Elon Musk’s $44bn takeover of Twitter was meant to be one of the ultimate bounties for Wall Street lenders, with seven banks tripping over one another to lend $13bn to fund the deal in April.

Now those lenders are staring at losses that could reach hundreds of millions of dollars or more, as they prepare to wire billions of dollars to Musk.

The $13bn debt financing, led by Morgan Stanley and a coterie of some of the biggest names in the leveraged finance industry, has become the focus for dealmakers on both sides of a chaotic takeover that has captured the public’s attention.

The banks, including Bank of America, Barclays, and Japanese bank and Morgan Stanley-investor MUFG, are not expected to attempt to raise $12.5bn of the debt through public or private debt markets before the takeover is finalised, as is usually the case in a leveraged buyout, according to multiple people briefed on the matter.

Instead, they are likely to fund it themselves and keep the $12.5bn on their own balance sheets, as volatile debt markets and the threat of further litigation between the social media site and Musk hangs over the deal. They will also keep a $500mn revolving credit facility on their balance sheets, money that a privately held Twitter could soon tap as it embarks on a restructuring.

The debt financing is separate from the roughly $33bn in cash Musk will need to stump up himself, some of which he has raised from outside investors.

The $13bn debt package includes a $6.5bn term loan, a $3bn secured bond and $3bn of unsecured debt — the riskiest portion of the deal and a corner of debt markets that is almost entirely paralysed amid the wider sell-off in financial markets.

The yield the banks would need to market the debt to investors today is far higher than the terms they agreed in April. But because they have already committed to those initial terms they must make up any extra discount themselves.

It will result in paper losses that are likely to reach into the hundreds of millions of dollars. Credit analytics firm 9fin estimated losses of $500mn after taking into account the tens of millions of dollars the banks earn in fees. People involved in the financing package said the losses could near $1bn given the troubles Twitter’s business has faced this year and the rapid deterioration in credit markets.

“The gap between where banks are prepared to take the loss and where people are prepared to buy Twitter [debt] is too wide to get a deal done so if a deal comes they’ll have to sit with it for a while,” said Roberta Goss, a senior managing director at asset manager Pretium. “That will be ugly.”

It is an incredible shift from April, when bankers accelerated due diligence processes over the Easter holiday so Musk could put forth a credible financing pitch to Twitter’s board. Several banks got comfortable with the deal based on the sheer size of the cheque Musk was writing.

“Is he going to let a $30bn equity valuation for him go for $12bn of debt in a default? He would just pay the debt down,” one banker told the Financial Times in April. “It is how a lot of banks got comfortable.”

Morgan Stanley, Bank of America, Barclays and MUFG, which are on the hook for $11.15bn of the $12.5bn package, declined to comment. Mizuho, BNP Paribas and Société Générale, which together have committed to lend the remaining $1.35bn, also declined to comment.

Large banks have struggled to offload tens of billions of dollars of debt they had committed to finance this year. They sustained $600mn in realised losses late last month when they sold $8.55bn of debt at knockdown prices to finance the takeover of software maker Citrix.

The group of lenders were stuck holding roughly $6.5bn of Citrix debt on their own balance sheets, with the threat their losses could balloon when they move to sell the riskiest portion of the bond financing.

Last week, banks shelved a planned $3.9bn debt offering to fund Apollo Global Management’s takeover of telecoms group Brightspeed after failing to find willing investors. They are also working to finance buyouts of the media ratings company Nielsen, TV broadcaster Tegna and car parts maker Tenneco.

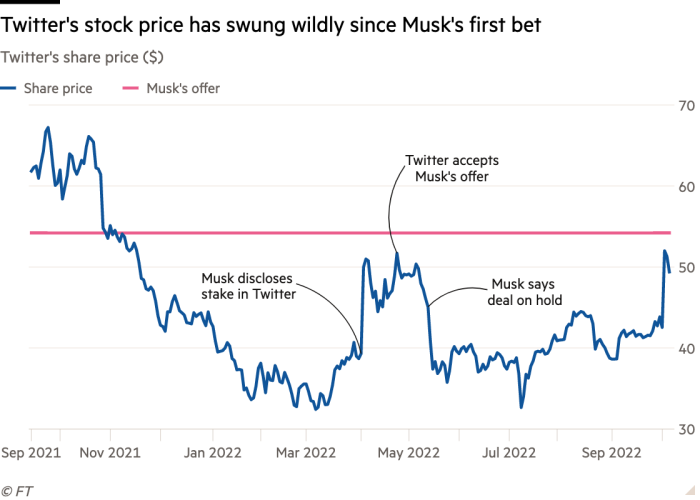

The terms of the financing package may be one reason Musk surprised Twitter earlier this week when, after previously attempting to back out, he said he would proceed with his $44bn takeover at its original $54.20 price. If he were to renegotiate a lower price, Musk risked having to return to bank lenders to rearrange financing at far more expensive prices because of rising interest rates.

“The financing package, if it comes through, is very valuable to Elon Musk. There is a hidden value there,” said David Allen, chief investment officer at AlbaCore Capital Group.

Allen estimated that the package was worth billions of dollars to Musk, mitigating some of the perceived erosion of Twitter’s overall equity value since this spring as technology stocks have plunged.

How Twitter and Musk handle the existing financing package remains in flux. Twitter’s board and top management are wary about agreeing new terms with the billionaire, a person close to the social media company said.

“We’re not adding any new contingencies,” the person said. “Deal certainty is what matters. Otherwise we go to trial. We have all the leverage especially since he [Musk] already caved.”

The judge overseeing the case has agreed to a brief delay in the litigation to allow the parties to move ahead with the transaction. Musk has stressed that the closing of the deal would depend on receiving debt financing from the banks that agreed to back the transaction in April.

That request is a non-starter for Twitter, multiple people briefed about the matter said. For the two parties to move on without a legal fight Musk will need to secure the cash to close the deal as soon as possible. Otherwise, the social media group will prefer getting a court to rule on the matter, as the company is confident the judge will rule in its favour, those people said.

Twitter’s biggest fear is that Musk will try to find another way to back out of the transaction at a later stage, with some of the company’s directors suspicious that his lenders may help him scuttle a deal. One potential avenue for the banks is to argue the social media platform would be insolvent once saddled with the new debts.

There is precedent for banks using a buyout target’s solvency as justification for not providing committed debt financing. In 2008, Huntsman Corporation sued Apollo after the private equity firm attempted to terminate its $11bn acquisition of the chemicals company arguing that its banks would not provide the required debt.

Huntsman sued Apollo, Credit Suisse and Deutsche Bank, and ultimately settled for a multibillion-dollar payout.

In a motion filed in a Delaware court on Thursday, attorneys for Musk said each lender had “prepared to honour its obligations”, “subject to satisfaction of the conditions” in their debt commitment letters.

But Twitter responded that the debt financing remained a point of contention. Its lawyers pointed to sworn testimony from one of Musk’s lenders who said the bank had not yet received a customary notice from the billionaire to borrow the $12.5bn.

People close to the banks involved in the financing said that it was out of question that they would walk away. Three bankers admitted that their institutions would take a loss on the debt package but the reputational damage from walking away from the financing — even before the potential legal risk — could be substantial and cost them lucrative business in the future from big private equity clients.

“Nobody would trust us if we tried to pull some dirty trick,” one banker involved in the deal said. “Would we like this to go away? Sure, but we are well-capitalised to handle the hit.”

Additional reporting by Sujeet Indap and Joshua Franklin

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Technology News Click Here