Around 750 jobs are being axed at online car seller Cazoo across the UK and Europe as it looks to cut costs by more than £200m by the end of next year, PA Media reports.

The British group, which is listed in America, has said it plans to slash its workforce by about 15% and also slow down on hiring new staff under a major cost-savings drive, as it warned over recession fears and consumer cut backs.

Cazoo did not give a breakdown of where the jobs will go, but it is understood the bulk will be across its UK operations – its biggest division – as well as in its European bases in Germany, France and Italy.

The group said the “business realignment” was needed to protect profits in the face of tougher economic times.

But it also comes as firms such as Cazoo have seen online car sales dwindle as pandemic restrictions have been lifted, with used car dealer Carzam collapsing late last week.

#Breaking Online car seller Cazoo has said it will cut around 750 jobs across the business in the UK and Europe as it looks to make savings of more than £200 million by the end of next year pic.twitter.com/lKCWXdM9Sc

— PA Media (@PA) June 7, 2022

Over in the US, retailer Target has announced an aggressive plan to clear out unwanted stock by slashing prices.

The move will hit profitability, with Target also cutting its profit margin expectations for the fiscal second quarter as it tries to shift excess inventory as consumer spending patterns change.

Just three weeks ago, Target warned that rising costs would hit its profits this year — and it is now taking further steps to clear its shelves.

CEO Brian Cornell has told CNBC that Target wants to make room for merchandise that customers do want, such as groceries, beauty items, household essentials and seasonal categories like back-to-school supplies.

“We thought it was prudent for us to be decisive, act quickly, get out in front of this, address and optimize our inventory in the second quarter — take those actions necessary to remove the excess inventory and set ourselves up to continue to be guest relevant with our assortment,”

Just in: Target is rolling out an aggressive plan to get rid of unwanted inventory. I spoke to CEO Brian Cornell about why it decided to accelerate markdowns — even though that will hit Q2 profits. $TGT https://t.co/qkTW4EnAXk

— Melissa Repko (@melissa_repko) June 7, 2022

Target’s shares have fallen over 8% in pre-market trading:

Oil prices are likely to extend their recent gains, adding to inflationary pressures, according to new forecasts from Goldman Sachs.

Goldman analysts estimate that Brent crude will need to average $135 a barrel in the 12 months from July, up $10 from its previous forecast, for global inventories to normalize by late next year

Brent is trading around $120/barrel today, up from under $80/barrel at the start of this year.

Higher prices would help global crude stockpiles to be rebuilt in the face of rebounding Chinese demand and reduced production from Russia.

OIL MARKET: Goldman Sachs tells clients it expects Brent crude to average $140 a barrel between July and September (and because US strength and sky-high refining margins, consumers will ‘experience’ retail prices like if Brent has surged to ~$160 a barrel) #OOTT pic.twitter.com/2q4oxFDlIt

— Javier Blas (@JavierBlas) June 7, 2022

⚠️????️???? Goldman Sachs hikes Q3 ’22 oil price forecast for WTI crude to $137 from $119 prev.

???? Hikes Brent price to $140 from $125 prev.

(H/T @FerroTV) pic.twitter.com/ajgNsRMnJ8

— Michael Goodwell (@MichaelGoodwell) June 7, 2022

The FT’s Valentina Romei says London’s faster growth shows the challenges of the government’s regional “levelling up” drive.

The capital’s economy benefited from its reliance on higher productivity services jobs that mostly continued throughout the pandemic with employees working from home.

This is in contrast with the West Midlands, which is more reliant on manufacturing, where first-quarter output was 10.4 per cent below pre-pandemic levels and growth was 0.5 per cent in the period.

The figures suggest that the pandemic and recovery have contributed to widening the UK’s economic inequalities.

London’s economic recovery outpaces other UK regions

London’s economy is outpacing the rest of the UK, according to new official data which shows the government’s levelling up agenda is struggling.

The Office for National Statistics reports that London’s GDP rose by 1.2% in January-March, much faster than the UK average of 0.8% during the first quarter of 2022.

Wales, at 1%, and the East Midlands, at 0.9%, were the only other regions to grow faster than average.

Northern Ireland was the slowest with 0.4% growth, while the North East, Yorkshire and The Humber, and the South West all matched the average.

The East of England, North West, Scotland, and the South East were all slightly slower with 0.7% growth.

The report also shows that London, and Northern Ireland, are the only economies larger than their pre-pandemic levels in Q4 2019.

The West Midlands’ GDP is still 10% smaller than before Covid-19. That suggests its manufacturing base has been harder hit by the pandemic than the capital, where many employees shifted to home-working.

New model-based estimates of regional GVA by @ONS show that, as of Q1 2022, only in London and Northern Ireland was activity above its pre-COVID level pic.twitter.com/ocj2WlLFjO

— Alpesh Paleja (@AlpeshPaleja) June 7, 2022

South Africa beats forecasts with Q1 growth

South Africa’s economy grew faster than expected in the first quarter of this year, lifting it back to pre-pandemic levels.

A strong performance by the factory sector helped South Africa’s GDP increase by 1.9% in January-March, and by 3% more than a year ago, as it emerged from the disruption of the omicron variant.

That beat forecasts of 1.2% quarter-on-quarter growth and 1.7% year-on-year growth.

Statistics South Africa said manufacturing grew 4.9% quarter-on-quarter, while the trade, catering and accommodation category expanded 3.1% and agriculture, forestry and fishing 0.8%.

Mining and quarrying contracted 1.1%.

Investor morale in the euro zone has risen this month for the first time since Russia’s invasion of Ukraine.

Sentix’s index of eurozone investor confidence has rise to -15.8 points in June from -22.6 in May — which was the weakest figure since June 2020.

Although it’s an improvement, it shows the economy is still in a downturn.

Sentix managing director Manfred Huebner has cautioned that:

“As impressive as the improvement in the situation and expectations values may appear at first glance, this is unlikely to mark a turnaround.”

UK service sector slowdown – what the experts say

UK services firms suffed a worrying combination of slower growth and higher prices in May, says Tim Moore, Economics Director at S&P Global Market Intelligence (which compiled the PMI report).

“There were bright spots in customer-facing parts of the economy during May, buoyed by a rapid recovery in consumer spending on travel, leisure and entertainment.

However, hospitality businesses widely reported constraints on recovery from a lack of candidates to fill vacancies and difficulties meeting demand due to ongoing global supply chain disruption.

“Service providers are increasingly concerned about the near-term business outlook, with price resistance among consumers and escalating cost of living pressures set to dampen spending during the second half of 2022.

Growth expectations have dropped in each month since the invasion of Ukraine and are now the weakest since October 2020.”

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, says firms faced rising fuel and food prices, and salaries.

Though there was a glimmer of hope with export orders which were not as flat as in previous months, Brexit customs restrictions and war in Ukraine continued to impact overseas confidence still further.

“One bright spot was strong employment levels. Job seekers still had the pick of the bunch in terms of roles and requested salaries but as capacity levels are reached and new order gaps appear, the window of opportunity is starting to close.

“The sudden fall in the overall index is a cause for worry and was reflected in the sector’s optimism which was the lowest since the height of the pandemic in October 2020.

Recessionary fears are growing bigger and stronger amid the realisation that 2022 as the year of stable recovery has not materialised yet.

Sam Cooper, Vice President of Market Risk Solutions at Silicon Valley Bank, says:

“Despite beating expectations, today’s PMI print is unlikely to move the needle for sterling.

With a deluge of bad news in the form of political tensions, worrying BRC sales data and a chronic labor shortage paired with rampant inflation, long term forecasts for the pound are likely to be revised lower as pressure continues to mount”

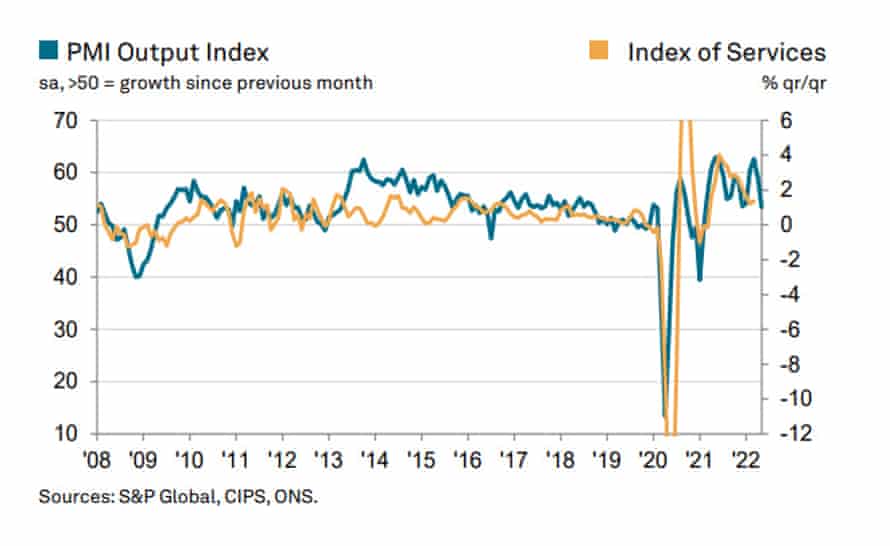

UK services firms hit by rising inflation

Growth across the UK’s service sector slowed sharply last month as rising inflation hits customer demand.

Services firms saw the weakest growth since February 2021, when many businesses were locked down in the pandemic, according to the latest purchasing manager’s survey.

It found that business activity growth eased considerably in May, while profit margins were squeezed by rising prices.

Many firms reported that worries about the economic outlook and heightened risk aversion hit customer demand. But, the hospitality sector had a strong month, helped by the easing of pandemic restrictions.

This dragged the Services PMI down to 53.4 in May, from 58.9 in April — the biggest jump since the survey began in 1996, apart from during Covid-19 lockdowns.

However, it is better than the ‘flash’ reading of 51.8 taken during May.

UK S&P Global/CIPS Services PMI May F: 53.4 (exp 51.8; prev 51.8)

– S&P Global/CIPS Composite PMI May F: 53.1 (exp 51.8; prev 51.8)— LiveSquawk (@LiveSquawk) June 7, 2022

The survey shows that the cost of living squeeze didn’t abate — firms were hit by a record increase in input costs, and lifted their own prices at an unprecedented speed in response.

Firms were gloomier too, with growth projections lowest since October 2020.

The report says:

The weakest headline index reading since February 2021 mostly reflected subdued business and consumer confidence, with worries about the economic outlook also contributing to softer demand patterns in May.

Travel, leisure and entertainment was the main exception, with hospitality businesses widely commenting on strong consumer demand due to the removal of pandemic restrictions.

MUFG: UK political instability not good for GBP

The UK’s political instability is not good for the pound, writes Derek Halpenny of Japanese bank Mitsubishi UFJ.

The stance of the PM and his supporters is that a victory is a victory and that it is time to “draw a line” and “move on”. That could prove difficult to do. Two bi-elections on 23rd June are likely to reveal huge swings in favour of Labour and the Lib Dems while the conclusions of an enquiry into whether Johnson lied to parliament and an enquiry into the government’s handling of covid are likely to come after the summer recess.

With 41% of sitting MPs now wishing him to go the outlook does not look good and a divided party is not favourable for getting policies through parliament. The difficult economic outlook that lies ahead will be far more difficult to get through with a PM that lacks support. Difficult policies like altering the framework of the Northern Ireland Protocol that is integral to the relationship with the EU and the Withdrawal Agreement points to further divisions down the road.

We already have GBP forecasts that indicate underperformance and weaker GBP/USD levels than the current spot level through Q3 and the outcome of last night’s vote is consistent with our bearish GBP view.

Boris Johnson emerged wounded after his narrow victory in no-confidence vote, writes Modupe Adegbembo, G7 Economist at AXA Investment Managers:

Adegbembo also believes Johnson could use government spending to shore up support:

We do not expect that the vote will have a significant impact on the macro environment in the near term.

Fiscal policy and the outlook for monetary policy is likely to remain unchanged (we expect the Bank of England to hike 4 more times this year). However we do see the risks that a weakened PM seeks to shore up support amongst the public and MPs using fiscal giveaways.

It also increases the risk of more populist policies to try and regain lost support. This may include more extreme action with regards to Northern Ireland. All of this will add to an already uncertain macroeconomic background.

RBC Wealth Management’s Frédérique Carrier also predicts that the UK govenment could roll out further stimulus measures as the PM “attempts to improve his popularity”.

If so, that could spur the Bank of England to raise interest rates even faster, Carrier explains:

Chancellor Sunak’s recent £15bn stimulus package led expectations for the year end Bank Rate to reach 2.3%.

Any further such supportive measures would likely boost further the Bank Rate year end expectations.”

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here