Marbella, Costa del Sol. Image- Alex Tihonovs/Shutterstock

As many of us know, buying a property can be one of the most stressful experiences in life – especially if you are in a foreign country with another language and laws to contend with, lots of documents to arrange, and the immigration process and visas.

Drawing on 30 years of experience in the property market in Marbella and the Costa del Sol, Verdin Property is here to make your buying experience as exciting, stress-free and straightforward as possible.

Known for its luxurious properties, buzzing nightlife, high-end restaurants and bars, an abundance of amenities and mild weather throughout the year, it’s no surprise that Marbella is one of the most popular areas for expats moving to the Costa del Sol. But how do you start the process of making the move to this wonderful part of southern Spain and who do you trust to help you throughout your journey?

Verdin Property are experts in helping clients to find the perfect property, primarily serving the most prestigious areas of Marbella and Benahavis. With decades of experience in helping thousands of expats find the perfect property for their budget, lifestyle, and taste, Verdin Property is the leading luxury real estate agency in Marbella.

In this guide, you will find everything you need to know about how to buy a home in Marbella, including the most sought-after areas to invest, the types of properties available, the documents and paperwork required, and how Verdin Property can assist you on the journey.

Why buy a property in Marbella?

Marbella is a firm favourite for British nationals moving to the warmer climate of the Costa del Sol. This buzzing city and resort area has the Sierra Blanca Mountains as its backdrop and 17 miles of stunning sandy beaches, some of the best golf courses in Europe, and the most luxurious properties.

Due to the many high-quality properties available in Marbella, whether you are looking for a luxury home in the middle of the hustle and bustle, a remote property in the stunning mountain valleys, a villa close to all of the best golf courses, or a penthouse a stone’s throw away from the stunning Mediterranean Sea, Verdin Property has something to suit every buyer. Choose from homes featuring quality brand appliances, air-con, well-kept communal facilities and pools, stylish architecture and other features that are commonplace in properties in Marbella.

Because Marbella attracts many foreigners who are buying a second home in Spain, homes are built and designed accordingly and promise incredible views of the Mediterranean, the majestic hills, and even North Africa.

![]()

The best estate agents for buying a property in Marbella

Our recommendation

Verdin Property

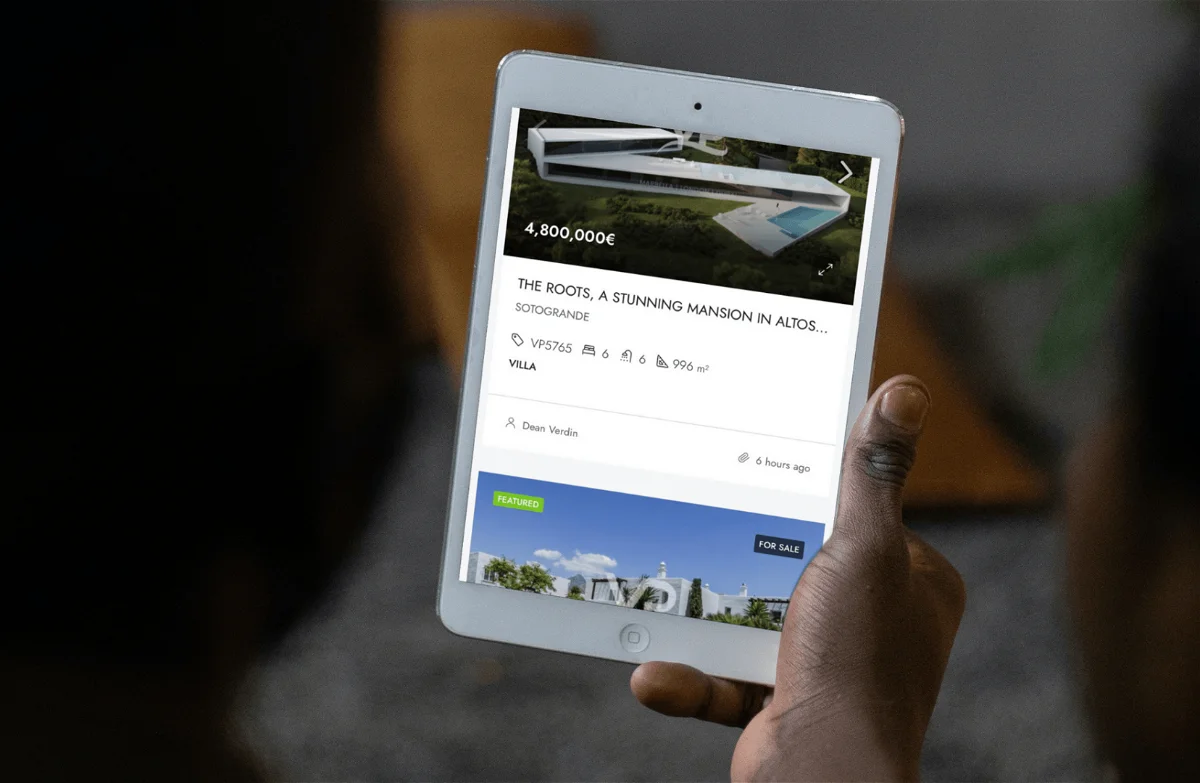

Based on the world-renowned Golden Mile, Verdin Property is a luxury real estate agency specialising in the most prestigious areas of The Golden Mile, Nueva Andalucia, Puerto Banus, La Zagaleta and La Quinta.

Established in 2016 by Tyler and Dean Verdin, Verdin Property has built up a well-respected reputation among clients and local agencies as an honest, trustworthy and straightforward agency.

Consistently striving to stay at the forefront of the real estate market, the team ensure they keep up to date on the latest trends, constantly adapting and innovating to provide the best solutions for clients buying or selling property in the most affluent locations on Costa del sol.

Verdin Property are also founding members of the Guild of Spanish Property Professionals and co-owners of Luxuria Lifestyle Spain, an award-winning digital magazine ranked number 1 on Google ahead of all other luxury magazines in Spain.

Get in touch with Tyler, Dean and the team of experienced real estate agents at Verdin Property for a stress-free buying or selling experience.

Website: Click here

Address: Marbella, 29602

Telephone: +34 711 079 817

Email: [email protected]

Facebook: Click here

Sponsored

![]()

The most sought-after areas in Marbella to buy property

Puerto Banus

With its beautiful marina full of yachts, a long list of luxury boutiques and shops and lots of restaurants and bars, Puerto Banus is one of the most popular places to visit in Marbella. If beach bars and entertainment are important to you, the nightlife in Puerto Banus is also the best in the area, with several of the most popular beach clubs including Ocean Club, Funky Buddha and La Sala by the Sea.

Nueva Andalucia

Many of the villas in Nueva Andalucia have front-line golf positions and boast exceptional mountain or sea views. Known as Golf Valley, the area has excellent sporting facilities as well as amenities such as restaurants, bars and one of the largest international schools in Marbella.

The Golden Mile

Marbella’s Golden Mile is one of the most luxurious areas along the western coast – if the name didn’t already give it away – and a great option for investing in property. Just 30 minutes drive from Malaga Airport and close to Puerto Banus, if you fancy enjoying ocean views from your own home, or perhaps whilst strolling around your own private grounds, there are properties here aplenty to suit your needs.

Sierra Blanca

Close to the centre of Marbella and only a short distance away from schools, shopping centres and breathtaking beaches, Sierra Blanca is perfect for those who want to relax without worrying about being too far from the action of the city. As one of the most exclusive residential areas in this part of Spain, this is one of the best options if you’re considering investing in a property in Marbella.

Benahavis

Stretching from the coast to the mountains between the two municipalities of Marbella and Estepona, the tranquil village of Benahavis is a true hidden treasure in Andalucia that has kept its traditional feel and has gained popularity, particularly amongst foreign people wanting to move to Spain.

![]()

How to buy property in Marbella

It can take a lot of time, paperwork and planning to buy a property in Marbella, but the experienced and friendly team at Verdin Property are here to help. In this section, we will take a look at the steps you need to take and how to get everything in order for the buying process.

Plan and do your research

Like with all other financial decisions, planning and research are paramount when buying a property in Marbella. Use internet searches to find areas that appeal to you and your lifestyle, focusing on what amenities and services you need. For example, do you want to live close to the beach? Would you prefer to live in a gated community? Do you need to be within close proximity of schools and transport links? The location is just as important as the property itself.

It’s a good idea to work with an agency that is reputable, trustworthy, transparent and not just focused on your budget. The Verdin Property website makes it super simple to search for properties in your desired area, using a comprehensive MLS system meaning they have access to every single property on the coast, regardless of who the listing agent is. So why go elsewhere?

Organise viewings with Verdin Property

Once you have decided on which areas you would like to explore, all you need to do now is book some viewings! Verdin Property recommends planning ahead and arranging a selection of tours that will take place over an entire day. This is one of the best ways to get familiar with an area and ensure that you waste as little time as possible. Around 4-5 viewings a day is perfect, that way, you won’t forget potentially important details of the earlier properties but will have a good grasp of what’s on offer.

It’s a good idea to take a drive around the area and see how you feel. Another great tip is to visit the property again during the evening hours, dusk or maybe just after dark if possible, as any house feels different at night and it could change your perspective of the property.

Be sure to have all of the required paperwork

Spain is well-known for requiring a large amount of paperwork when applying for residency and buying or selling property, so it’s essential that you have everything in order. It’s even recommended that you have all of the paperwork and documents before viewing any properties.

Although there are no particular restrictions for foreign non-residents when buying a property in Spain, you will need to meet specific requirements before beginning the purchasing process:

- Get your NIE number (foreigners identification number)

If you are a UK citizen, you will be considered a foreign buyer and will need an NIE (Numero de Identidad de Extranjero). This number will allow you to carry out what is necessary to buy a home here in Spain, such as opening a bank account and buying said property. The easiest way for you to acquire your NIE is at your local Oficina de Extranjeros, the immigration office in Spain, or going down to your designated police station in the area.

Depending on where you are coming from in the UK, you may or may not be able to apply for your NIE at your local Spanish embassy or consulate. To obtain your NIE number you will need: Your passport and photocopies, and a valid reason for requesting an NIE number (for example, a job offer or to buy a property).

- Open a Spanish bank account

Once you have your NIE number, you can then open a Spanish bank account. If you aren’t fluent in Spanish, it is advised that you open an account that accommodates foreigners, such as Sabadell, Caixa Bank and Santander.

To open a bank account in Spain you will also need a variety of documents: Passport or ID, NIE number, proof of funds, and any other documents the bank sees necessary (job contract etc).

- Find a good lawyer or tax advisor

Taxation in Spain is a complex issue and the taxes associated with buying and selling property in Spain can and will differ from region to region. It is always advisable to seek the professional advice of an accountant or professional tax advisor. Further information can also be found on the Spanish tax authority’s website, Agencia Tributaria.

It’s recommended that to make sure you have enough money to cover taxes, notary fees, legal fees, land registry, bank charges, etc, you put aside at least 15 per cent of the purchase price.

Make an offer on your desired property

Once you have found the perfect property, it’s time to make an offer. Verdin Property will help you in every step of the process and it is advisable to make your offer in writing through your agent. This offer must include the offered price, proposed payment terms and deadlines. Make sure that your offer is serious and reasonable, taking into account that this can significantly affect your position and chances of getting your dream property.

It is best to negotiate and make an offer through your agent as this will make the process more controlled and gradual, as well as giving you a better chance of getting the property you want for your desired budget.

It’s also worth mentioning that you should note any technical issues, including minute details and cosmetic issues such as cracks in walls, paying special attention to plumbing and electricity. These issues should be included in your initial offer.

Contracts and completing the purchase

Once your offer has been accepted, it’s time to get into the legalities and contracts. You will be asked to:

- Sign a reservation contract

- Sign a purchase contract

- Complete an official deed at the Notary on the day of completion

The contracts you will have to complete and sign include:

This is signed by the buyer and the vendor and reserves the property for an agreed time – usually between 7 and 14 days. A reservation fee is applied by the seller for the buyer to pay, this can vary from €6,000 to €20,000, 1 per cent of the purchase price, or any other amount mutually agreed on by both parties. If the buyer decides to purchase the property, the amount paid goes towards the purchase price.

- Private purchase contract

After signing the reservation contract, the buyer signs a private contract and then pays 10 per cent of the purchase price, which includes the reservation fee paid before (for example, if you pay 1 per cent at reservation, you then pay the remaining 9 per cent).

It is sometimes possible to proceed directly to a private 10 per cent deal without first signing a reservation contract, however, this is typically done if the purchase price is high and the seller is unable to remove the property from the market in exchange for a tiny reservation offer. In any case, this approach is not really advised.

There are three types of contracts you may sign that are all similar when making the 10 per cent payment:

1. Penitential Deposit Contract

This contract penalises the vendor if the property is not sold under the agreed terms previously set. If they decide not to sell, they will have to pay double what the buyer originally paid.

2. Private Purchase Contract

This contract doesn’t allow the seller to back out of the deal. The buyer can choose to execute this option during the contract and make the purchase.

3. Purchase Option Contract

Although this scenario doesn’t occur often, it’s worth noting. This contract is less commonly used since it requires both parties to purchase and sell, which implies that the loss of the 10 per cent paid or the seller’s refund of double the amount may not be sufficient to terminate the contract. If one of the parties refuses to sell or purchase, the other party can compel them to do so in court. The seller may be obliged to sell (even if they refuse to appear before the notary) or the buyer may be obligated to purchase (even if they do not wish to).

Getting a mortgage

Like buying a property or home in the UK, there is a range of mortgages on offer which can vary according to your interest rates, repayment periods, and initial starting fees. Whether you choose a variable-rate mortgage or fixed-rate mortgage, it is essential that you fully understand the mortgage agreement you sign.

If you are applying for a mortgage for your new home you will have to have an appraisal of the property, which is often organised by the bank. After the property valuation, the bank will then know what percentage of financing they can provide.

The typical conditions for obtaining a mortgage are:

a) Amount of up to 60 per cent of the purchase price

b) Rate of 1.5 per cent – 2.5 per cent per year

c) Typical term of up to 25 years

d) A bank may also require property and/or life insurance

*Always seek professional advice on this

Spanish Notaries

A Spanish notary is needed to prepare for the sale of the contract and the public deeds, you will need this to secure your new property in Marbella. The decision on what notary to use for this step of buying your home is up to you. Notaries are public servants whose duty is to provide free and impartial legal advice on parts of the contract pre-signature. Once a date has been set for your signing, you have three days before that to visit the notary and ask any questions that you may have.

Post completion

After you have completed your purchase at the Notary, paid the applicable taxes, and submitted the new title deed to the Land Registry, you must ensure that all utilities, such as water bills, electricity bills, community fees, and council taxes, are changed to your name with the appropriate bank details.

Registration

You must now register your new house with the property registration once all property taxes have been paid. This will ensure your ownership rights. You will need the following papers for this procedure:

a) NIE and passport photocopy

b) Payment of ITP tax confirmed

b) A copy of the vendor’s IBI tax payment

Thank you for reading this essential guide on how to buy a property in Marbella. Get in touch with the experienced and professional team at Verdin Property now to start your buying journey.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Travel News Click Here