Key events

Filters BETA

Kremlin warning on Nord Stream 1 reliability

Kremlin spokesman Dmitry Peskov has also warned that the reliability of the Russian Nord Stream 1 gas export pipeline is under threat.

Peskov says that one turbine is operational at the key compressor station, which is currently closed for a three-day maintenance outage.

Nord Stream 1, which connects Russia and Germany, was only operating at 20% capacity before Wednesday’s temporary shutdown, which Russia blamed on faulty or delayed equipment.

According to Bloomberg, Gazprom has said the only functioning turbine at Nord Stream’s entry point must undergo technical maintenance every 1,000 hours. That’s about every 42 days, with the next checks due in mid-October.

Russia says it will stop selling oil to countries that impose price cap

The Kremlin has hit back at the G7’s push for curbs on Russian oil prices (see earlier post).

Kremlin spokesman Dmitry Peskov told reporters in a conference call that Russia would stop selling oil to countries that impose price caps.

“Companies that impose a price cap will not be among the recipients of Russian oil.

“We simply will not cooperate with them on non-market principles.

Deputy Prime Minister Alexander Novak made a similar pledge yesterday.

KREMLIN: RUSSIA WILL STOP SELLING OIL TO COUNTRIES WHICH SUPPORT PRICE CAPS FOR RUSSIAN OIL.

— Breaking Market News ⚡️ (@financialjuice) September 2, 2022

#OOTT Kremlin: Russia Will Stop Selling Oil To Countries Which Support Price Caps For Russian Oil

– Russia Will Ship Oil To Countries Which Act In Accordance With To Market Rules— LiveSquawk (@LiveSquawk) September 2, 2022

The US Federal Reserve is set for several more rate rises before the year is over, predicts Mark Haefele, chief investment officer at UBS Global Wealth Management.

“We maintain our view that the Fed will raise rates by a further 100bps by year-end, with risks for more if inflation does not slow in line with our forecasts.

With rates likely to stay higher for longer, our base case is for further volatility, earnings downgrades, and higher-than-expected default rates over the course of next year.”

US rates are now in a target range of 2.25%-2.5%, after two large rises of 75bp (basis point) rises at the Fed’s last two meetings.

“This is the worst year in history by far for fixed income,” says Lawrence Gillum, fixed income strategist for LPL Financial.

“If that’s not a bear market in bonds I don’t know what is.”

[bonds are classed as ‘fixed income’, because bond-holders receive a regular fixed payment, or ‘coupon’, until the debt matures and the face value of the bond, or the ‘principal’, is repaid]

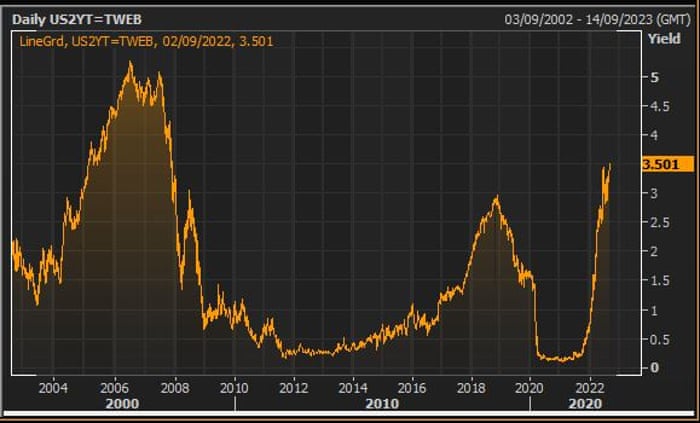

The changes in the US government debt market in the last year are quite dramatic, helping push global bonds into bear-market territory.

The yield on two-year Treasury bonds has hit its highest level since late 2007, at the start of the financial crisis. It’s jumped to 3.5%, up from just 0.2% a year ago.

Bond yields rise when prices fall, and this year’s selloff came as the US Federal Reserve abandoned its hope that inflation would be ‘transitory’, and cracked on with a series of sharp interest rate increases.

That tightening isn’t over yet, with another hike expected this month.

Fed in 2021 — “We are not even thinking about thinking about raising rates.”

Fed in 2022 — “We will maintain restrictive policy for some time.”

— Puru Saxena (@saxena_puru) September 2, 2022

Global bonds tumble into ‘first bear market in a generation’

The selloff in government debt has driven the global bond market into its first bear market in over three decades, Bloomberg reports.

Bloomberg’s Global Aggregate Bond Index, which tracks government and investment-grade corporate bonds, has now fallen more than 20% from its 2021 peak, following the latest pressure from central bankers trying to grip inflation.

That’s the index’s biggest drawdown since its inception in 1990.

Bond prices have been weakening steadily this year, driving up the yield (or interest rate) on sovereign debt. Within inflation soaring, and interest rates rising, investors have been demanding a higher rate of return.

Last Friday’s hawkish speech by Federal Reserve Chair Jerome Powell at the Jackson Hole symposium, when he vowed to keep fighting inflation, has triggered fresh losses this week.

Bloomberg says:

“I suspect that the secular bull market in bonds that started in the mid-1980s is ending,” said Stephen Miller, who’s covered fixed income since then and now works as an investment consultant at GSFM, a unit of Canada’s CI Financial Corp. “Yields aren’t going to return to the historic lows seen both before and during the pandemic.”

The elevated inflation the world now faces means central banks won’t be prepared to re-introduce the sort of extreme stimulus that helped send Treasury yields below 1%, he said.

The selloff has undermined one of the main investing strategies, that investors seek out bonds when they’re nervous, and shares when they’re optimistic. That’s the basis of the classic 60/40 portfolio (60% of funds in equities for capital growth and dividends, and 40% in bonds which pay a fixed-income).

Both bonds and stocks have slumped this year – Bloomberg’s bond gauge is down 16% in 2022, while MSCI Inc.’s index of global stocks has lose 19%.

UK gilts certainly haven’t been immune. Benchmark 10-year UK government bonds had their worst month since the 1980s, with yields at the highest since 2014.

Shell boss Ben van Beurden prepares to stand down, reports say

Kalyeena Makortoff

Shell’s long-serving chief executive, Ben van Beurden, is preparing to step down next year after almost a decade in the role, according to Reuters.

The London-headquartered energy company has shortlisted four internal candidates to take his place after months of succession planning efforts that were accelerated once Sir Andrew Mackenzie became Shell’s chair in May 2021.

Van Beurden, who took over in 2014, would leave Shell in the middle of the most severe energy crisis of his tenure, which has subsequently pushed the oil and gas giant’s profits to record highs.

The energy boss, who was paid €7.4m (£6.1m) in 2021, warned earlier this week that gas shortages in Europe would probably last several years, raising the prospect of continued energy rationing.

Van Beurden could be replaced by the Canadian head of Shell’s integrated gas and renewables division, Wael Sawan, who is said to be the frontrunner in Shell’s search for a successor….

Here’s the full story:

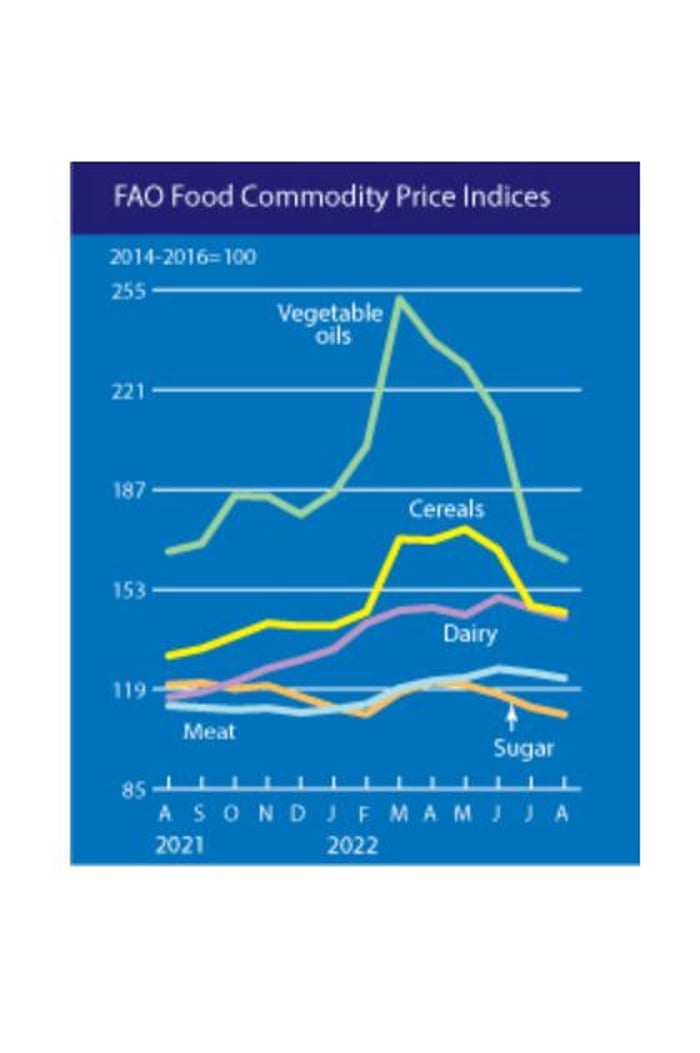

World food prices fall as Ukraine grain shipments resume

World food price fell back in August for the fifth month in a row, helped by the resumption of grain exports from Ukrainian ports.

The United Nations food agency’s world price index fell further away from its record highs earlier this year, as commodity food price eased.

International wheat prices fell by 5.1%, which the UN says was:

….driven by improved production prospects, especially in Canada, the United States of America and the Russian Federation, and higher seasonal availability as harvests continued in the northern hemisphere as well as the resumption of exports from the Black Sea ports in Ukraine for the first time in over five months of interruption.

Vegetable oil prices fell 3.3%, due to lower world prices of palm, sunflower and rapeseed oils.

Dairy prices dropped 2%, with weak demand hitting butter and milk powders.

Meat fell 1.5%, driven by poultry and meat.

Sugar dropped 2.1%, following “an increase in the sugar export cap in India, and lower ethanol prices in Brazil, which raised expectations of a greater use of sugarcane to produce sugar”.

Germany was hit by a decline in trade in July, as Europe’s largest economy continues to be buffeted by the energy crisis, and the wider disruption from the Ukraine war.

German exports were down by 2.1% month-on-month in July, while imports fell 1.5% compared with June, lowering Germany’s trade surplus.

Trade with Russia were hit by sanctions, with exports down 15% in the month, and 55% less than a year ago, while imports from Russia fell 17%.

Good Morning from Germany where its nimbus as export powerhouse is fading. Germany’s trade surplus narrowed in Jul as exports fell at greater pace than imports. Balance of exports & imports was €5.4bn, narrowing from €6.2bn in Jun. Surplus has shrunk significantly in past mths. pic.twitter.com/3QvlyZDNlH

— Holger Zschaepitz (@Schuldensuehner) September 2, 2022

This decline in trade adds to concerns that Germany could fall into recession, says Carsten Brzeski, ING’s global head of macro.

Trade is no longer a growth driver but has become a drag on German growth. Since the second quarter of 2021, the growth contribution of net exports has actually been negative.

Global supply chain frictions, geopolitical risks and rising production costs are the obvious drivers behind this new trend. Looking ahead, the outlook for German trade is mixed. There is some relief in supply chains and transportation costs.

However, at the same time, low water levels, high energy prices and the possible fundamental change in supply chains and production processes on the back of geopolitical uncertainty will be clear obstacles to growth.

UK and European gas prices have dropped in early trading, away from the highs in late August in the scramble to secure supplies before winter.

The Dutch wholesale contract for weekend delivery has fallen 21.5%, while the British equivalent is down 10%.

The UK month-ahead contract is down 5% at 455p per therm, but still over three-times higher than a year ago when it was around 130p.

BCC: UK going into recession now

The British Chambers of Commerce has forecast that the UK will enter into a recession before the end of 2022 (highlighting the pressures on the pound).

Baroness Ruby McGregor-Smith, president of the BCC, told BBC Radio 4’s Today programme that small firms, in particular, need more support.

We still believe, currently, that we are going into recession now.

“We’ve just put out an economic forecast today that talks about that. But all these measures will start to change that because the challenge for us is, we’re not just talking about big businesses, many of whom are going to really, really struggle.

“We’re talking about more and more and more SMEs, which are the lifeblood of our economy. So they need more support now, as they did during Covid. This for us is no different.”

Baroness McGregor-Smith also warned that two-thirds of pubs may have shut their doors this winter (as flagged earlier).

After four days of losses, the UK’s blue-chip share index has opened a little higher this morning.

The FTSE 100 index is up 35 points, or 0.5%, clawing back a little of Thursday’s 1.8% slide. Oil giants BP and Shell, and retailer JD Sports, are among the risers.

But UK housebuilders, a bellwether of domestic economic confidence, are falling, after HSBC slashed its share price targets. Berkeley Group (-4.7%), Barratt (-3.5%), Persimmon (-2.1%) and Taylor Wimpey (-1.6%) are the top fallers.

UK house prices are likely to stall next year as inflation continues to bite and mortgage rates rise.

But tenants will continue to be hit by rising rental prices, despite the squeeze on their finances.

That’s a prediction from estate and letting agent Hamptons; it forecasts prices to be unchanged in the fourth quarter of 2023 compared with the same period in 2022.

Sales are expected to be hit next year too, as rising interest rates deter first-time buyers, but 2024 could be a “year of recovery”.

Despite affordability issues for tenants, Hamptons said it expects rents will rise by 5% annually next year and in 2024, before slowing slightly to 4% in 2025.

The report said:

“Lower rental yields in London will make it harder for landlords to absorb rising costs than their counterparts in the North.

“This is why we think the supply of rental homes in the capital looks set to shrink further, pushing up rents.”

If so, that’s another blow to tenants. Last month, homeless charity Shelter warned that private tenants in London are facing “increasingly unaffordable” rents, due to high demand and a shortage of properties in the capital.

Celebrity chef Tom Kerridge has revealed that the annual energy bill at his pub has soared from £60,000 to £420,000 – as the hospitality sector faces a “terrifying landscape”.

He told The Telegraph that “at the minute it’s a hugely volatile marketspace”, adding:

“There’s no way that businesses are going to be able to absorb four, five, six hundred per cent price increases.”

Speaking to the BBC, Mr Kerridge said one of his pubs has a monthly electricity bill of £5,000 – but this is set to soar to £35,000 in December when a tied contract ends.

Energy bill at Tom Kerridge’s pub to leap from £60,000 to £420,000; Chef warns that hospitality sector faces ‘terrifying and scary landscape’ as owners say they may close over Christmas https://t.co/WtjoYIBkC4

— Mark Wingett (@Wingers76) September 2, 2022

Kerridge certainly isn’t alone. Earlier this week, brewery bosses warned that thousands of pubs face closure without urgent government support to soften the blow from soaring energy bills.

One survey has found that more than 70% of pubs didn’t expect to survive the winter without help to ease energy costs.

Finance ministers from the Group of Seven are expected to firm up plans on Friday to impose a price cap on Russian oil aimed at slashing revenues for Moscow’s war in Ukraine, Reuters reports.

The ministers from the club of wealthy industrial democracies are due to meet virtually, and could issue a communique that lays out their implementation plans.

The aim, G7 officials say, is to keep crude flowing to avoid price spikes.

Here’s the details:

“A deal is likely,” a European G7 official said, adding that it was unclear how much detail would be revealed, such as the per-barrel level of the price cap, above which complying countries would refuse insurance and finance to Russian crude and oil product cargoes.

British Finance Minister Nadhim Zahawi said on Thursday in Washington that he was hopeful that G7 finance ministers will “have a statement that will mean that we can move forward at pace to deliver this.”

“We want to get this oil price cap over the line,” he told a think tank event in Washington a day after discussing the cap with U.S. Treasury Secretary Janet Yellen.

Yellen is also pushing for a price cap on Russian oil – she warned that failure to agree a deal would hurt the global economy.

Engie CEO: Energy markets are facing a turning point

Europe’s energy sector is going through an “exceptional crisis”, the chief executive of France’s leading gas importer Engie has warned.

“The world of energy as we have known it won’t ever be the same again,” Catherine MacGregor told RTL radio, explaining that curbs to Russian energy imports and the shift towards green energy were a ‘turning point’.

Tensions between France and Russia escalated this week when Gazprom said it would cut supplies to Engie, in a row over contracts.

Asked if Engie, France’s main gas supplier to households, may face a gas shortage this winter, MacGregor said she was “very confident that we will make it”, unless particularly severe weather conditions lead to an unusually high demand.

“This is why the message of energy sobriety remains extremely important”.

More here: Engie CEO: Energy markets are facing a turning point

The severety of winter is a key factor determing whether Europe can get through the next few months without gas rationing and blackouts – as it whether Russian gas supplies are stopped.

couple of hours of listening to conference calls about European Gas. Some interesting “takeaways” (thread)

— Paul McNamara (@M_PaulMcNamara) September 1, 2022

Important as whether Russian flows are low or zero is, the key variable is severity of winter. A mild winter will make this look like a fuss about nothing, no scope to prepare for a bad one

— Paul McNamara (@M_PaulMcNamara) September 1, 2022

European wholesale gas price have dropped back from August’s record highs this week, but remain sharply higher than before the Ukraine war.

Gazprom’s Nord Stream 1 is due to reopen on Saturday, after three days of maintenance.

Introduction: Pound under pressure as recession looms

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

The pound is at risk of hitting its lowest level against the US dollar in 37 years, as a looming recession, rocketing inflation and political uncertainty hit the currency.

Last night, sterling sank to just $1.15 against the US dollar, making a weak start to September – after its worst month against the greenback since shortly after the Brexit referendum.

It is approaching the Covid crash low of just over $1.14 in March 2020, which was the worst level since 1985.

Predictions that Britain is falling into recession as storm clouds gather over the economy have hit demand for UK assets.

Warnings that Britain faces a ‘frankly terrifying’ cost of living squeeze as inflation rises over 10%, also weighed. Real wages are expected to hit their lowest level since 2003, wiping out 20 years of growth.

A weak currency will push up the cost of importing goods, adding to the pressures on UK businesses – on top of soaring energy bills, raw material costs, and ongoing supply chain disruption.

The pound isn’t alone in struggling against the US dollar. The greenback hit a 20-year high against a basket of currencies yesterday, after economic data suggested America’s Federal Reserve would keep hiking interest rates into 2023.

As Jim Reid of Deutsche Bank points out:

The reverse picture was that the Euro fell back beneath parity against the dollar, and the Japanese yen fell to 140 per dollar for the first time since 1998.”

But, the pound has also lost ground against the euro in recent weeks, as soaring eurozone inflation is likely to prompt the European Central Bank to raise interest rate sharply.

Sterling is currently trading around €1.158, compared with almost €1.20 at the start of August.

Kit Juckes, currency expert at Société Générale, says:

Sterling has been helped by rising short-term rates in recent weeks. However, with more and more ECB council members pushing the idea of a 75bp hike next week, sterling’s support is waning.

Meanwhile, higher Gilt yields aren’t so helpful when people see them as the price the UK pays to suck in huge amounts of money needed to balance the budget in the months/years ahead.

The UK economy is in recession, the balance of payments is catastrophic and more/faster rate hikes won’t do much to restore confidence.

Also coming up today

Investors are poised for the latest US jobs report, which could show a slowdown in hiring last month. The Non-Farm Payroll is expected to have risen by around 300,000 in August, after 528,000 in July.

We’ll also hear how UK construction firms fared last month, and how fast factory gate prices are rising in the eurozone.

The agenda

-

7am BST: German trade balance for July

-

9.30am BST: UK construction PMI report for August

-

10am BST: Eurozone PPI measure of producer prices inflation

-

1.30pm BST: US non-farm payroll employment report for August

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here