earlier this month, the UK’s spending watchdog is to examine the deal.

According to Bloomberg, Scottish Power objects to the deal struck as it may involve a “dowry” being paid to Octopus of at least £1bn to cover buying energy to supply customers with, its lawyers said in court documents.

Most UK business leaders say ‘Brexit freedoms’ not a priority

Richard Partington

Most UK businesses have no interest in or understanding of the government’s flagship “Brexit freedoms” plan to scrap EU regulations, according to a survey of bosses.

The British Chambers of Commerce (BCC) said almost three-quarters of company directors were either unaware of the government plans or did not know the details.

Across all business areas, about half in the survey of almost 1,000 firms said deregulation was either a low priority or not a priority at all.

William Bain, the head of trade policy at the BCC, which represents thousands of firms of all sizes across the country, said:

“Businesses did not ask for this bill, and as our survey highlights, they are not clamouring for a bonfire of regulations for the sake of it.

“They don’t want to see divergence from EU regulations which makes it more difficult, costly or impossible to export their goods and services.”

Bank of England’s Mann: We could pull back on rates once inflation tamed

Richard Partington

Just in: Bank of England policymaker Catherine Mann has suggested the Bank could cut interest rates from the middle of next year

Mann has said that financial market pricing suggesting cuts in interest rates were “an accurate assessment of what the prospects for Bank rate are”

Asked on an online conference hosted by the Conference Board what the determinants would be for considering rate cuts, she said:

“One of the things about market assumption was that it did contain some drift down from the peak. A humped profile. I think that is an accurate assessment of what the prospects for Bank rate are.

That there will be a peak that will serve to temper medium-term inflation expectations, and at that point, we have the opportunity to pull back from that peak.

So we’re really managing in my view, it’s critical to manage inflation expectations, and in order to do that you might have to be a bit more aggressive in the near term so that you can then pull back once you have tempered those medium term inflation expectations.”

Mann also flagged that inflation is ‘increasingly embedded’ in UK firms, something which will concern the BoE.

BoE’s Mann:

– Inflation is increasingly embedded in UK firms

-This is a dramatic change in underlying inflation

-Inflation expectations are drifting towards 4% in firms— DailyFX Team Live (@DailyFXTeam) November 29, 2022

The financial markets are currently pricing Bank rate hitting at least 4.5% by next summer, up from 3% at present, before then easing back.

Last week, deputy governor Sir Dave Ramsden suggested he could vote to cut interest rates if cost of living pressures eased faster than expected.

Inflationary pressures in Germany have eased, in a sign that the cost of living crunch might be easing.

Consumer prices in Europe’s largest economy rose by 10% in the year to November, down from 10.4% a month earlier. During the month, prices fell by 0.5%.

Energy and food prices were the biggest factors pushing up the cost of living.

Statistics body Destatis says:

In November 2022, food prices showed above-average growth (+21%) compared with the same month of the previous year. In contrast, energy prices have eased slightly but are still 38.4% higher than in the same month a year earlier.

On an EU-harmonised basis, Germany’s inflation rate dipped to 11.3% from 11.6%.

Although double-digit inflation is clearly Still Too High, it may indicate that the worst of Europe’s inflationary surge is over….

Softer German CPI has bonds bid everywhere. While the ECB would be delighted, the three previous ‘head-fakes’ might keep them from turning dovish immediately. pic.twitter.com/6oLsq2Q0zo

— Rishi Mishra (@aRishisays) November 29, 2022

FT: Alibaba founder Jack Ma living in Tokyo after China’s tech crackdown

The Financial Times have a good scoop – Jack Ma, the Alibaba founder and once the richest business leader in China, has been living in central Tokyo for nearly six months.

Ma’s whereabouts have been unclear since Beijing launched a crackdown on China’s tech sector. He vanished for several months at the end of 2020, after regulators dramatically blocked Ma’s plans to float his Ant Group on the stock market, in what would have been the world’s largest share offering.

Ma had angered Beijing by criticising China’s banks, claiming they had a “pawnshop mentality”, prompting authorities to rein him in.

As the FT point out, Ma has managed to avoid the zero-Covid restrictions that have hampered China’s recovery, and angered its people.

They report:

Ma’s months-long stay in Japan with his family has included stints in hot spring and ski resorts in the countryside outside Tokyo and regular trips to the US and Israel, according to people with direct knowledge of his whereabouts….

Since his fallout with Chinese authorities, Ma has been spotted in various countries including Spain and the Netherlands.

Spending less time in his home in China means the billionaire has avoided the tough Covid-19 quarantines imposed on anyone entering the country, as well as thorny political issues arising from his previous push to build influence in the country’s halls of power.

Switzerland’s economy is growing less rapidly than expected, the latest official figures show.

Swiss GDP rose by 0.2% in the third quarter of the year, slower than forecast, and was just 0.5% larger than a year ago.

Although net exports jumped, there was an unexpected slowdown in private consumption, as households cut back.

That followed downwardly revised quarterly growth of 0.1% in the second quarter.

#Swiss Q3 22 GDP slowed to larger extent than expected due to surprisingly slower private consumption in contrast to strong net exports surge and solid capex!

=> 2023 growth forecast unchanged at 0.9% y/y given mild slowdown in coming quarters pic.twitter.com/QtV43THFLh

— Nikolay Markov (@MarkoNikolay) November 29, 2022

????Quick market update???? (been a while):

£ currently $1.2018 & €1.1583. Stronger than pre-mini budget but weaker than earlier this yr

10yr bond yield at 3.1%. Much same story (except lower, not higher).

Markets pricing in just over 4.5% peak in BoE rates next year. Similar story. pic.twitter.com/JbtIEsuh2l— Ed Conway (@EdConwaySky) November 29, 2022

Abrdn: Pound faces an unhappy time

Hopes that China might ease its Covid restrictions soon have cheered investors, weakening the safe-haven US dollar.

That’s pushed the pound back over the $1.20 mark – back above its levels before the mini-budget.

#GBPUSD holds over 1.20 despite disappointing data.

???????? UK mortgage approvals fall steeply to 58.9k in October to a 2.5 year low.

???? Approvals drop as interest rates rise.#GBPUSD ???? 0.5% (1d)

RW: Forex trading involves significant risk.#tradingdotcom #marketupdates

— Trading.com US (@tradingdotcom) November 29, 2022

Sterling has also benefitted from hopes that America’s Federal Reserve may slow its interest rate rises soon.

However, the pound may suffer if the UK falls into recession.

James Athey, investment director at abrdn, fears that the recent rally may fade,

We think the easy gains have been had for now. The reality is that a recession is coming, and a Fed rescue is coming less quickly than in recent years.

We see that reality as a coming cold shower for buoyant risk markets and as ever we expect the dollar to benefit from the resultant flight to quality. With the UK economic outlook being even worse, this portends an unhappy combination for sterling.

Back in the City, banking giant HSBC is among the top FTSE 100 risers after selling its Canadian banking operations in an £8bn deal.

Royal Bank of Canada has agreed to acquire HSBC Canada for $13.5bn Canadian dollars.

The deal follows pressure from the group’s largest shareholder, Ping An, to split off its Asia-Pacific arm to boost value for shareholders.

HSBC shares are up over 4%, also benefiting from China’s push to vaccinate its elderly population faster.

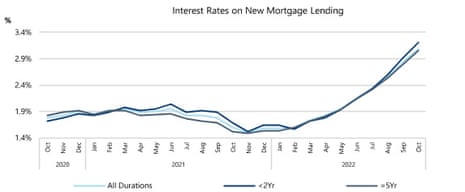

Investment bank Jefferies has helpfully produced this chart, showing how new mortgage rates continued to surge upwards in October – hitting demand for home loans.

With mortgages approvals sliding, people selling their home need to price it ‘realistically’ to get a sale, warns Jason Tebb, CEO of property search website OnTheMarket.com:

With interest rates and the cost of living continuing to rise, buyers may have less buying power but even in challenging markets, people need to move.

Sellers should take advice from experienced local agents and price realistically or may find their properties stick on the market.”

Yesterday, property website Zoople reported that demand had weakened, prompting homeowners to accept offers below the asking price.

That trend could accelerate if prices to start to correct, having risen strongly over the last two years.

Strike News 2): UK firefighters are to vote on whether to strike, in the latest industrial dispute over below-inflation pay offers.

The Fire Brigades Union (FBU) said the “historic ballot” comes after its members – firefighters and control staff – rejected a 5% increase to their wages.

The strike ballot is set to be open from Monday 5 December to Monday 30 January.

If a national strike were to take place, it would be the first national strike since pension action between 2013 and 2015 (which did not include control), and the first on pay since 2002-2003, the FBU says.

Matt Wrack, Fire Brigades Union general secretary, said staff have been left with no option but to vote on strike action:

This is an historic ballot for firefighters and control staff. We are rarely driven to these lengths.

Nobody wants to be in this position. But after years of derisory pay increases and a pay offer that is well below inflation firefighters’ and control staff’s living standards are in peril.

Wrack added it is “utterly disgraceful” to call people “key workers” and then only offer them a real terms pay cut.

Last week we told employers that unless we received an improved pay offer we would formally give notice of a strike ballot.

We have now done that. It’s #FairPayorFireStrike.

— Fire Brigades Union (@fbunational) November 29, 2022

Strike news 1): The UK’s Transport Secretary has made it clear his role is to “facilitate and support” a deal in the long-running rail dispute, rather than get involved in negotiations.

In a letter to the Rail, Maritime and Transport union (RMT), following a letter last week, Mark Harper said the industrial dispute on the railways was bad for workers, businesses and customers.

“We both want a long-term sustainable railway that provides both great service and rewarding jobs.

“Every day’s industrial action makes that harder to deliver.”

Following last week’s talks, RMT general secretary Mick Lynch said it wasn’t clear who had the authority to negotiate a pay settlement that would end the dispute.

Despite that, Harper is still keeping to the sidelines, saying his role is to “facilitate and support, not negotiate”.

“Negotiations will continue between trade unions and employers, but I can see scope for agreement.”

Andy Sparrow’s Politics Live blog has all the details:

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here