The RBI discussion paper merely sought public feedback and suggestions on charges to be applied to UPI transactions.

India is leading in the digital payment sector with over 260 million digital payment transactions daily. More than two-thirds of these 260 million transactions are processed by the Unified Payments Interface (UPI) system.

Just last month, UPI registered the all-time highest number of transactions since its launch in 2016 with 6.28 billion transactions in July 2022.

On the heels of this huge achievement came the news that the government is contemplating levying some charges on UPI payments.

Just like the announcement of GST on pre-packed food items like paneer and curd last month, the news of UPI charges caused an uproar on social media.

Addressing the concerns of the people, the Central government came forward with a clarification that “there is no plan to levy any charges for UPI services.”

But where did this “UPI charges” news arise from?

IT ALL STARTED WITH RBI

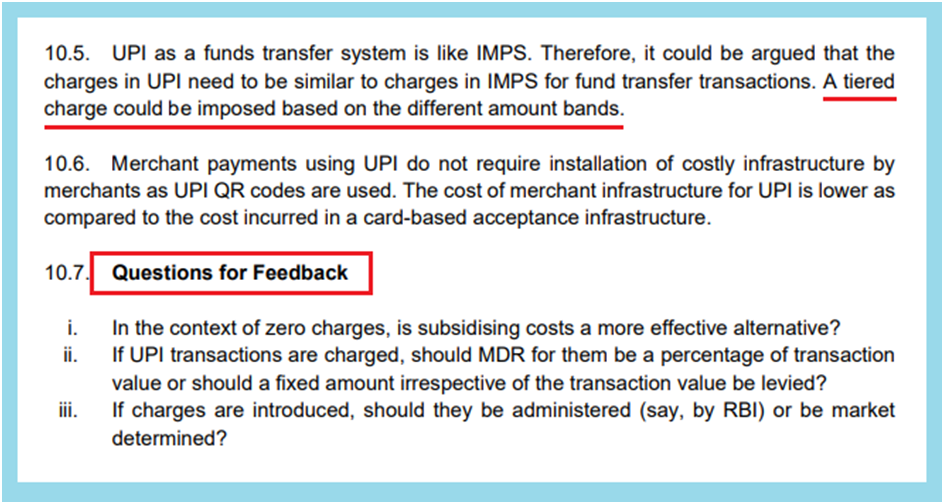

On 17 August, The RBI issued a discussion paper in which it was suggested that UPI payments might be subjected to a tiered charge based on different amount brackets. Actually, the intent of this discussion paper is to elicit general feedback from stakeholders on the possibility of imposing charges on various payment systems (IMPS, NEFT, RTGS, UPI, Credit/Debit cards).

The inputs received would be used to frame policy interventions going forward. The RBI paper is open for comments till 3 October. You can read the RBI paper here.

WHAT DID IT SAY ABOUT UPI?

The paper argued that UPI is a fund transfer system like Immediate Payment Service (IMPS) and therefore the charges in UPI need to be similar to charges in IMPS for fund transfer transactions.

The RBI has asked that if UPI transactions are charged, then should the merchant discount rate (MDR) be imposed based on the transaction value, or should a fixed amount be charged as MDR irrespective of the transaction value?

MDR (Merchant Discount Rate) is a fee that a merchant is charged by their issuing bank for accepting payments from their customers through various payment instruments.

WHY WERE CHARGES MOOTED?

Like any other industry, digital payment systems operators require capital for operations and technology upgradation costs. The RBI holds the view that payment system providers should earn income for continued operations of the system to facilitate investments in new technologies, systems, and processes.

Therefore, the RBI sought feedback on whether imposing charges on digital transactions could be an option for the promoters to recover costs and generate sufficient returns to ensure continued operations.

Also, the failure rate with UPI transactions is increasing (at over 1.4 percent) as the efficiencies of the existing systems cannot be improved in the current cost structure, reports Business Line.

Hence, the RBI floated the idea of monetarily rewarding the stakeholders in the payments ecosystem.

IS IT THE FINAL WORD?

The answer is ‘no’.

The RBI paper was a general discussion, not a policy framework. The aim was to receive public feedback. Based on the feedback received, RBI would try to structure its policies and streamline the framework of charges for different payment services.

RBI vehemently stated in the paper that “it has neither taken any view nor has any specific opinion on the issues raised in this discussion”.

WHAT DID GOVERNMENT SAY?

After the reports of the possibility of UPI transactions carrying a service charge circulated online, the Ministry of Finance rushed to issue a statement denying the news on 21 August.

Calling UPI a “digital public good”, the central government clarified that there is no consideration in Government to levy any charges for UPI services.

Currently, RBI has not issued instructions regarding charges for UPI transactions. Users are not charged for transactions done through UPI.

PRIVATE PLAYERS WANT CHARGES

Like any service provider, UPI facility providers need to earn income and recover their operational costs. The charges on each UPI transaction could be one such means.

But to boost the digitization of monetary transactions and build a cashless economy, the central government has mandated a zero-charge framework for RuPay Debit Card and UPI transactions starting from 1 January 2020. Thus, charges in UPI are nil for users and merchants alike.

The payments industry was not happy with the decision. It criticized the zero-MDR policy claiming it would negatively impact their revenue and affects small startups and FinTech companies, as banks are not able to pay for their service.

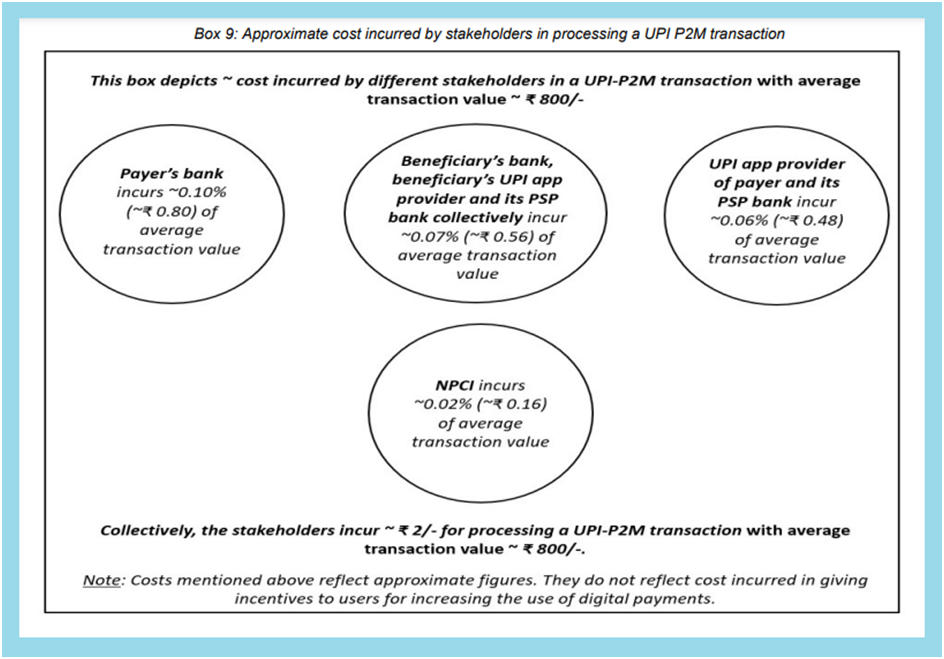

According to RBI, the UPI system (payer’s band, beneficiary’s banks, NPCI, and UPI app) collectively bear Rs. 2 cost for a transaction value of Rs. 800. Every month, the total UPI transaction value surpasses Rs 10 lakhs crores. This means that the UPI system approximately incurs Rs. 30 thousand crores of the annual cost. The question that often arises that how are UPI system players supposed to recover this cost?

“The zero MDR on UPI will kill the industry and make the business model unviable. It’s like nationalization of the payments industry. If the government wants to drive digitization, then it should bear the cost,” said Vishwas Patel, Payments Council of India (PCI) Chairman.

GOVERNMENT REIMBURSEMENTS

The payment industry was asking to be compensated for the infrastructure. To address the industry concerns, the government approved a scheme to provide incentives of small amounts for transactions done through the RuPay Debit Card and BHIM UPI.

In 2021-22, the government paid Rs 1,500 crores for reimbursement.

This year, the government allocated Rs. 200 crores for the same.

The government believes that the current compensation structure for payment service providers is adequate. Hence, refuting the charges on UPI, the finance ministry said concerns of the service providers for cost recovery have to be met through other means.

Although, PCI chairman Vishwas Patel claimed that none of the payment aggregators (PA) or facility providers received the monetary support provided by the Centre to the banks.

“All the support money provided by the finance ministry [to compensate for the zero-charge levy on UPI transactions] has been appropriated by the banks,” he tweeted in reply to the ministry’s clarification tweet.

CONCLUSION

It is clear that no charges have been imposed on the transactions done through UPI. The RBI discussion paper merely sought public feedback and suggestions on charges to be applied to UPI transactions. The government has clarified there is “no consideration” to levy any charges for UPI services.

However, there have been calls from the industry to levy charges on UPI transactions. Even the RBI said that there does not seem to be any justification for a free service. The payment system should earn income for continued operations of the system to facilitate investments in new technologies but who should bear the cost of setting up and operating such an infrastructure is a moot point, it said.

Title:EXPLAINER: Everything to Know About Charges on UPI Transactions

By: Mayur Deokar

Result: Explainer

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Fact Check News Click Here