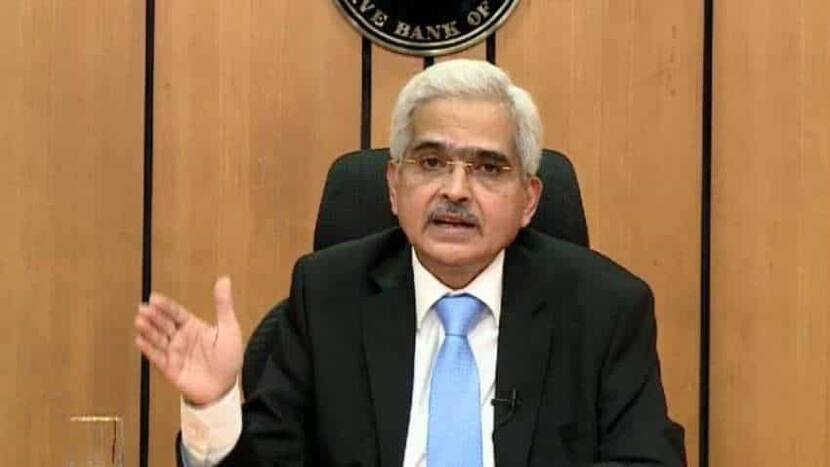

RBI Governor Shaktikanta Das responded to a query on whether the central bank would revise the inflation target.

New Delhi: The Reserve Bank of India (RBI) has no plan of changing the inflation target of 4 per cent, Governor Shaktikanta Das said. RBI Governor Shaktikanta Das said there was no need to change the inflation target despite the central bank’s failure to keep it below the 6 per cent upper tolerance level for 9 consecutive months.

RBI Governor Shaktikanta Das, who made the remarks at the HT Leadership Summit, said higher than 6 per cent inflation would hurt growth. He said it would be too early to enter into that discussion of revising inflation target while noting that internationally there is a debate on shifting the goal post.

As per a notification issued on March 31, 2021, the central government retained the inflation target at 4 per cent (with the upper tolerance level of 6 per cent and the lower tolerance level of 2 per cent) for the five-year period April 1, 2021 to March 31, 2026. Retail inflation in September increased to 7.4 per cent from 7 per cent in August on higher food and energy costs.

Why RBI would not revise inflation target now

As per the mandate given to the Reserve Bank by the Union Government, the central bank is required to ensure that retail inflation remains at 4 per cent with a margin of 2 per cent on either side.

Quoting an RBI internal research, Shaktikanta Das said inflation above 6 per cent for India would be detrimental to growth. It will be counterproductive because the financial savings and investment climate will be hit and India will lose the confidence of international investors if inflation remains above 6 per cent for a prolonged period, he noted.

The inflation band of 2-6 per cent also provides RBI enough policy space to use during times of stress, as was done during the COVID-19 pandemic. Although the inflation was about 5.5 per cent, the Monetary Policy Committee very consciously and quite rightly decided to tolerate higher inflation because during COVID-19 the priority was to support the economy by keeping liquidity easy by keeping the interest rates lower, he pointed out.

“We should not think of shifting the goal post because we have not been able to meet it. We remain committed to bring the inflation down to 4 per cent over a period of time,” he said.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here