Receive free World updates

We’ll send you a myFT Daily Digest email rounding up the latest World news every morning.

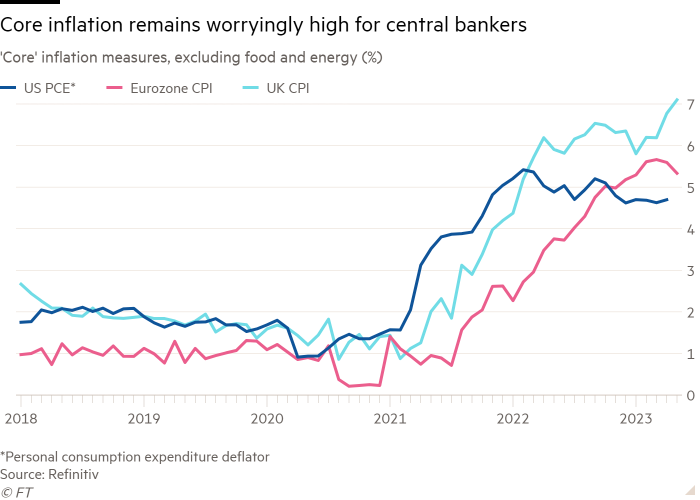

Global central banks are entering a new phase in their battle to bring down soaring prices. While headline inflation rates have fallen across most economies, core rates — which exclude volatile categories such as energy and food — remain at or close to multi-decade highs.

These rates, which are seen as a better gauge of underlying price pressures, have sparked concern that central banks will struggle to meet targets without triggering a recession.

“The next leg of the improvement in the inflation numbers is going to be harder,” said Carl Riccadonna, chief US economist at BNP Paribas. “It requires more pain, and that pain likely involves a recession in the back half of the year.”

Torsten Slok, chief economist at Apollo Global Management, added: “The only way to get inflation down to 2 per cent is to crush demand and slow down the economy in a more substantial way.”

The Bank of England has a particular problem, raising rates by a substantial half percentage point yesterday, a day after data showed core inflation rising to 7.1 per cent last month.

Its peers have been able to move less aggressively. The European Central Bank raised rates by a quarter-point while the US Federal Reserve skipped a rate rise entirely, but both signalled inflation was far from vanquished and warned of further increases ahead.

Here’s what else I’m keeping tabs on today and over the weekend:

-

Economic data: S&P Global releases flash purchasing managers’ indices for the UK, the EU, France, Germany and the US. The UK also has retail sales figures.

-

Elections: Voters in Guatemala, Sierra Leone and Greece head to the polls this weekend.

-

UK politics: Today marks the seventh anniversary of the Brexit referendum. In Dundee tomorrow, the Scottish National party discusses holding a second independence referendum.

Five more top stories

1. The five passengers on board the submersible diving to visit the Titanic’s wreckage were killed after the vessel, known as Titan, suffered a “catastrophic implosion”, the US Coast Guard has said. Authorities confirmed a debris field near the historic shipwreck contains the remains of the submersible.

-

Related: Stockton Rush launched the manned submersible operator OceanGate with vast ambition, but his need to improve its economics appears to have been behind a highly risky design decision.

2. The City of London is planning to fast-track applications to convert unused older offices for new purposes such as hotels to avoid buildings lying empty as “stranded assets”. While demand for 80 per cent of “prime” offices in the Square Mile is high, the rest are older buildings that will struggle to attract tenants, the chair of the City’s planning committee said. Read the full Financial Times interview with Shravan Joshi.

3. Exclusive: The EU plans to lift controls on some genetically modified crops to help farmers cope with climate change, proposing that many varieties of plants created through gene editing should be approved as conventional rather than go through a laborious and expensive existing regime. Here’s why the move could reignite a Europe-wide debate.

4. TikTok’s chief operating officer Vanessa Pappas has stepped down after five years “to refocus on their entrepreneurial passions”, said chief executive Shou Zi Chew in an internal memo seen by the FT. The exit comes as the social media platform faces increasing scrutiny in the US. Here are other leadership changes Chew announced.

5. Germany has signed a 20-year deal to import more US liquefied natural gas, as Berlin moves to replace Russian energy in its economy amid Moscow’s war in Ukraine. Read more about the deal.

How well did you keep up with the news this week? Take our quiz.

The Big Read

Mediterranean Shipping and AP Møller-Maersk were always unlikely bedfellows. Yet in 2015, they set aside their rivalry to share containers and ships, cutting costs without reducing the number of ports they could serve and thereby reshaping the industry. Eight years later, the world’s two biggest container shipping companies are divorcing and plotting strikingly divergent courses with important implications for global trade.

We’re also reading . . .

Chart of the day

Yesterday’s surprise interest rate rise is unlikely to endear the BoE to the British public. A recent Ipsos opinion poll showed more people blamed the central bank’s decisions for the soaring cost of mortgages than on the government, Brexit or Russia’s war on Ukraine.

Take a break from the news

Not sure about which movies to watch this weekend? We have you covered. From Wes Anderson’s Asteroid City featuring a terrific performance from Scarlett Johansson to the latest Flash rendition starring Ezra Miller, here are the FT’s six films to watch this week.

Additional contributions by Benjamin Wilhelm and Gordon Smith

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest World News Click Here