Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

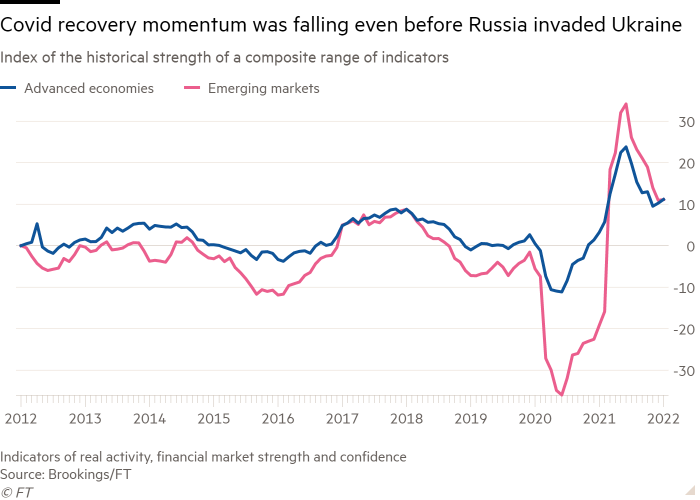

The twin perils of slowing growth and high inflation, or stagflation, will hit the global economy this year as Russia’s war against Ukraine exacerbates a slowdown in the recovery from the coronavirus pandemic, according to Financial Times research.

Mounting price pressures, slipping output expansion and sagging confidence will all pose a drag for most countries, according to the latest Brookings-FT tracking index.

As a result, policymakers will be left with “grim quandaries”, said Eswar Prasad, senior fellow at the Brookings Institution.

The IMF is this week expected to downgrade its forecasts for most countries as finance ministers and central bankers convene at the spring meetings of the fund and the World Bank to discuss how to respond to the darkening economic outlook.

Policymakers must work out how to address rapidly rising prices and the dangers of raising interest rates when debt levels are already high.

Kristalina Georgieva, IMF managing director, on Thursday called the war in Ukraine a “massive setback” for the global economy.

Thanks for reading FirstFT Asia. Here’s the rest of the day’s news — Sophia

The latest from the war in Ukraine

-

Military briefing: Russia’s defence ministry demanded the surrender of Ukraine troops holding out in Mariupol, who have used the city’s network of tunnels to their advantage.

-

Nato: Lithuanian president Gitanas Nauseda urges Sweden and Finland to join Nato, arguing that it would boost the security of the Baltic states and reinforce the western military alliance.

-

Shipping and logistics: Russian trucks are stuck in long queues at the EU’s eastern borders following a ban on their vehicles which went into effect on Saturday.

-

Wall Street: The number of failed trades in the US corporate bond market shot higher following Russia’s invasion of Ukraine, with investors linking the settlement problems to sanctions imposed after the war began.

-

Finance: US banks last week detailed billions of dollars in potential losses from the war while warning that they saw no end in sight for market turbulence.

-

Sanctions: The US has a “long playbook” of further Russia sanctions planned, said a senior state department official.

-

Heritage: Ukraine is battling to protect its churches, historic sites and national monuments from the ravages of war.

-

Opinion: Vladimir Putin once presided over a period of fast economic growth, but as the Russian economy stagnated, his regime has now reverted to a 20th-century dictatorship based on fear.

Coronavirus digest

-

South Korea lifts restrictions: Starting today, the midnight curfew as well as restrictions on private gatherings and large-scale events will be lifted in South Korea. The country has downgraded Covid-19 to a “Class 2” disease.

-

Explainer: With the lockdown in Shanghai and more Asian central banks grappling with inflation, policymakers across the region nervously watch for slowed economic growth in China.

-

Omicron’s impact: The way China reports infections and deaths is obscuring the true impact of the Omicron wave and complicating its public health response.

Five more stories in the news

1. How journalists crowdfunded their coverage of the war Crowdfunding platform Patreon is home to more than 3,000 contributors in Ukraine. Now the company, which was founded with artists and musicians in mind, could play an instrumental role in supporting independent journalism.

2. China views Russian invasion as a ‘strategic utility’ The country is hoping to exploit a distracted west to focus on its competition with the US, and will welcome a prolonged war in Ukraine as a “rolling strategic diversion” from its own assertiveness, according to former Australian prime minister Kevin Rudd.

3. Inflation surge slashes $11tn from world’s negative-yielding debt Bond prices have tumbled this year as central banks move to end large-scale asset purchases and raise interest rates in their battle with soaring inflation. The change is close to ending the era of negative-yielding debt — and wiping out negative yields entirely would mark a return to normality for a broad range of big investors.

4. Shanghai residents clash with police Small protests have broken out in Shanghai as residents grow increasingly frustrated with Covid lockdown restrictions. Videos of desperate residents being physically restrained by police dressed in white personal protective equipment following a confrontation in the street were quickly erased from Chinese social media.

5. TikTok under US government investigation The US Department of Homeland Security is investigating how TikTok handles child sexual abuse material, according to two sources familiar with the case. The Department of Justice is also reviewing how a specific privacy feature on the Chinese-owned social media app is being exploited by predators.

The day ahead

Chinese economy The country’s National Bureau of Statistics releases its estimates for first-quarter gross domestic product growth.

Bank of America The global financial services company will also release its Q1 results today.

Boston Marathon The world’s oldest annual marathon takes place in Boston, Massachusetts, for the 126th time.

Join us for the FT’s Crypto and Digital Assets summit on April 26-27. Register today to be part of a critical conversation with the world’s global financial and corporate elite, as they carve out the path ahead for bridging traditional finance and the crypto leaders of tomorrow.

What else we’re reading

Is the world truly unified against Russia? Initial euphoria over the west’s response to the war in Ukraine has ebbed, as even optimists are aware that unity could be fragile. Add to that the Global South’s indifference — the likes of India, South Africa and Brazil — and Moscow’s narrative of western hypocrisy, and the initial impression that the whole world had united in outrage against Russia was clearly misleading.

A rude awakening for Elon Musk The world’s richest man cast himself as Twitter’s saviour, claiming that he would bring free speech back to the social media platform with his $43bn hostile takeover bid. But his pitch has fallen largely on deaf ears, as sceptics doubt the seriousness of Musk’s follow-through.

The ‘grey resignation’ poses a problem Nearly 70 per cent of the 5mn people who left work in the US during the pandemic were older than 55. This may be a welcome development for younger people, but it has left an already-tight labour market with an even lower supply of experienced workers.

Japan’s ‘new capitalism’ is a zeitgeisty thought with no bite According to leaks, the government is discussing changes to relieve listed companies from the burdens of quarterly reporting. The true extent of any changes is hazy, though — the real objective of these leaks was to posit new prime minister Fumio Kishida against a villainous “short-termism”, writes Leo Lewis.

The best business books for April If you are looking for some reading this Easter weekend, our Work & Careers team have selected their favourite business books published this month. They include advice from entrepreneurs and a study of how flexible working can improve our lives and cities.

Gardening

Feeling inspired by the change of the season to try your hand at growing some veggies? Two new books, from Cinead McTernan and Mark Ridsdill Smith, aim to guide city dwellers through the unique challenges presented by growing crops amid concrete in small yards or on balconies.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to [email protected]. Sign up here

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest World News Click Here