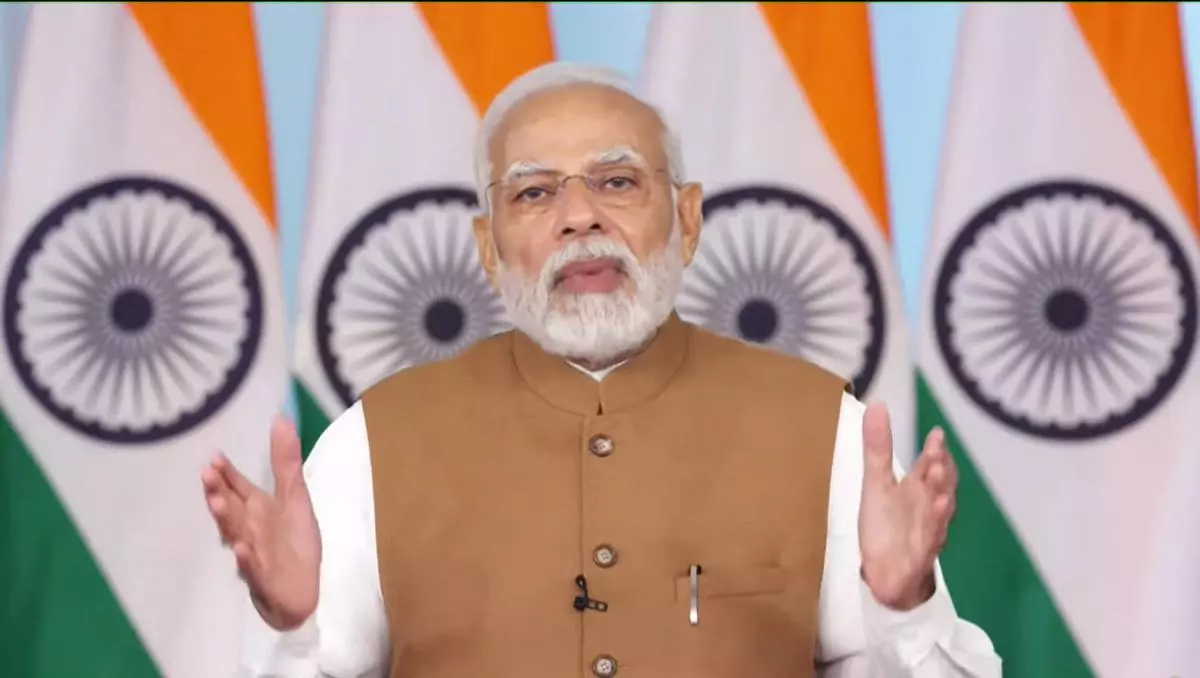

Prime Minister Narendra Modi, on Sunday, dedicated to the nation 75 digital banking units (DBUs) as part of efforts to ensure that the benefits of digital banking reach every nook and corner of the country.

The 75 DBUs in 75 districts, covering all the States and Union Territories, was announced in this year’s budget by Finance Minister Nirmala Sitharaman to commemorate 75 years of India’s Independence.

As many as 11 public sector banks, 12 private banks, and one small finance bank are participating in the DBU endeavour.

Both Finance Minister Nirmala Sitharaman and RBI Governor Shaktikanta Das attended the DBU launch event virtually from Washington.

Related Stories

FM Sitharaman to attend Annual Fund-Bank meetings at Washington, leaves for the US tonight

Will also participate in G20 Finance Ministers & Central Bank Governors meetings during her official visit to the U.S from Oct 11-16

Simplifying lives

Inaugurating the 75 DBUs, PM Modi, in his virtual address, said DBUs are one more significant step in the ongoing campaign to simplify the lives of common people.

PM Modi said the country’s move to focus on digital banking has ushered in transparency in the functioning of banking system.

He urged banks to set targets so as to bring as many people as possible into the digital banking fold. Every bank branch should look to bring at least 100 businessmen in their region within the fold of 100 per cent digital banking. “ This will create the foundation of big banking revolution for the country. I can only request you and not pass any rule or law for this”, he told bankers attending the virtual event.

This will catapult the Indian banking system to become “future-ready” and pave the way for India to lead the global economy in the years to come.

Digital banking

RBI Governor Shaktikanta Das highlighted that digital banking had, in recent years, emerged as a preferred channel for delivering banking services across the country.

He said that the establishment of DBUs will augment the digital infrastructure in the country. This will act as an enabler and facilitate customer experience through seamless banking transactions, he added.

Related Stories

‘Setting up digital banks should be part of banks’ digital banking strategy’

RBI releases guidelines for banks to open digital banking units

“DBUs will also promote financial inclusion by providing financial services in a paperless efficient safe and secure environment”, Das said.

Das said that banks are also free to engage business correspondents to expand the footprint of DBUs. These physical units will act as focal points for building customer awareness and education about utilising digital facilities for doing banking operations.

“This will result in greater credit penetration in the country”, he said.

Paperless mode

Finance Minister Nirmala Sitharaman said that these 75 DBUs will equip people who do not have a personal computer, laptop, or smartphone to be able to access banking services. They can do it in a paperless mode.

“For those who are not tech savvy, they can be made to avail of the paperless services. The operations in DBU will be available 24×7,”. Financial literacy can also be promoted through these DBUs, she added.

“Popularising digital banking is important as it is going to be cost-effective for consumers. It is also safe and secure for them,” Sitharaman added.

The setting up of these 75 DBUs by the Indian Banks Association will give an impetus to digital banking in India and help the economy move to a cashless and an inclusive economy, she added.

The brick and mortar DBU outlets will provide a variety of digital banking facilities. such as opening of savings account, checking balance, printing passbooks, transferring funds, opening fixed deposits, applying for loans,, pay taxes and bills among others.

DBUs will enable customers to have cost-effective, convenient access, and enhanced digital experience of banking products and services. They will spread Digital Financial Literacy and special emphasis will be given to customer education on cyber security awareness and safeguards.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest For Top Stories News Click Here