The retail inflation rose to 6.52 per cent in January 2023 breaching RBI’s comfort zone of 6 per cent. The CPI-based inflation stood at 6.44 per cent in February.

New Delhi: The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) began its three-day review meeting on Monday. It’s widely expected in the industry that this will be the last of the bi-monthly rate hike that began in May 2022 in view of containing inflation.

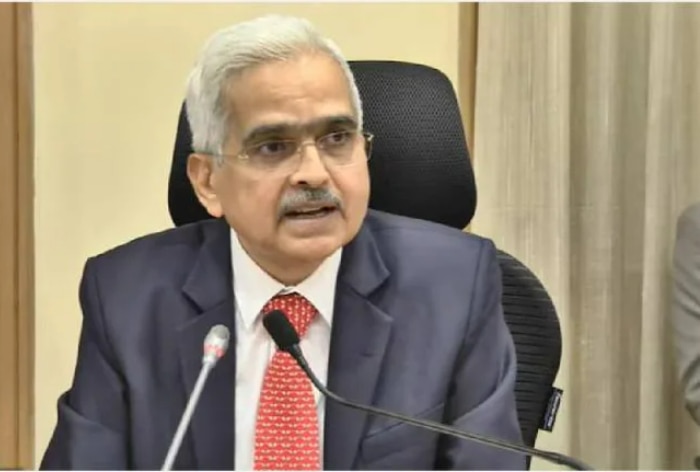

The meeting, which began on 3 April 2023 will continue to 6 April 2023, where the central bank Governor Shaktikanta Das-headed MPC will take into account various domestic and global factors before coming out with the first bi-monthly monetary policy for fiscal 2023-24. The decision of the six-member rate setting panel will be announced by the Governor on Thursday.

Since May 2022, the central bank has increased repo rate by a total of 250 basis points in a bid to contain inflation even though it has continued to remain above the RBI’s comfort zone of 6 per cent most of the time. The RBI committee is expected to deliberate firmly on two key factors — elevated retail inflation; recent action taken by central banks of developed nations, especially by the US Federal Reserve, the European Central Bank and Bank of England.

The retail inflation rose to 6.52 per cent in January 2023 breaching RBI’s comfort zone of 6 per cent. The CPI-based inflation stood at 6.44 per cent in February.

A Timeline Of The Past Rate Hikes By RBI Since May 2022

- 4 May 2022: After an off-cycle MPC meeting, the RBI increased the repo rates by 40 basis points (bps) for the first time in the two years. The revised repo rate stood at 4.40 per cent. The reverse repo rate; however, was kept unchanged at 3.35 per cent.

- 8 June 2022: A month after the 40 bps rate hike, RBI MPC again met in June 2022. After review, the repo rate was hiked by 50 bps to 4.9 per cent.

- 5 August 2022: Two months after the second consecutive rate hike, the RBI MPC again met in August 2022. The repo rate was hiked by another 50 bps to 5.4 per cent.

- 30 September 2022: In September 2022, the RBI increased the repo rate by another 50 basis points taking the effective rate to 5.9 per cent.

- 7 December 2022: After two consecutive 50 bps rate hikes, the central bank slowed down a bit in December. It increased the rate by 35 bps taking the effective repo rate to 6.25 per cent.

- 8 February 2023: The RBI again slowed down the rate hike in February 2023. The central bank resorted to a 25 bps rate hike hinting even as it hinted that more rate hikes may come. The effective repo rate stood at 6.50 per cent.

RBI MPC April 2023 Meeting: Expectations

It’s widely believed that the central bank will raise the key policy rate (repo) by 25 basis points on Thursday, and it would probably be the last in the current monetary policy tightening cycle that began in May 2022.

The central bank is tasked to ensure that retail inflation remains at 4 per cent with a margin of +/-2 per cent. However, it failed to keep inflation rate below six per cent for three consecutive quarters beginning January 2022.

“It’s been a very busy FY23 for global central banks. On one hand, they had to take an aggressive monetary policy stance by hiking interest rates and withdrawing liquidity from the system, and on the other hand, they had to take steps to protect the banking sector from fears of contagion risk spreading across the financial system,” said Srikanth Subramanian, CEO, Kotak Cherry.

Subramanian added that in the Indian context, “there seems to be a very limited risk of the banking crisis situation considering the stringent regulations around liquidity coverage ratios and capital adequacy requirements”. He is confident that the MPC will take note of all the evolving stories during the April 2023 meeting.

The central bank has already raised repo rates by 250 bps.

“There is no overheating in the economy despite resilient growth. RBI may decide to take a 25bps hike in policy rates in the upcoming policy meeting and then take a pause,” Subramanian added. He also added that there could be more clarity on the direction of the US Federal Reserve in the next few months.

Mandar Pitale, Head- Treasury, SBM Bank India, also is of the view that the RBI would resort to a 25 bps hike.

“We expect the RBI to hike the repo rate by another 25 bps during the MPC meeting scheduled in the first week of April 2023,” said Pitale.

He added that the present macroeconomic environment is witnessing weaker than expected global growth trend for an extended period, supply side shocks to global commodity/domestic food prices and progressive tightening of financial conditions.

According to Pitale, this may lead to weaker business sentiments in the longer run. “Given the current backdrop of high inflation and mixed signal on growth, RBI will need to walk a tight rope to achieve a balance.”

Commenting on the recent crisis in the global banking sector, Pitale said that the European Central Bank, US Fed, Bank of England and Swiss National Bank have increased the policy rates in their jurisdiction.

Apart from the fact that the domestic CPI inflation has remained above RBI’s tolerance limit of 6 per cent for the last two months, upside risks to food inflation exist due to unseasonal rains and in case there are El Nino led disruptions, said Pitale.

“Therefore, at this juncture, it becomes important for RBI to reinforce its commitment towards taming inflation. The expectation of the Federal Reserve continuing its rate hike cycle to control inflation may support the RBI’s decision to raise the repo rate in the April meeting before pressing the pause button”, he added.

Mandar Pitale also said that market participants will closely watch for any implicit hints on the current rate hike cycle’s end. He is also hopeful that this rate hike would be probably the last one in this rate hiking cycle by the RBI.

“While we do not expect any change in monetary policy stance from “withdrawal of accommodation” to “neutral” in forthcoming April policy announcements; the expected hike of 25bp will probably be the last one in this rate hiking cycle,” Pitale opined.

The RBI MPC consists of three RBI officials and three external members appointed by the central government. The external members are Shashanka Bhide (Honorary Senior Advisor, National Council of Applied Economic Research, Delhi); Ashima Goyal (Emeritus Professor, Indira Gandhi Institute of Development Research, Mumbai); and Jayanth R Varma (Professor, Indian Institute of Management, Ahmedabad).

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here