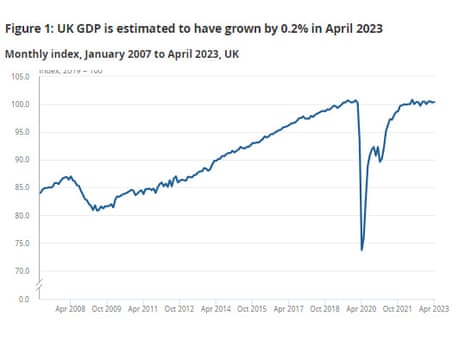

UK GDP grew 0.2% in April

Newsflash! The UK economy has returned to growth.

UK GDP increased by 0.2% in April, new figures from the Office for National Statistics show, matching City forecasts.

That follows the 0.3% contraction recorded in March.

Over the three months to April, the economy only expanded by 0.1%

The ONS says the services sector was the main contributor to the growth in monthly GDP in April, expanding by 0.3%.

Output in consumer-facing services grew by 1.0% in April 2023, following a fall of 0.8% in March 2023.

But the production sector shrank by 0.3% in April, while construction output shrank by 0.6%.

Key events

Oil demand growth to slow dramatically as peak nears, IEA says

Newsflash: Growth in global oil demand is set to slow significantly by 2028, with a peak in demand in sight before the end of the decade.

That’s the verdict from the International Energy Agency, in a new ‘medium-term report’.

It predicts that the use of oil for transport will go into decline after 2026, due to increased take-up of electric vehicles, the growth of biofuels and improving fuel economy reduce consumption.

Overall consumption is expected to be supported by strong petrochemicals demand, though, the IEA adds.

It forecats that growth in the world’s demand for oil is “set to slow almost to a halt in the coming years”. High prices, and concerns about security of supply following Russia’s invasion of Ukraine, will speed the shift towards cleaner energy technologies, they say.

The IEA predicts that global oil demand will rise by 6% between 2022 and 2028 to reach 105.7 million barrels per day (mb/d), due to “robust demand” from the petrochemical and aviation sectors.

But annual demand growth is expected to shrivel from 2.4 million barrels per day this year, to just 0.4 mb/d in 2028, putting “a peak in demand in sight”.

The report also predicts that demand growth in China is forecast to slows markedly from 2024 onwards, as the rebound in demand after the pandemic fades.

IEA executive director Fatih Birol says:

“The shift to a clean energy economy is picking up pace, with a peak in global oil demand in sight before the end of this decade as electric vehicles, energy efficiency and other technologies advance,” said

Birol adds that oil producers need to pay “careful attention to the gathering pace of change” and calibrate their investment decisions accordingly, to “ensure an orderly transition.”

World oil demand growth is set to slow to a crawl in the coming years.

The high prices & security of supply concerns highlighted by the global energy crisis are hastening the shift towards cleaner energy technologies.

More in Oil 2023 ⬇️ https://t.co/4iGiSPuyui

— International Energy Agency (@IEA) June 14, 2023

Jeremy Hunt insists UK in ‘very different situation’ than last autumn

British finance minister Jeremy Hunt has said the UK was in a very different situation on borrowing costs compared to last Autumn, when the mini-budget spooked the markets.

Speaking after the cost of UK short-term borrowing surged to 15-year highs yesterday, Hunt told reporters:

“We are in a very different situation to where we were last autumn.”

The yield (or interest rate) on two-year UK government bonds climbed to nearly 4.9% this morning, the highest since 2008.

That adds to its surge yesterday, when rising wages fuelled forecasts that the Bank of England will hike interest rates several more times to fight inflation.

Last autumn, the bond market was rocked by the unfunded tax cuts in Kwasi Kwarteng’s mini-budget – which Hunt reversed upon taking office.

The BBC’s Faisal Islam has more details from Hunt:

NEW

Chancellor Jeremy Hunt, responding to economics broadcasters on the April GDP figures, says they confirm the “UK’s underlying resilience.. but we still has a big issue with inflation.. that is the number one challenge”…

— Faisal Islam (@faisalislam) June 14, 2023

NEW:

Pushed on fact 2Y gilt rate now exceeded levels seen after Truss mini budget…Hunt said:“We are in a v different situation to where we were last autumn…econ is on right track, doing right thing to support BoE…no alternative to tackling inflation with every bit of vigour” pic.twitter.com/xE4MmE0Xwq

— Faisal Islam (@faisalislam) June 14, 2023

NEW

asked if he was following Major’s famous maxim on interest rates/ high inflation that “if it isnt hurting it isnt working”, Hunt said: ”in the end, there is no alternative to bringing down inflation ..that’s why we will be unstinting in our support for the Bank of England…”— Faisal Islam (@faisalislam) June 14, 2023

UK GDP is likely to have been weak in May, due to the extra bank holiday for the coronation, and strikes in the health and education sectors, other parts of the civil service, and on the rail network, says Martin Beck, chief economic advisor to the EY ITEM Club.

Beck adds:

The likelihood of a weak May for GDP means the EY ITEM Club expects output to be flat or fall slightly in Q2 as a whole, before a firm recovery in Q3.

But the EY ITEM Club thinks the recovery will struggle to gain momentum thereafter, given the strong headwinds from still-high inflation and the lagged effects of tighter monetary policy.”

Britain’s construction sector was hit by a drop in new housebuilding in April.

Today’s GDP report shows that new work in the construction sector fell by 1.0%.

Feeling the economic pinch – following 2mths consecutive growth, monthly construction output decreased 0.6% in April 23. The main contributors being private housing repair & maintenance & private housing new work, which decreased 5.7% (£149m) & 3.0% (£99m), respectively. pic.twitter.com/Z47F9OmG0L

— Emma Fildes (@emmafildes) June 14, 2023

The ONS adds:

At the sector level, the main contributors to the monthly decrease were seen in private housing repair and maintenance and private housing new work, which decreased 5.7% and 3.0%, respectively.

Britain’s housebuilders have already warned they are cutting back on the construction of new homes, as rising mortgage rates worried potential buyers…

Eight of the 13 sub-sectors within UK manufacturing shrank in April, today’s GDP report shows.

The pharmaceuticals sector’s output dropped by 5%, followed by manufacturing of computer, electronic and optical products, which fell by 3.8%.

Households and businesses still face a difficult few months, despite the rebound in activity in April, says Ben Jones, lead economist at CBI Economics.

Jones says the outlook is “brightening a little”, with inflation having peaked, wholesale energy prices normalising and labour supply slowly improving.

Jones adds:

Inflation is coming down, but more slowly than expected, with interest rates set to rise a little higher. The combination of high inflation and rising debt service costs will constrain consumer cash-flow and dampen the housing market.

Capital Economics: recession is on its way

The resurgence in activity in April is unlikely to last, fears Capital Economics.

Ruth Gregory, their deputy chief UK economist, explains how a reduction in industrial action on the railways helped the economy to return to growth in April, by 0.2%.

Some of the strength in April was due to fewer strikes by train workers in that month. Transport output rose by 0.5% m/m after the 1.7% m/m drop in March. As such, the rise was strongest in services output, which increased by 0.3% m/m after falling by 0.5% m/m in March.

Equally, though some of the falls in activity in other areas in April were probably temporary too. Strikes by junior doctors and civil servants probably contributed to the fall in health output (0.9% m/m) and the subdued 0.1% m/m in public administration.

But, high interest rates could pull the economy into recession, Gregory warns:

We estimate that by the end of Q2 2023 less than 40% of the drag will have been felt and that more than 60% lies ahead. And we think interest rates need to rise further to quash inflation, from 4.50% now to a peak of 5.25%.

That’s why we still think a recession is on its way in the second half of this year.

ICAEW: economy probably suffered ‘notable decline’ in May

April’s growth was probably not repeated in May, warns Suren Thiru, economics director at ICAEW (Institute of Chartered Accountants in England and Wales).

Thiru points out that bad weather hurt the economy in March. And he fears that rising interest rates will increase the risks of recession, saying:

“Although GDP rebounded in April, this reflects more the reversal of the squeeze on service sector activity from poor weather in March, than a meaningful improvement in our underlying growth trajectory.

“April’s upbeat reading should be followed by a notable decline in May GDP as the extra bank holiday for the Coronation and ongoing strike action will have stifled activity across much of the economy.

“While lower energy bills should boost incomes and support output over the summer, the financial squeeze from a higher tax burden and soaring borrowing costs means our economy may continue to tread water for some time.

“If the Bank of England continues to hike interest rates, as is likely next week, they risk reigniting recession fears by further increasing the financial fragility of households and businesses.”

“Too early to call ‘all clear’ on UK economy”

April’s 0.2% growth means the UK economy made a positive start to the second quarter of 2023, having grown by just 0.1% in the first quarter (and shrinking in March).

Jeremy Batstone-Carr, European strategist at Raymond James Investment Services, fears that “a Herculean effort” will still be needed to avoid a recession.

“Today’s GDP growth of 0.2% proves that the UK economy opened the latest quarter more strongly than the previous quarter, boosting the possibility that economic activity will be resilient enough to help the UK sidestep a recession.

However, it is far too soon to call the ‘all clear’, particularly with the Bank of England poised to remain on its rate-hiking mission to suppress inflation that remains too high for comfort.”

“Following March’s dip in economic activity fuelled by industrial action, April saw fewer days lost to strikes and was accompanied by the retail sector springing back to action. Manufacturing and industrial production remain resilient after a solid first quarter, supported by a positive trend in vehicle production, gas output and mining activity.”

“While the UK economy is proving rather more resilient than its Euro Area counterpart, there remain grounds for continued caution. Consumer spending continues to be smothered by relentless inflation and households are under growing pressure from rising mortgage rates. Given these ongoing squeezes, a Herculean effort will still be required to avoid a recession.”

The “wholesale and retail trade and repair of motor vehicles and motorcycles” made the largest contribution to UK service sector growth, followed by the “information and communications” sectors.

The latter was driven by growth in “motion picture, video and TV programme production, sound recording and music publishing”, followed by computer programming and consultancy.

This chart shows how the services sector lifted the UK economy in April (by growing by 0.3%), while production output (-0.3%) and construction output (-0.6%) shrank during the month:

UK GDP: political reaction

Reaction to this morning’s growth figures is rushing in.

Chancellor Jeremy Hunt said:

“We are growing the economy, with the IMF (International Monetary Fund) saying that from 2025 we will grow faster than Germany, France and Italy.

“But high growth needs low inflation, so we must stick relentlessly to our plan to halve the rate this year to protect family budgets.”

Labour’s shadow chancellor Rachel Reeves said:

“Despite our country’s huge potential and promise, today is another day in the dismal low-growth record book of this Conservative Government.

“The facts remain that families are feeling worse off, facing a soaring Tory mortgage penalty and we’re lagging behind on the global stage.”

Bars and pubs helped economy grow

UK bars and pubs had a relatively strong April, the Office for National Statistics reports, helping the economy grow by 0.2% during the month.

There was also a rebound in car sales, after a drop in March which hit GDP.

Activity in the education sector also increased, following strike action in March which hit output.

But, health sector activity was hit by strikes as the pay row between unions and the government continued.

Darren Morgan, director of economic statistics production & analysis at the ONS, says:

“GDP bounced back after a weak March.

“Bars and pubs had a comparatively strong April, while car sales rebounded and education partially recovered from the effect of the previous month’s strikes.

“These were partially offset by falls in health, which was affected by the junior doctors strikes, along with falls in computer manufacturing and the often-erratic pharmaceuticals industry.

“House builders and estate agents also had a poor month.”

UK economy 0.3% larger than pre-pandemic

Monthly UK GDP is now estimated to be 0.3% above its pre-coronavirus levels, set in February 2020, the ONS reports.

UK GDP grew 0.2% in April

Newsflash! The UK economy has returned to growth.

UK GDP increased by 0.2% in April, new figures from the Office for National Statistics show, matching City forecasts.

That follows the 0.3% contraction recorded in March.

Over the three months to April, the economy only expanded by 0.1%

The ONS says the services sector was the main contributor to the growth in monthly GDP in April, expanding by 0.3%.

Output in consumer-facing services grew by 1.0% in April 2023, following a fall of 0.8% in March 2023.

But the production sector shrank by 0.3% in April, while construction output shrank by 0.6%.

Yesterday’s turbulence in the financial markets gets plenty of coverage in today’s newspapers.

The i newspaper warns that mortgage misery is set to be as bad as the 1980s — with interest rates seen heading for 5.75% by next spring.

The Financial Times highlights Bank of England governor Andrew Bailey’s warning that inflation is “taking a lot longer” than hoped to come down.

The Daily Telegraph reports that Downing Street has “ordered banks to protect struggling homeowners from soaring mortgage costs”, as markets bet interest rates could hit almost 6pc by the end of the year.

The Prime Minister’s spokesman said yesterday:

The Chancellor has made clear his expectation that lenders should live up to their responsibilities and support any mortgage borrowers who are finding it tough right now.”

“There do remain a large range of mortgage deals available to the public, but we know this current situation may be concerning for some homeowners and mortgage holders.”

Deutsche Bank predict the UK economy expanded by 0.2% in April, rebounding from its March contraction.

Their senior economist, Sanjay Raja, explains:

After a surprise contraction in March, we see GDP expanding modestly in April. What do our models tell us? Our April nowcast sits at 0.2% m-o-m. What’s driving the rise in activity? More services output, as some of the drag from industrial action unwinds.

Consumer facing services, we think, will lead the rebound into spring. We also see construction output expanding a little (0.3% m-o-m).

The one drag to GDP will likely come from industrial production, which we expect will see broad based weakness from energy, water, oil, and manufacturing production.

We’ll find out in 15 minutes if they’re right….

Looking ahead, Deutsche Bank continue to see UK GDP this year expanding by 0.3%.

Introduction: UK GDP and Fed decision in focus

Good morning, and welcome to our rolling coverage of business, the financial markets and the world econony.

At 7am we discover how the UK economy fared in April, when the latest growth figures are released.

Economists predict the UK returned to growth in April, with GDP tipped to have risen by 0.2% despite high inflation, rising interest rates and disruption caused by strikes.

The economy shrank by 0.3% in March, meaning the economy only grew by 0.1% in the first quarter of this year [although this data may be revised]. That left the UK at the bottom of the G7 growth league since the pandemic, behind Germany, France and the US.

But the UK has defied fears of a recession, so far anyway, with the economy showing more resilience than expected, assisted by easing energy costs after last year’s spikes.

Michael Hewson of CMC Markets sets the scene…

As we look to today’s UK April GDP numbers, we’ve just come off a March contraction of -0.3% which acted as a drag on Q1’s 0.1% expansion. The reason for the poor performance in March was due to various public sector strike action from healthcare and transport, which weighed heavily on the services sector which saw a contraction of -0.5%.

The performance would have been worse but for a significant rebound in construction and manufacturing activity which saw strong rebounds of 0.7%.

This isn’t expected to be repeated in today’s April numbers, however there was still widespread strike action which is likely to have impacted on public services output.

The strong performance from manufacturing is also unlikely to be repeated with some modest declines, however services should rebound to the tune of 0.3%, although the poor March number is likely to drag the rolling 3M/3M reading down from 0.1% to -0.1%.

Also coming up today

Today’s GDP report comes amid turmoil in the UK mortgage markets, as lenders scramble to reprice deals as UK borrowing costs soar.

Yesteday, the interest rate on a two-year UK government bond jumped over the levels hit during Liz Truss’s disastrous premiership, following faster-than-expected wage growth this year.

Yesterday, the governor of the Bank of England, Andrew Bailey, warned that inflation was “taking a lot longer” than hoped to come down.

He told the House of Lords economic affairs committee:

“We still think the rate of inflation is going to come down, but it’s taking a lot longer than we expected.”

Tonight America’s central bank sets interest rates, with many forecasters predicting the Federal Reserve will pause its cycle of higher borrowing costs.

Yesterday, US inflation dropped to 4% in May, bringing some relief to households (and some envious looks from the Bank of England’s headquarters…).

That pushed stock markets higher yesterday, as Danni Hewson, head of financial analysis at AJ Bell, explains.

“With US inflation coming in at the lowest print in more than two years markets have taken the bull by the horns and run.

Both the S&P and Nasdaq have surged to fresh 2023 highs as investors buy into speculation that the Fed will indeed pause its rate hiking cycle this month, even if what happens in the months beyond remains uncertain.

The agenda

-

7am BST: UK GDP report for April

-

9am BST: IEA monthly oil market report

-

1.30pm BST: US PPI index of producer price inflation

-

7pm BST: US Federal Reserve decision on interest rates

-

7.30pm BST: US Federal Reserve press conference

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here