Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

National Grid has hiked its profit forecasts after reporting a jump in earnings…. as its subsea cables that connecting Britain to other countries benefit from high energy prices across Europe.

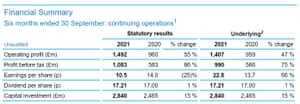

Pre-tax profits at National Grid, which runs the UK’s power infrastructure, jumped 86% in the first half of the financial year (to 30th September), to £1.08bn, from £583m a year ago.

The jump was partly driven by higher auction prices across its interconnector portfolio, the high voltage cables which connect the UK’s electricity systems to other countries.

And the early commissioning of the world’s longest under-sea electricity cable between Britain and Norway could also boost the firm’s fortunes, as well as improving the UK’s energy security.

National Grid bought Western Power Distribution, the UK’s largest electricity distribution network operator, for £7.8bn, earlier this year, as part of a pivot away from gas and towards electricity.

That gave a lift to operating profits, as did National Grid’s new IFA2 (Interconnexion France-Angleterre 2) link to France.

Revenues from electricity transmission also rose.

National Grid told the City:

Excluding the first time contribution of £257m from Western Power Distribution (WPD), underlying operating profit was up 20% driven by the first six months of operations at IFA2, reduced impact from COVID-19 compared to the prior year, and higher UK Electricity Transmission net revenue as we accelerate our investment for the energy transition at the start of RIIO-T2.

[RIIO-T2 are the new set of network price controls set by regulator Ofgem].

Shareholders will see the benefits — National Grid now expects earnings per share to be ‘significantly’ higher than previously thought, partly due to higher auction prices.

The new North Sea Link (NSL) which will be able to channel up to 1.4 gigawatts of electricity between Norway and the United Kingdom, will also help, it says:

Given the strong start to the year, we now expect to deliver full year underlying EPS significantly above the top end of our 5 – 7% range. This is primarily driven by early commissioning of our new NSL interconnector, coupled with higher auction prices across our interconnector portfolio, which is expected to deliver around £100 million higher operating profit.

Interconnector operators make money through auctions, so when price difference between two different markets are wide, profits are higher.

But those same high prices are hitting consumers and businesses who have seen their bills soar as energy suppliers have struggled under record gas prices and rising electricity costs.

Yesterday, UK inflation hit a 10-year high of 4.2%, with higher energy costs the biggest driving factor.

National Grid’s CEO, John Pettigrew, says:

In the UK, we have made a strong start to the new RIIO-T2 period in electricity transmission, and we are preparing our business plan submission for WPD. In the US, we have completed a full refresh of rates across our distribution businesses. In National Grid Ventures, we commissioned the North Sea Link, our new interconnector to Norway.

Whilst delivering this strong performance, we have completed our acquisition of WPD, launched the process to sell a majority stake in National Grid Gas and the sale of our Rhode Island business is on track to be finalised by the end of our financial year, progressing our strategic pivot towards higher growth electricity, all made possible by the commitment of our people.

Looking ahead, the new organisational structure that we have implemented, alongside a major cost efficiency programme, will ensure we are in a strong position to capitalise on the significant growth opportunities ahead. Our focus will be on delivering critical and green investment to enable the decarbonisation of power, transport and heat, and lead a clean, fair and affordable energy transition across the jurisdictions we serve.”

The agenda

- 7am GMT: Eurozone new car registrations for October

- 9.30am GMT: Weekly business insights and impact on the UK economy report

- 1.30pm GMT: US weekly jobless figures

- 1.30pm GMT: Philadelphia Fed manufacturing index

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here