Grocery price inflation hits record 14.7%

Supermarket inflation in the UK has soared towards 15%, driving up the average bill by £682 per year.

Grocery prices were 14.7% higher than a year ago in October, Kantar Worldpanel reports, as shoppers continued to be hit by rising costs.

That’s the highest reading on record, and means shoppers would face paying an extra £682 per year if they didn’t trade down to cheaper items, or simply not buy as much.

Prices are rising fastest for items such as margarine, milk and dog food, reports Kantar.

Worryingly, Kantar cautions it’s ‘still too early to call the ceiling’ on rising prices.

Sales of own label sales rose by over 10%, as people tried to save where possible, while the branded goods market grew far slower at 0.4%.

Kantar food inflation 14.7% in 4 weeks to Oct 30, a new record and possibly not the peak

Usual caveats: this compares like products with like, and doesn’t represent inflation at the till as it doesn’t allow for downtrading, economising etc

— Jonathan Eley (@JonathanEley) November 8, 2022

Here’s Fraser McKevitt, head of retail and consumer insight at Kantar:

“Yet again, we have a new record high figure for grocery price inflation and it’s too early right now to call the top.

Consumers face a £682 jump in their annual grocery bill if they continue to buy the same items and just over a quarter of all households [27%] now say they’re struggling financially, which is double the proportion we recorded last November.

Nine in ten of this group say higher food and drink prices are a major concern, second only to energy bills, so it’s clear just how much grocery inflation is hitting people’s wallets and adding to their domestic worries.”

Sales of Halloween items were down this year, while 32% fewer shoppers have bought their Christmas pudding than this time last year.

Key events

Filters BETA

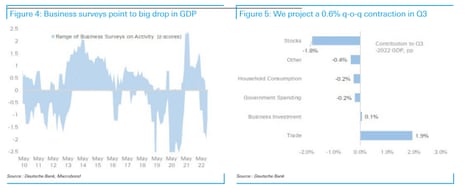

Deutsche Bank: A deep, long UK recession may have started

We will find out on Friday if the UK economy shrank in the last quarter.

Deutsche Bank’s chief UK economist, Sanjay Raja, predicts UK GDP fell by 0.6% quarter-on-quarter in July-to-September, which could be the start of a ‘a deep and long recession’.

Raja explains:

The drop in Q3 GDP reflects continued weakness in household and business confidence, higher inflation, and higher interest rates in the economy, with household consumption contracting in the quarter, business investment slowing, and government spending falling further.

We also expect to see a material softening in inventories after two consecutive quarters of historically strong stockpiling, which should push GDP firmly into negative territory.

Another contraction in the October-December quarter can’t be ruled out either, Raja adds, which would be a technical recession.

Looking further ahead, Deutsche Bank remain more downbeat on the economic outlook, he adds:

Headwinds to the UK economy will almost inevitably push the economy into recession, with global growth slowing, confidence deteriorating, and persistently high inflation and rising interest rates squeezing disposable incomes further.

Bank of England’s Pill: UK entering recession

The UK economy is entering recession, the Bank of England’s chief economist has warned.

Huw Pill has told a conference organised by Swiss bank UBS this morning that the Bank can’t claim victory in its attempt to stop inflation becoming embedded in the economy.

Pill explained that interest rates are likely to rise further, in an attempt to prevent inflation leading to a spiral of higher wages and prices.

“I think we cannot declare victory against second-round effects, but we are entering a recession.

That’s a difficult trade-off environment for monetary policy.”

That trade-off saw the Bank make its biggest interest rate rise in 30 years last week, while also guiding the markets that borrowing costs wouldn’t increase as much as had been expected.

Pill said the Bank would need to think about the broader economic outlook at some point, but shouldn’t put the housing market ‘on a pedestal’.

And he insisted that the Monetary Policy Committee are not “inflation nutters” – but needs to control the surge in prices to stop inflation spreading.

Pill told the UBS conference:

“We’re not meant to be inflation nutters.

We are meant to sort of manage this trade-off in a way that avoids unnecessary, counterproductive maybe, disruptions to the real economy.”

[Thanks to Reuters for the quotes].

Supermarkets urged to help those in England’s ‘food deserts’,

Patrick Butler

People living in areas of Birmingham and Liverpool are most likely to struggle with access to affordable food, according to new research from Which? today.

The consumer group is urging the big supermarkets to step up support for low-income customers marooned in England’s “food deserts”, so they can readily access healthy groceries during the cost of living crisis.

The scarcity of affordable, healthy food is so acute in some of the poorest parts of Birmingham, Liverpool, Bradford, Durham and the Welsh valleys that the vast majority of neighbourhoods in these areas should get targeted help, Which? says.

The study found nearly half of neighbourhoods in the north-east of England – and about a third in Yorkshire, the West Midlands and the north-west of England – lacked easy access to supermarkets, and had poor availability for online deliveries and low levels of car ownership.

That makes it much harder for low-income households to put food on the table.

Persimmon: housing demand and prices fall as market falters

One of the UK’s largest housebuilders has warned that the housing market is slowing, as prices fall and more people cancel house purchases.

Persimmon has reported a “recent deterioration in market conditions”, with its average prices down 2% in the last six weeks.

Cancellation rates have increased to 28%, up from 21% in the preceding 12 weeks from the start of July.

That six week period covers the period following the mini-budget, when mortgage rates soared and lenders pulled many deals.

Chief executive Dean Finch told shareholders:

“Rising interest rates and broader economic uncertainty are clearly impacting mortgage lending and customer behaviour and this is reflected in our recent weekly sales rates and forward sales position.

Persimmon says cancellation rates have jumped from 21% to 28% in the past six weeks , introducing ‘some uncertainty’ towards meeting the target of completing 14,500 to 15,000 units this year. See below for damage to sales rates caused by the cursed mini-budget pic.twitter.com/V5V0Z50BG0

— Peter Bill (@peterproperty) November 8, 2022

In another sign that the market has slowed, Persimmon has booked £770m of sales beyond the current year, down from £1.15bn at this stage a year ago.

Average sales per Persimmon outlet has dropped to 0.60, from 0.78 – with demand cooling since the mini-budget.

Persimmon says:

Reflecting the uniquely disruptive political conditions and deteriorating economic outlook since September, in the last six weeks the average net private weekly sales rate per outlet has fallen to 0.48.

Persimmon has also lifted its provision for remedial safety work on blocks of flasts following the Grenfell Tower disaster, to £350m.

Shares in Persiimmon have fallen 6% – and have more than halved so far this year.

Victoria Scholar, head of investment at interactive investor, says:

Shares in Persimmon have been trading in a downtrend all year with losses accelerating in September in the aftermath of the mini-budget which sent mortgage rates soaring while a number of mortgage products were temporarily removed from the market altogether.

With borrowing costs spiking and the expectation that the housing market will fall into next year, potential buyers are deferring their decisions, holding off until property prices ease and mortgage rates also soften, adding to downward pressures on the housing market. We are also heading towards the seasonally slower period around Christmas when many buyers and sellers typically wait until the holidays are over in the new year to return to the market.

Julia Kollewe

It’s been a grim morning for some commuters, as the UK rail network struggles following the last-minute cancellation of this week’s strikes.

Many train services started later than usual, and Avanti West Coast will run a reduced timetable all day.

Three 24-hour strikes planned by railway workers for 5, 7 and 9 November were called off last Friday, as the RMT union said it would enter “a period of intensive negotiations” with Network Rail and other train operators.

However, there is still widespread disruption to services. Avanti said it would run a limited service between London Euston and Manchester, Liverpool, Birmingham and Preston, from just before 8am until mid-afternoon.

North Wales, Shrewsbury, Blackpool and Edinburgh will have no Avanti West Coast services, with the disruption likely to continue into the next two days.

Government: we’ll fix ‘blockage’ stopping energy vouchers reach prepayment customers

With prices soaring in the shops, its vital that struggling families get cost of living support from government.

But many households with prepayment energy meters have not been receiving vouchers which give them monthly discounts, leaving them struggling to pay bills.

And today, Work and Pensions Secretary Mel Stride has acknowledged there is a “blockage” in getting energy discount vouchers for people on pre-payment meters.

Put to him on ITV’s Good Morning Britain that the programme has had a “huge number” of people getting in touch to say they are struggling to get their vouchers, he said:

“Firstly… the Government is very alive to the issue, and will be working with the energy companies, and are as we speak, to resolve those particular issues.”

Stride added that he has not “personally” had conversations with the energy firms, but pledged that his department will help clear the blockage.

“The most important thing, as I say, is that the Government is going to be gripping this issue and doing whatever is necessary to make sure that we unblock the blockage that there is in terms of getting those vouchers out.”

‘It’s great you’re announcing new measures, what about the existing measures? It’s £400 and people aren’t getting it.’@susannareid100 questions Work and Pensions Secretary Mel Stride on the pre-payment energy vouchers. pic.twitter.com/50bEUo1cue

— Good Morning Britain (@GMB) November 8, 2022

Kantar retail sales data for the UK shows continued market share gains for discounters, as food inflation continues to hit new records: pic.twitter.com/oFGssHevpy

— BionicBanker (@BrokenBanker) November 8, 2022

Sales of the very cheapest value own label ranges have jumped by 42% year-on-year, as cash-strapped shoppers traded down.

Kantar’s Fraser McKevitt explains:

These items currently represent just under 3% of the market, although retailers have been adding new products in recent months, so it will be interesting to see if this continues.”

Aldi and Lidl see fastest growth

Shoppers continued to flock to discount supermarkets.

Aldi was the fastest growing retailer in October, increasing its sales by 22.7% year on year to now hold a 9.2% market share.

Lidl boosted sales by 21.5% to take its market share to a new record high of 7.2%.

In contrast, Tesco’s sales grew 3.1%, while they fell 1.9% at Waitrose and by 4.6% at Morrisons.

Aldi and Lidl now make up 16.4% of the UK market, versus 4.4% 14 years ago.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here