Introduction: Regular pay lagging behind inflation

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

Regular pay in the UK continues to lag behind inflation, as workers – particularly in the public sector – are hit by the cost of living squeeze, even as the unemployment rate hits the lowest since 1974.

Figures just released by the Office for National Statistics show that regular pay (excluding bonuses) rose by 4.2% per year in the three months to March.

That means basic pay shrank in real terms, as CPI inflation hit 7% in March, and may have soared over 9% in April.

Inflation continuing to outstrip wage rises. Regular pay down 1.2% in real terms in the months to March.

The squeeze on household incomes intensifies. pic.twitter.com/Y9tIOc4HHy

— Tom Boadle (@TomBoadle) May 17, 2022

Another example of the earnings squeeze that’s hit households over the past year. Regular, real terms pay *fell*. https://t.co/bpxBolRPs7

— Paul Waugh (@paulwaugh) May 17, 2022

But total pay was stronger up – up 7% per year, with bonuses swelling some pay packets.

The Office for National Statistics reports that:

In real terms (adjusted for inflation) in January to March 2022, growth in total pay was 1.4% and regular pay fell on the year at negative 1.2%.

Today’s labour market report also shows a stark difference between workers in the public and private sector.

Average total pay growth for the private sector was 8.2%, but just 1.6% for the public sector.

The finance and business services sector showed the largest growth rate (10.7%), partly because of strong bonus payments, the ONS says.

The jobs report also shows that the UK’s unemployment rate dropped from 3.8% to 3.7% — the lowest since 1974.

The UK’s employment rate increased by 0.1 percentage points on the quarter to 75.7%, while the number of job vacancies remained at a record high.

The data comes a day after Bank of England governor Andrew Bailey reiterated his call for workers to show restraint on wage rises, particularly the better paid.

Bailey told MPs:

“I do think people, particularly people who are on higher earnings, should think and reflect on asking for high wage increases.

It’s a societal question. But I am not preaching about this. It’s not for me to go around telling people what to do.

Unions hit back at Bailey, with Unite saying he should not “lecture” workers about wage restraint.

TUC Deputy General Secretary Paul Nowak pointed out that:

The last thing working people need right now – in the middle of the worst living standards crisis in generations – is to have their wages held down.

With the cost of living crisis intensifying, the CBI is calling for immediate assistance for ‘people facing real hardship’, adding to the pressure on the government to help those hardest hit by Britain’s cost of living crisis.

CBI Director-General, Tony Danker, said the Government must move on two fronts right away.

“The first is to help people facing real hardship now; it’s the moral underpinning of our economy and society. Recent surveys suggest more than one in 10 households have skipped – or had smaller meals – in the past month because of a lack of affordability, while around half a million more households are expected to face choices between heating and eating*. Putting pounds in the pockets of people struggling the most should not be delayed.

“Secondly; start stimulating business investment now – we will need to ensure that there is economic growth in the pipeline to avoid any downturn in our economy that could worsen or prolong the cost-of-living crisis.

European stock markets are set to open higher:

The agenda

- 7am BST: UK labour market report

- 10am BST: Eurozone GDP growth statistics for Q1 2022 (second estimate)

- 1.30pm BST: US retail sales report for Apro;

Kremlin says G7 using Russia’s reserves for Ukraine would be ‘outright theft’

The Kremlin has said it would be “outright theft” for the Group of Seven economic powers and European Union to enable Ukraine to use Russia’s frozen reserves, Reuters reports.

The Kremin called such a move illegal and one that would demand an appropriate response.

German finance minister Christian Lindner told four European newspapers that he was open to the idea of seizing Russian state assets to finance the reconstruction of Ukraine and that proposals to that effect were already being discussed among the G7 and in the EU.

KREMLIN: IT WOULD BE OUTRIGHT THEFT FOR THE G7 AND EU TO USE FROZEN RUSSIAN RESERVES ON BEHALF OF UKRAINE.

— Breaking News | FinancialJuice (@Financialjuice1) May 17, 2022

Roughly $300bn of Russian foreign exchange reserves were frozen when the EU, the US and their allies imposed sanctions on the country’s central bank after the Ukraine war began.

Last week Josep Borrell, the EU’s high representative for foreign policy, said EU capitals should consider seizing those frozen reserves to cover the costs of rebuilding Ukraine after the war.

The cost of rebuilding Ukraine could surpass half a trillion dollars. A leaked EU reconstruction plan showed that Ukraine could receive loans, grants and possibly the proceeds of seized Russian oligarch property to help pay the cost.

In the plan drafted in Brussels, the European Commission states that the Ukrainian government will have to take out loans to pay for rebuilding its war-ravaged country. Non-repayable grants from EU member states would provide another tranche of the funds needed to rebuild destroyed homes, schools, roads, railways, airports and bridges.

More here, by my colleague Jennifer Rankin:

In the property world, Landsec has returned to profit as people return to offices and shops after the Covid-19 lockdowns.

Landsec, the commercial property developer and investment company, made a pre-tax profit of £875m in the year to 31st March, compared with a loss of almost £1.4bn a year before.

The recovery was driven by a 12% rise in the value of Landsec’s portfolio of shops and offices, from £10.7bn to £12bn, as people returned to workplaces, restaurants, bars and retail sites.

Mark Allan, chief executive of Landsec, says:

“Landsec has delivered strong operational and financial results despite the turbulence within the UK economy.

The actions we have taken, driven by our strategic focus on three distinct areas have resulted in record leasing in our London office portfolio, a return to growth in our major retail destinations and clear, substantive progress in growing our mixed-use urban neighbourhood portfolio.

We continue to recycle capital out of mature assets, whilst our pipeline now offers the opportunity to invest £3bn in sustainable London offices and mixed-use development over the next five years at attractive returns.

The company is looking to Manchester for growth. Last year Landsec took a 75% stake in Media City, the 15-hectare (37-acre) media, digital and tech hub in Salford, and also bought urban regeneration developer U+I, which has operations in Manchester.

Inflation could force schools to cut meal portions or quality

Julia Kollewe

Soaring food inflation could force schools to choose between offering smaller portions at lunchtime and using cheaper ingredients, according to the boss of one of the UK’s largest food wholesalers.

Andrew Selley, the chief executive of Bidfood, a food distribution business with an annual turnover of nearly £2bn, said schools would be facing tough decisions unless the government increased funding for free school meals.

Selley said shortages caused by the war in Ukraine had led to a doubling in the price of sunflower oil compared with a year ago, with knock-on effects on other vegetable oils.

Baked goods are 20% to 30% dearer, and the increase in wheat prices will also feed through into pasta, egg and chicken prices, as wheat is used as chicken feed, he said.

Selley said the amount of money provided by the government for free school meals had gone up by only 1.7% over the past 10 years, which was well behind food inflation even before the sharp increases seen in recent months. More details here.

Eurozone economy stronger than first thought

Euro zone economic growth was stronger than previously expected in the first quarter, according to revised data released this morning.

The European Union’s statistics office Eurostat said eurozone GDP rose by 0.3% in January-March. That’s better than the 0.2% first estimated, and matches the growth at the end of 2021.

That growth rate is still slower than the UK, where GDP rose by 0.8% despite a small fall in March, but better than the US where the economy shrank by 0.4% in Q1.

European growth in the first quarter was hit by Russian invasion of Ukraine on February 24, which led to a surge in energy prices, disrupted supply chains, and hurt business and consumer confidence.

But eurozone employment continued to rise in January-March — up 0.5% quarter on quarter and 2.6% year-on-year.

Yesterday, the EC cut its growth forecast for the euro area, due to the impact of the Ukraine war.

Here’s the latest on the Twitter takeover….

Walid Koudmani, chief market analyst at financial brokerage XTB, says:

“The latest comments from Elon Musk have heightened tensions surrounding his $44bn buyout deal for the social media company. This is either a negotiating tactic from Musk to seek a much lower price or he is laying the grounds to walk away.

It’s a risky game because this is all happening in the public sphere and to that degree, this has the potential to turn quite volatile. It does appear less and less likely that a deal at $44bn will happen and with the share price trading at a discount to the offer level, it would appear investors agree.”

Full story: UK pay hit by inflation but unemployment falls to 48-year low

Phillip Inman

Soaring bonuses for City bankers and high signing-on fees for construction and IT professionals pushed Britons’ average annual pay up by 7% in March, but most workers suffered a fifth consecutive month of falling living standards.

Without bonus payments, workers were paid an average 4.2% wage increase in the three months to March, well below the 7% inflation rate recorded in the same month, according to the Office for National Statistics.

Analysts said the UK was suffering a chronic shortage of workers after about 500,000 quit the labour market during the Covid-19 pandemic and many continental European workers left Britain following Brexit. The unemployment rate fell to 3.7%, the lowest since 1974.

Paul Dales, the chief City economist at the consultancy Capital Economics, said:

“Anecdotal evidence suggests that businesses have been raising bonuses to maintain staff, so it is probably another sign of how the tight labour market is feeding into faster wage growth.”

Illustrating the widening gap between the number of staff employers need and those seeking work or to move job, vacancies rose to a record of 1,295,000 in the three months between February and April – an increase of 33,700 from the previous quarter and a jump of almost 500,000 since March 2020.

Here’s the full story:

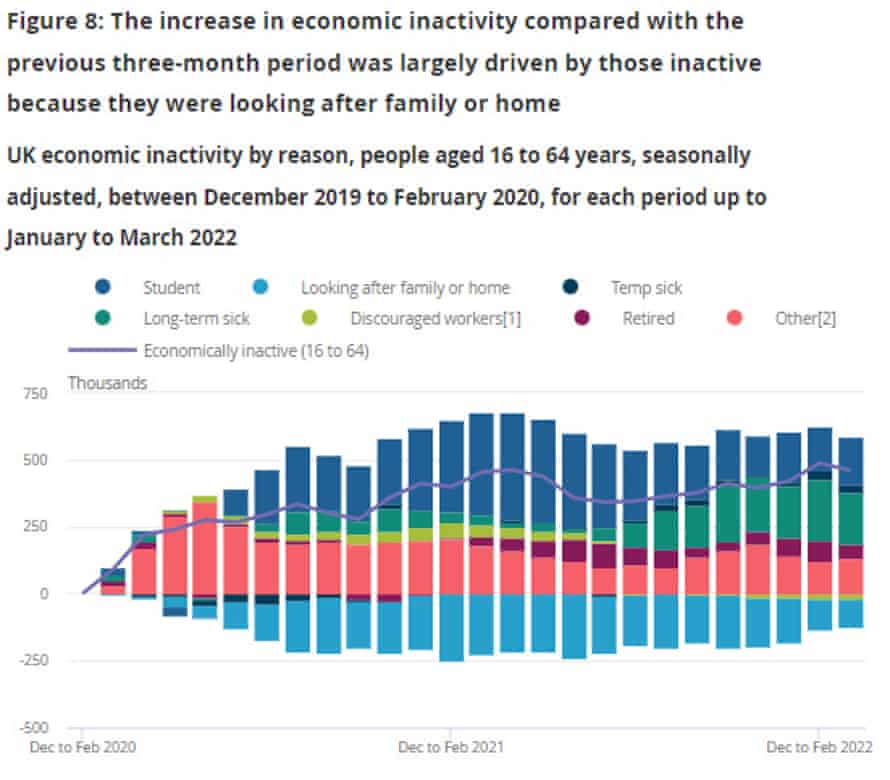

This chart from Simon French at Panmure Gordon shows the rise in people leaving the jobs market with long-term sickness (as highlighted earlier).

Strong UK labour demand continues with 1.3m vacancies & > unemployed of 1.25m for 1st time on record. Still ~400,000 more reporting themselves economically inactive vs pre-CV19 with ~50% of this reporting LT sickness. Activation of this group key to easing labour market pressure pic.twitter.com/eOyshXoOYa

— Simon French (@shjfrench) May 17, 2022

In the City, shares have hit its highest level in over a week.

The FTSE 100 share index is up 50 points, or 0.66%, at 7514 points, even thoug the strong pound is holding back exporters.

European markets are showing stronger gains, with France’s CAC and Germany’s DAX up 1.3% each.

Bloomberg says optimism that China will ease its corporate crackdown and Covid lockdown is outweighing worries about the economic outlook:

Fueling the risk-on mood even further, Shanghai is tentatively unraveling a punishing lockdown, while Chinese tech stocks jumped on optimism that a meeting between the nation’s top regulators and corporate giants would result in Beijing dialing back its yearlong clampdown on the industry.

Pound jumps

In the financial markets, sterling is strengthening against major currencies after UK unemployment rate fell unexpectedly to a 48-year low of 3.7%.

The pound is up 1.5 cents against the US dollar to $1.247, its highest level since tumbling almost two weeks ago when the Bank of England slashed its growth forecasts.

Sterling is up a cent against the euro too, at €1.19.

Ricardo Evangelista, senior analyst at ActivTrades, says traders are expecting further UK interest rate rises, with inflation forecast to have hit 9% in April.

Sterling is benefiting from surprisingly positive data released this Tuesday morning, with unemployment and wage figures both surpassing expectations, painting a more positive picture for the British economy than had been expected.

Against such background, expectations have risen for the Bank of England to step-up the pace of monetary policy tightening; with inflation data being released tomorrow predicted to surpass 9%, officials at the BoE should have little choice but to continue to rise interest rates, creating scope for further pound gains.

Musk: spam account doubts could scuttle Twitter deal

Elon Musk’s deal to buy Twitter is looking increasingly troubled.

The billionaire has tweeted that the deal, agreed last month, ‘cannot go forward’ unless company can show that less than 5% of accounts are fake or spam.

20% fake/spam accounts, while 4 times what Twitter claims, could be *much* higher.

My offer was based on Twitter’s SEC filings being accurate.

Yesterday, Twitter’s CEO publicly refused to show proof of <5%.

This deal cannot move forward until he does.

— Elon Musk (@elonmusk) May 17, 2022

Yesterday, Musk suggested that he could seek to pay a lower price for Twitter, as he expressed further concerns about the presence of fake accounts on the platform.

The Tesla CEO said reducing his agreed $54.20 per share offer wouldn’t be “out of the question”, days after putting the $44bn ($36bn) deal “on hold” after he queried the number of spam accounts on Twitter.

Musk told the All-In Summit in Miami that the deal going through depended on Twitter’s response to his concerns about fake accounts.

“It really depends on a lot of factors here,” he said in comments reported by the Financial Times.

“I’m still waiting for some sort of logical explanation for the number of sort of fake or spam accounts on Twitter. And Twitter is refusing to tell us. This seems like a strange thing.”

Musk also failed to distinguish himself with an exchange with Twitter CEO Parag Agrawal over spam on the platform:

We suspend over half a million spam accounts every day, usually before any of you even see them on Twitter. We also lock millions of accounts each week that we suspect may be spam – if they can’t pass human verification challenges (captchas, phone verification, etc).

— Parag Agrawal (@paraga) May 16, 2022

Our actual internal estimates for the last four quarters were all well under 5% – based on the methodology outlined above. The error margins on our estimates give us confidence in our public statements each quarter.

— Parag Agrawal (@paraga) May 16, 2022

Twitter’s share price fell 8% yesterday, to $37.39, back to levels before Musk revealed he has build a stake in the company, and then launched his $54.20 per share offer.

They’re down another 1.7% today in premarket trading at $36.70, as traders conclude the deal is very unlikely to happen at the original price, or possibly at all.

Economic inactivity worryingly high

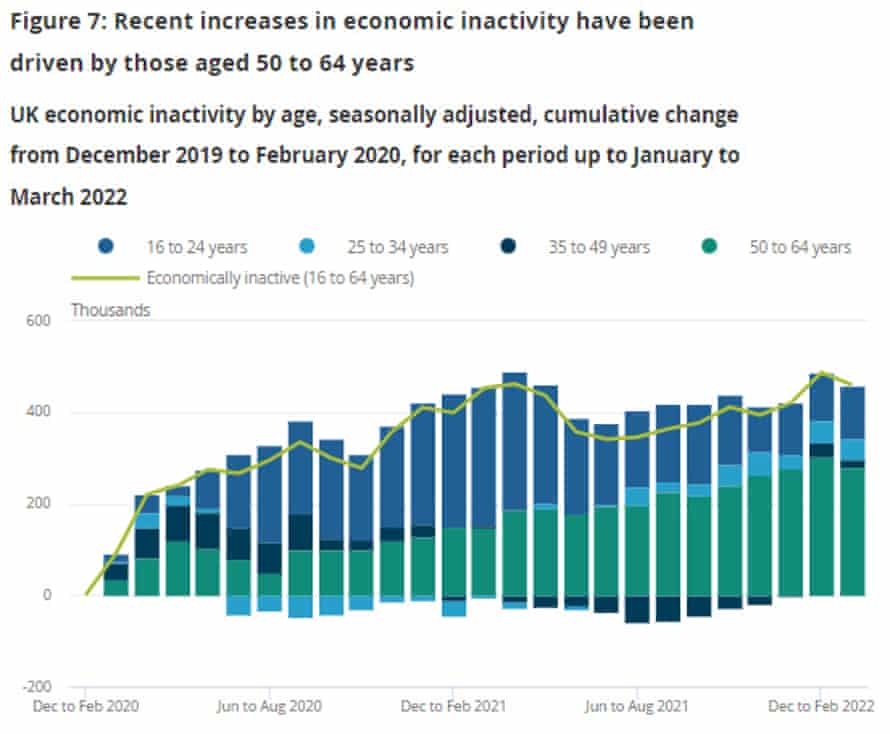

Today’s jobs report shows that there are around 460,000 more people ‘economically inactive’ than before the pandemic — neither in work, nor looking for a job.

The total economically inactive rose by by 65,000 in January-March, to 8.829m.

As this chart shows, there has been a rise in long-term sickness, as well as in people leaving the jobs market to care for family:

Many of those are over 50s, as Emily Andrews, Deputy Director for Work at the Centre for Ageing Better, explains:

“The UK workforce participation crisis is continuing – driven by older workers leaving the labour market. There are 246,000 fewer people aged 50-64 participating in the workforce than there were at the start of the pandemic.

“This means there could be up to a quarter of a million older workers out of employment earlier than they had planned, potentially impacting their retirement plans, while companies are missing out on the positive impact older workers can bring.

Tony Wilson, director of the Institute for Employment Studies, says there is a recruitment crisis:

“There’s some good news in today’s figures, with record pay growth in the private sector just about keeping wages ahead of inflation, and unemployment continuing to fall to its lowest since 1974. However this is masking now the tightest labour market that we have seen in at least half a century, with more vacancies than there are unemployed people for the first time ever, and well over a million fewer people in the labour force than on pre-pandemic trends.

It’s this recruitment crisis that is fuelling higher private sector pay and bonuses and is also behind recent rises in interest rates. However rather than trying to dampen demand, we need to be doing far more to boost labour supply, which would support economic growth, raise household incomes and help contain inflation. In fact if anything, we’re cutting investment in employment support at just the time that we should be ramping it up.

Back on the UK jobs report, and Resolution Foundation’s Torsten Bell points out that real regular pay is falling at the fastest pace in a decade, in the tightest jobs market on record:

Such a weird labour market: the tightest jobs market on record is delivering the biggest real regular pay falls in a decade

— Torsten Bell (@TorstenBell) May 17, 2022

Large numbers of vacancies have kept bringing unemployment down reaching a new low of 3.7% – recent falls are all about fewer longer term unemployed pic.twitter.com/K7QoSj8WjG

— Torsten Bell (@TorstenBell) May 17, 2022

What a tight labour market isnt doing is tempting the older/male/self-employed workers who left the labour market entirely during the pandemic back pic.twitter.com/PKXLCmSznn

— Torsten Bell (@TorstenBell) May 17, 2022

How are firms coping with the tight labour market but also economic uncertainty? Well in some cases by significantly raising bonuses – total pay is up 7% – but not regular pay as much (it’s much steadier at 4.2% = falling in real terms) pic.twitter.com/2rSKvaPB3e

— Torsten Bell (@TorstenBell) May 17, 2022

We should be clear that the good news on bonuses is very sector specific – nominal total pay growth is 8.2% in private sector vs 1.6% in public sector. And within the private sector finance is way out in front. Lucky bankers have their bonuses back.

— Torsten Bell (@TorstenBell) May 17, 2022

Norman: Food price inflation could hit 10% this year

M&S chairman Archie Norman also warned that food price inflation in Britain could hit 10% this year.

He told Radio 4’s Today programme that global prices are rising, such as wheat and freight costs, oil and energy, so all retailers will “reluctantly” have to lift their prices.

But will it be an ‘apocalyptic’ extent, as Bank of England governor Andrew Bailey warned yesterday?

Norman says he wouldn’t use that term — but concedes it will be a tough time for consumers.

“I think you have to keep it in context, wages have been rising quite well in the UK, we’ve given all our people over 5% wage increase this year.

It will be “very negative for consumer discretionary income”, but not apocalyptic, at least not for M&S’s customers, Norman adds.

“It wouldn’t be surprising to see food price inflation over the course of the year running towards 8-10%.”

“But we don’t know that yet because it runs through the year, some has gone through now but quite a lot’s still to come.”

“All UK food retailers are reluctantly going to have to allow some food price inflation”

Marks & Spencer Chairman Archie Norman tells @JustinOnWeb over the course of the year it wouldn’t be surprising to see food inflation running at 8-10%https://t.co/I8T4pqlbdB | #R4Today

— BBC Radio 4 Today (@BBCr4today) May 17, 2022

M&S chair: UK NI’s protocol approach a ‘triumph of common sense’

The chairman of Marks & Spencer has backed the British government’s efforts to make changes to the Northern Ireland protocol.

Archie Norman told the Today Programme that M&S is in the front line of the problem at the UK border since Brexit, which is adding to its costs and creating much more paperwork.

It has to close its French business because of customs rules, and it is proving very tough to make its business in the Republic of Ireland work, he says.

Norman explains the new frictions at the borders, following Brexit. At the moment, M&S wagons arriving in the Republic have to carry 700 pages of documentation covering the items on board, which takes eight hours to prepare. Some of the descriptors, particularly of animal products, have to be written in Latin, and in a certain typeface, Norman says.

Impressed by M&S chair Archie Norman on Today prog articulating the incredible paperwork mountain needed for the Protocol @bw_businesswest

— Ian Mean (@BlueMeanie10) May 17, 2022

M&S employs 13 vets in Motherwell to prepare it all, and it pushes up driver time by 30% — meaning it all costs around £30m.

Currently, there’s an easement in Northern Ireland, so the controls aren’t the same. But the EU are looking for comparable controls to be introduced.

Were that to happen, Norman says, “quite a lot of products” wouldn’t get to Northern Ireland, and what did get in would be very expensive.

Marks & Spencer is a big company, we can make almost anything work, however bureaucratic, but for the small artisan cheesemaker or cake-baker, and so on, it would simply be impossible to export any more.

Right now, Norman says, it is managing to supply Northern Ireland without a shortfall, although it costs more money. The paperwork for Northern Ireland takes one hour, compared with eight for Dublin.

Norman (a former Conservative MP) argues that tougher safety checks on shipments to Northern Ireland aren’t needed, as UK food standards by law, are “equivalent or higher” than in the EU.

The Commission want every product from Great Britain going into Northern Ireland to be labelled as being meant for UK consumption only — that would cost M&S £9m per year, Norman says, and be impossible for small producers.

Q: Do you think, why on earth did the UK sign up to this?

Norman argues that EU is obsessed with the letter of the rules, while the UK looks at the the purpose of the rules.

Q: So should the UK try and agree a shorter, time-limited deal?

Norman suggests that train has ‘left the station’, and the priority now is to solve the problem on Northern Ireland, so its people get the food they deserve and require.

What the British government is proposing at the moment seems to me a triumph of common sense over rules-based mentality, and will make sure that at a time of inflation the Northern Irish people can get the fresh foods that they’re used to, and entitled to.

Resolution: Britain’s wage squeeze is going to get far worse

Soaring inflation means the wage squeeze is going to get ‘far worse’, even though some firms are paying bonuses to attract or hold onto staff in a tight labour market.

So warns Hannah Slaughter, senior economist at the Resolution Foundation, said:

“The UK labour market continues to tighten, with the number of unemployed people having fallen below the number of job vacancies for the first time ever. People are taking advantage of these conditions to move jobs, and employers are responding by paying bonuses to hire or retain key staff.

“But for the vast majority of the workforce, the labour market may feel far less hot. There is little sign of wider pay pressures building and real wages are getting squeezed even tighter.

“With inflation having shot up in recent months, the scale of Britain’s wage squeeze is going to get far worse.”

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here