India’s insurance sector is highly competitive and is witnessing mergers and acquisitions as insurers have tremendous opportunities and volume to co-exist in the space, according to the Economic Survey 2022-23 released on Tuesday.

“Additional FDI inflows, IPOs, simplified rules and regulations, and improved corporate valuations will likely further accelerate M&A activities in the sector,” it said.

Quoting a report by Swiss Re Institute World Insurance, it said that India is one of the fastest-growing insurance markets. In terms of total premium volumes, India is the tenth largest globally, with an estimated market share of 1.9 per cent, and the second largest among emerging markets.

India is expected to be one of the top six insurance markets by 2032, with non-life insurance growth likely to be driven by health coverage and compulsory motor third-party insurance as India’s middle class expands.

However, while life insurance penetration has increased, most products sold are savings-linked with a small protection component, thus leaving households exposed to significant financing gap in case of premature death of the primary bread winner, the survey said.

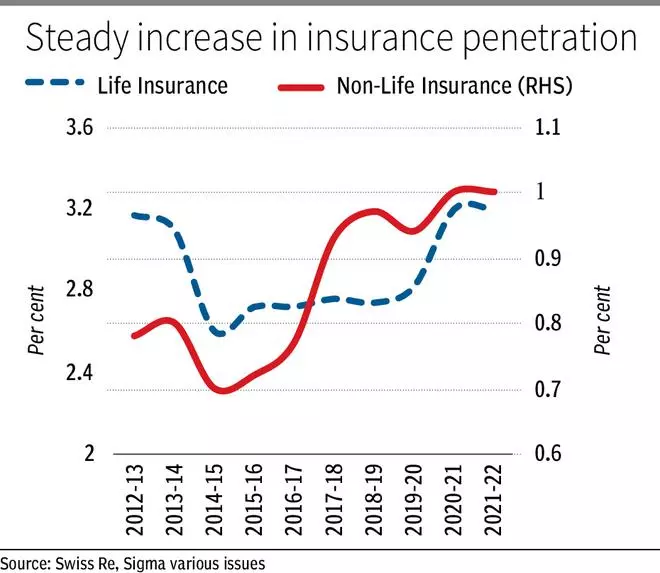

Insurance penetration rises

Insurance penetration has increased from 2.7 per cent in 2000 to 4.2 per cent in 2021. Of this, life insurance penetration was 3.2 per cent – almost twice more than the emerging markets and slightly above the global average. Insurance density also increased from $11.1 in 2001 to $91 in 2021, of which life insurance density was $69 and non-life insurance was $22.

“These (regulatory and government) measures, accompanied by an increase in FDI limit for Insurance companies, are likely to facilitate an increased flow of long-term capital, global technology, processes, and international best practices, which will support the growth of India’s insurance sector,” it said.

Private sector to lead pension expansion

Incremental growth for NPS (National Pension System) is expected to emanate from the private sector, both salaried and self-employed, according to the Economic Survey

Enhanced pension literacy, both of the subscribers and the intermediaries, coupled with a nudge from the regulator and the government, and encouraging young adults to join a pension scheme will accelerate growth in pension, it said.

The total number of subscribers under NPS and APY (Atal Pension Yojana) grew 25 per cent YoY as of November 2022, with the AUM rising 23 per cent. Overall contribution increased 28 per cent on year.

Quoting a study by PFRDA, the Economic Survey said that the population coverage under NPS and APY rose from 1.2 per cent in FY17 to 3.7 per cent in FY22. Assets as a proportion of GDP increased from 1.2 per cent to 3.2 per cent, reflecting that the pension sector is progressing much faster than the nominal growth of the economy and population.

“There is tremendous scope for growth in India’s pension sector as per capita income is expected to rise further as the economy transitions to a high-middle-income country,” the survey said, adding that however low financial literacy continues to be a significant challenge.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest For Top Stories News Click Here