UK economy grew 0.1% in Q1, ONS confirms

Newsflash: The UK has avoided recession over the winter, the latest national accounts confirm.

The Office for National Statistics has confirmed that the economy grew by 0.1% in the first three months of this year, and also in the final quarter of 2022.

That matches the initial estimate, and shows that the UK economy avoided contracting through the cost of living crisis last winter.

The major sectors of the economy all grew, the ONS says:

In output terms, the services sector grew by 0.1% on the quarter driven by increases in information and communication, and administrative and support service activities; elsewhere, the construction sector grew by a revised 0.4% (previously 0.7%), while the production sector grew by 0.1%, with a revised 0.6% growth in manufacturing (previously 0.5%).

Key events

Over in France, inflation has eased in a sign that the cost of living squeeze is easing.

French consumer price inflation fell to an annual rate of 4.5% in June, statistics body INSEE estimates, down from 5.1% in the year to May.

This is due to a drop in energy prices, with fuel cheaper than a year ago, and a slowdown in food prices.

On an EU-harmonised basis, inflation dropped to 5.3% this month from 6.0% in May, INSEE estimates.

An encouraging move, ahead of the eurozone-wide inflation report in 45 minutes.

But, it still means inflation in France is running at over twice the European Central Bank’s target of 2%.

Five-year fixed mortgage rates nearing 6%

Just in: UK mortgage rates are continuing to rise, as the squeeze on borrowers tightens.

The average 2-year fixed residential mortgage rate today is 6.39%, up from 6.37% on Thursday, according to financial information website Moneyfacts.

The average 5-year fixed residential mortgage rate today is 5.96%, up from 5.94% yesterday, as it approaches the 6% mark.

Rates have been climbing higher over the last two months, as the UK’s persistently stubborn inflation has raised expectations of further increases in interest rates.

Bank of England base rate is expected to hit at least 6% by the end of this year, up from 5% today.

Lenders have added two more deals to the market today, Moneyfacts reports, lifting the total residential mortgage products available to 4,432, up from 4,430 on Thursday.

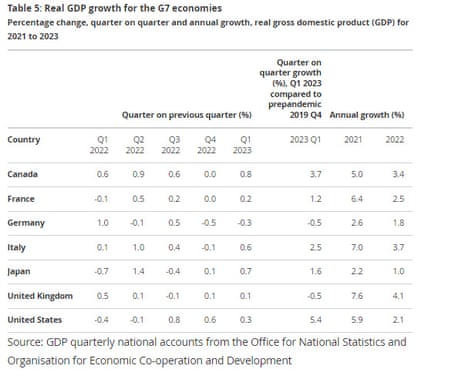

UK (and Germany) still 0.5% smaller than before Covid-19

The big picture is that the UK and Germany are jointly at the back of the pack for G7 growth since the pandemic.

Both economies were still 0.5% smaller than at the end of 2019, today’s National Accounts report shows, while America’s economy is over 5% larger.

The UK was the second-worst performing major economy in the first quarter of this year but – unlike Germany – it avoided recession.

Here’s how the G7 fared in Q1 2023:

-

Canada: grew by 0.8% quarter-on-quarter in January-March

-

France: grew by 0.2%

-

Germany: contracted by 0.3%, putting Europe’s largest economy into recession

-

Italy: grew by 0.6%

-

Japan: grew by 0.7%

-

United Kingdom: grew by 0.1%

-

United States: grew by 0.5% (revised data yesterday showed)

This morning’s confirmation that the economy grew by 0.1% q/q in Q1 means there won’t be a recession in the first half of this year.

But the sharp rise in interest rates is putting the economy increasingly at risk of falling into one at the end of 2023 or the start of next year, fears Thomas Pugh, economist at audit, tax and consulting firm RSM UK.

Pugh adds:

“We currently think the economy flatlined in Q2 and then will grow by around 0.2% q/q in Q3 and Q4 but further rises in interest rates could easily push that into the negative.

In any case, the big picture is that the economy could be no larger in 2024 than it was pre-pandemic.”

Barret Kupelian, senior economist at PwC, predicts that the UK economy contracted in May, due to the additional bank holiday for King Charles’ coronation.

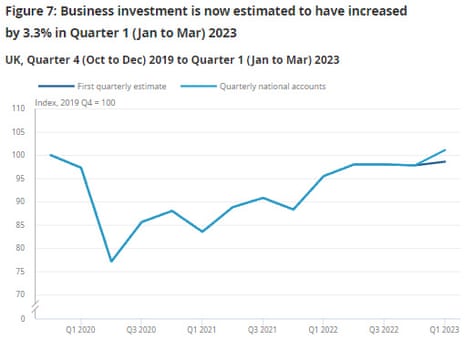

This chart shows how business investment jumped in the last quarter, as companies tried to take advantage of the super-deduction (which let them cut their tax bill by up to 25 pence for every £1 invested) before it expired on 31st March.

Here are the key points from today’s UK National Accounts report:

This morning’s GDP quarterly national accounts have confirmed there was no growth in real household expenditure in Quarter 1 2023.

That follows 0.2% growth in the previous quarter, as real household incomes were squeezed by high inflation.

The ONS says:

There were increases in expenditure on recreation and culture, clothing and footwear, communications, and housing in the latest quarter (Figure 6). These were offset by falls in transport, and alcohol and tobacco.

Capital Economics: UK recession still to come this year

A UK recession is still coming this year, fears Capital Economics, despite the economy managing some modest growth last autumn and winter.

Ashley Webb, their UK economist, says:

The final Q1 2023 GDP data confirms that the economy steered clear of a recession at the start of 2023. But with around 60% of the drag from higher interest rates yet to be felt, we still think the economy will tip into one in the second half of this year involving a peak-to-trough fall of around 0.5%.

The 0.1% q/q rise in real GDP in Q1 was unchanged from the previous estimate. This follows 0.1% q/q growth in Q4 2022, leaving the economy 0.5% below its Q4 2019 pre-pandemic level (but on the more up-to-date monthly data in April it was 0.2% above its pre-pandemic level). This leaves the UK economy still lagging behind all G7 countries except Germany.

The biggest revision was to business investment growth, which was revised up from +0.7% q/q to +3.3% q/q in Q1, Webb adds:

That may have reflected the bringing forward of investment by businesses in response to the super-deduction allowance, which expired on 31st March.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here