Introduction: UK house price growth slows in June

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

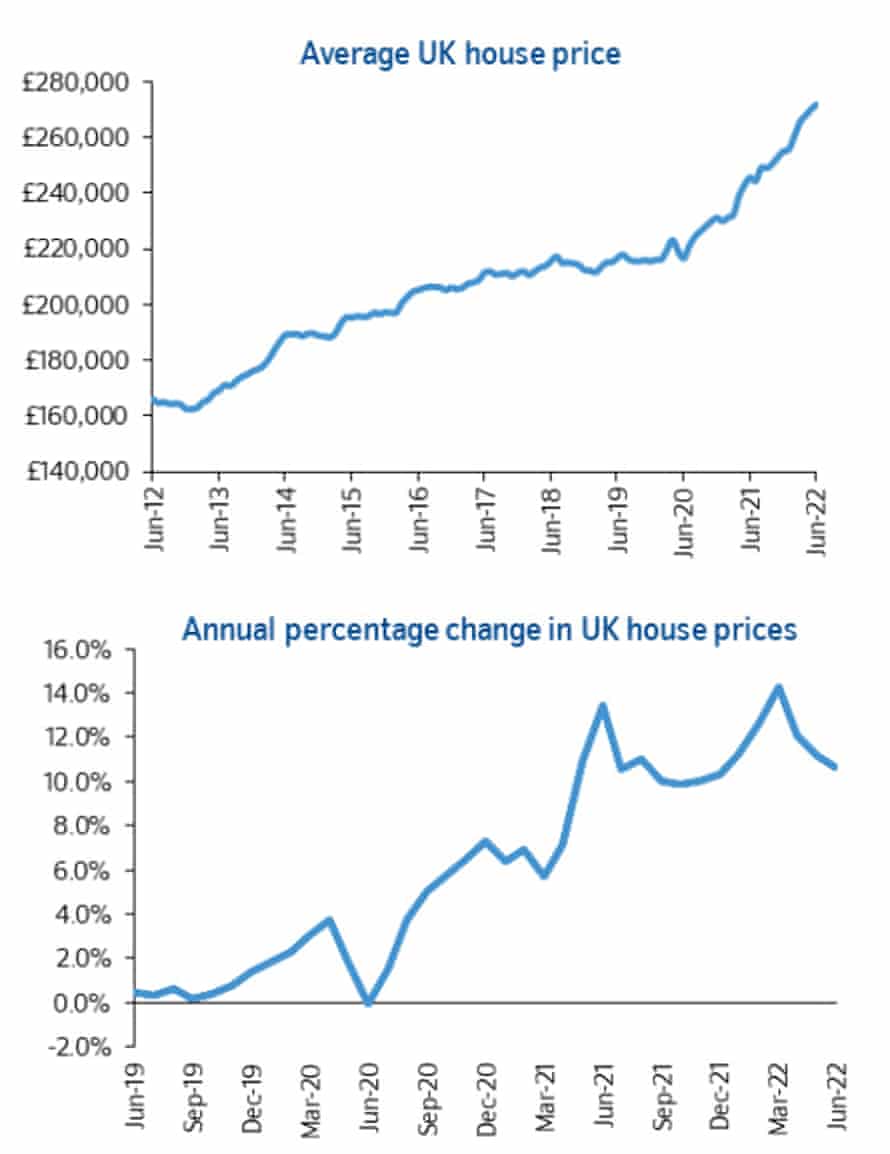

UK house prices growth slowed this month as the weakening economy, the cost of living squeeze, and rising interest rates cooled the market.

Lender Nationwide reports that prices rose by 0.3% this month, a notable slowdown on May’s 0.9% house price inflation — but still the 11th monthly rise in a row.

This pulled the annual UK house price growth to 10.7% in June, from 11.2% in May, with most regions seeing a “slight slowing” in annual growth over the last quarter.

Nationwide reports that:

- The price of a typical UK home climbed to a new record high of £271,613, with average prices up over £26,000 in the past year.

- South West overtook Wales as strongest performing region, while London remained weakest

- South West also strongest performing region through the pandemic

Robert Gardner, Nationwide’s chief economist, says the market is expected to slow further — as interest rates continue to rise:

“There are tentative signs of a slowdown, with the number of mortgages approved for house purchases falling back towards pre-pandemic levels in April and surveyors reporting some softening in new buyer enquiries.

Nevertheless, the housing market has retained a surprising amount of momentum given the mounting pressure on household budgets from high inflation, which has already driven consumer confidence to a record low.

Gardner says that the current strength of the labour market, and low availability of houses, have kept ‘upward pressure on house prices’.

But…..

“The market is expected to slow further as pressure on household finances intensifies in the coming quarters, with inflation expected to reach double digits towards the end of the year.

Moreover, the Bank of England is widely expected to raise interest rates further, which will also exert a cooling impact on the market if this feeds through to mortgage rates.

Also coming up today

The OPEC group of oil producers holds a regular meeting to agree production targets. A big change isn’t expected this month, despite pressure from the West to increase output.

At least five OPEC+ delegates said this week’s meeting will focus on confirming August output policies and would not discuss September, says Reuters.

A flurry of data will give us a new insight into the global economy, including French inflation, eurozone unemployment, US jobless claims and the PCE measure of US inflation.

Trade secretary Anne-Marie Trevelyan and shadow chancellor Rachel Reeves are both appearing at the British Chambers of Commerce’s annual conference, along with business leaders and a ‘senior cabinet minister).

Christine Lagarde will close the European Central Bank’s Forum in Sintra, where Bank of England governor Andrew Bailey yesterday warned that Britain will suffer a more severe dose of inflation than other major economies during the current energy crisis.

The agenda

- 7am BST: UK Q1 GDP report (second estimate)

- 7am BST: Nationwide house price index for June

- 7.45am BST: French inflation report for June

- 8.30am BST: Swedish Riksbank interest rate decision

- 10am BST: Eurozone unemployment report for May

- 1.30pm BST: US weekly jobless claims

- 1.30pm BST: US PCE measure of inflation for May

- 2.30pm BST: ECB president Christine Lagarde speech.

UK’s biggest recruiters warn ministers not to hire agency staff to replace strikers

Julia Kollewe

Britain’s biggest recruitment and staffing companies have written to the government to protest against plans to replace striking workers with agency staff, warning that this would further inflame strikes.

In a letter to Kwasi Kwarteng, the bosses of 13 companies including Hays, Adecco, Randstad and Manpower called on the business secretary to reconsider plans to repeal a decades-long ban on using agency workers to cover for picketing staff.

“We can only see these proposals inflaming strikes – not ending them,” the 13 groups warned in their letter, which was sent by Sarah Thewlis, chair of the Recruitment & Employment Confederation (REC).

Here’s the full story:

Businesses call for help to weather ‘perfect storm’

The Government is being urged to put in place support for businesses to help firms weather a “perfect storm” of spiralling costs and problems recruiting workers.

Shevaun Haviland, director-general of the British Chambers of Commerce (BCC), said action is needed to save the economy as the cost of doing business crisis continues to worsen.

She told the BCC’s annual conference in London that ministers must not to impose any more tax increases on businesses, and should provide more assistance in the autumn budget.

“Increasing costs of raw materials over last summer, supply chain and shipping issues, problems in recruiting people, and, by this March, spiralling energy prices. It really is the perfect storm for businesses, firmly putting the brakes on recovery.

“This has to change; we are on limited time. The Government has until the autumn Budget to reset, rethink and get their house in order.

“First, they need to put in place support for businesses now to weather this storm, and they need to work in partnership with us to develop a long-term economic strategy for growth.”

Britons cut back last week, with less spending on credit and debit cards and fewer trips to restaurants.

Data collated by the Office for National Statistics found that credit and debit card spending fell to 99% of its February 2020 average, down from 100% the week before.

The number of transactions at most Pret A Manger locations fell, while UK seated diners decreased by 16 percentage points.

That probably shows the impact of last week’s rail strikes which kept many workers at home, as well as cost of living pressures.

Firms may also have reined in their recruitment, with the total volume of online job adverts down slightly week-on-week.

And 35% of businesses reported their production and/or suppliers had been affected by recent increases in energy prices, up from 33% reported in early May 2022.

UK’s balance of payments deficit hits record

Britain racked up a record shortfall in its current account in early 2022, in part due to the soaring cost of its fuel imports.

The UK’s balance of payments deficit widened to £51.7bn in January-March, which is 8.3% of GDP, the ONS reported this morning.

Economists polled by Reuters had expected a deficit of just under £40bn pounds.

The shortfall was the biggest in records going back to 1955.

Samuel Tombs, an economist with Pantheon Macroeconomics, warned Britain’s current account gap would come under further strain as tourism resumes — which causes money to flow out of the country.

“With the current account deficit set to remain large over coming quarters, sterling will remain very sensitive to global trends in risk appetite.”

???? UK current account deficit including precious metals hits highest since records began in the 1950s at 8.3% of GDP in Q1 pic.twitter.com/P18OzMUqGm

— Andy Bruce (@BruceReuters) June 30, 2022

The ONS cautioned that the current account figures were subject to more uncertainty than usual, due to the impact of post-Brexit changes in how data is collected.

As Reuters’ Andy Bruce explains:

ONS says some caution needed when looking at this because of the way the UK changed collection of imports data since leaving the EU’s economic system.

That said… a lot of this is likely ‘real’ rather than a statistical anomaly

— Andy Bruce (@BruceReuters) June 30, 2022

Basically the changes are: UK now accurately captures the value of “below threshold” imports that were previously estimated (about 7% of total)

Also added customs declarations for non-VAT registered firms/people, which HMRC reckons had only a £500m impact in Q1

— Andy Bruce (@BruceReuters) June 30, 2022

More disruption at Heathrow

Airline passengers have complained of “total chaos” at Heathrow today after the airport made a last-minute order to cancel flights because it could not handle them.

Thousands of travellers were disrupted by a rare “schedule intervention” on Thursday morning, which led to the scrapping of 30 flights during the morning peak.

Some passengers did not find out their flights were cancelled until they arrived at the airport, the UK’s busiest.

The travel writer and broadcaster Andy Mossack tweeted: “Total chaos at Heathrow this morning. British Airways flights cancelled and zero customer service!”

Another affected passenger, Andrew Douglas, said he was due to be on a flight but had “spent the last four hours in multiple queues at Heathrow airport because it’s been cancelled”.

He added:

“Absolute shambles, complete chaos and only found out at check-in with no prior notification. Horrific service.”

Sarah Butler

Peter Cowgill, the former boss of JD Sports, more than halved his pay last year to £2.4m and continues to wrestle over his exit package after losing out on more than £1m in bonuses following a series of corporate governance mishaps.

Cowgill, who stepped down from JD last month, missed out on a share bonus related to long term performance at the fashion and outdoor kit retailer worth more than £850,000 because of his early exit from the business.

His annual bonus was trimmed by about £180,000 after the company was handed fines by the competition watchdog according to the group’s annual report published this week.

JD’s remuneration committee said it had “exercised discretion” to reduce the annual bonus pay out for Cowgill from 200% of salary to 180% after the corporate governance issues came to light.

The report says that executives are entitled to a pay off worth up to a year’s salary, benefits and “incidental expenses” but it is not clear if Cowgill will be awarded such a payment. Cowgill’s annual salary increased about 4% to £906,000 in April and his annual benefits were set at £3,000 indicating the potential size of any pay off.

JD is currently being run by an interim chair and chief executive as it searches for new permanent bosses.

The nominations committee said JD would “continue to further strengthen corporate governance” and would “specifically measure” corporate governance related issues as part of the annual bonus of executives in the current financial year.

Gazprom shares plunge after dividend shock

Russian gas giant Gazprom has shocked the markets by scrapping plans to pay out a record dividend.

Gazprom’s shareholders have voted against paying a dividend for 2021 at its annual meeting, sending shares tumbling by a quarter.

Deputy CEO Famil Sadygov said.

“The shareholders decided that in the current situation it is not advisable to pay dividends based on the 2021 results.

“Gazprom’s priorities currently are implementation of its investment program, including Russian regional gasification,” he said.

Gazprom, which is majority state owned, had proposed a dividend of 52.53 roubles per share, which would have been its biggest payout, after making record earnings in 2021 due to surging energy prices.

The European Central Bank plans to ask euro zone lenders to factor a possible recession into their business plans and will use this new calculation for approving

dividend payout proposals, ECB bank supervisor Andrea Enria said today.

Reuters has the details:

The ECB continues to project solid economic growth for this year and next but has argued that an escalation of Russia’s war in Ukraine, which could lead to a cut off in gas supplies could in an adverse scenario drag the euro zone into a deep recession next year.

“We will propose to ask banks to recalculate their capital trajectories under a more adverse scenario, including also potentially a gas embargo or a recessionary scenario, and use this also for the purpose of vetting their distribution plans going ahead,” Enria told European Parliament committee.

Inflationary pressures have pushed Sweden’s central bank into its largest interest rate rise in two decades.

The Riksbank has just hiked its benchmark rate to 0.75% from 0.25%, and warned that it expects to keep raising borrowing costs. It has also decided to unwind its asset purchase scheme faster than previously planned.

Announcing the 50 basis-point rate hike, it says:

The Executive Board’s forecast is that the policy rate will be raised further and that it will be close to 2 per cent at the start of next year.

The Executive Board has also decided that, in the second half of the year, the Riksbank’s asset holdings shall shrink faster than was decided in April.

The Riksbank said that the Ukraine war, and China’s pandemic lockdowns, have pushed up prices for energy, various input goods and food, prompting firms to hike their prices — some ‘unusually strongly’.

Just like in other countries, price rises in Sweden have now spread increasingly and prices for goods, food and services have been rising considerably faster than expected since the start of the year. Companies’ costs have increased rapidly.

The strong demand has made it possible to pass them on to consumer prices. There are also signs of changed price setting behaviour in that companies have raised prices unusually strongly in relation to how much costs have increased.

Sweden’s Riksbank has hiked rates by 50 basis points in a bid to get out in front of other central banks.

We reiterate our view that the near-term outlook for SEK remains largely detached from monetary policy dynamics.https://t.co/zhQjYpzHDK

— ING Economics (@ING_Economics) June 30, 2022

Today’s losses mean European shares are set for their worst quarter since the first three months of 2020, at the start of the pandemic.

The continent-wide Stoxx 600 index has dropped 1.5% today, taking its losses in April-June to over 10%.

The rise in French inflation to a new record added to concerns that central banks could tighten monetary policy aggressively to cool prices, risking a recession.

Ben Laidler, Global Markets Strategist at social investment network eToro, says there have been “few hiding places” for investors this year.

Driven by a one-two punch of high-for-longer inflation and aggressive central banks, followed by surging recession fears, US and global equities plummeted over 15%, Bitcoin more than halved and both bonds and commodities fell. Only China rose, among the biggest markets, and the US dollar, among asset classes.

“Now the race between peaking inflation and a recession is going to make for a long, hot summer. However, with financial conditions significantly tightening and economies slowing, US inflation should soon peak.

This will hopefully allow the Fed and other central banks to slow their hiking pace before a recession becomes inevitable, though the ECB faces an even tougher task of an interest rate lift-off with high-for-longer oil prices and a grinding Ukraine conflict.

Inflation in France has jumped to a record high.

Consumer prices in the eurozone’s second-largest economy climbed by 6.5% per year in June on an EU-harmonised basis, official preliminary figures show, up from 5.8% in May.

Prices rose by 0.8% in June alone.

Statistics agency INSEE said food and energy prices had risen sharply due to disruption resulting from Russia’s invasion of Ukraine.

French inflation quickened to fastest since euro formed, raising pressure on Emmanuel Macron and ECB to do more to contain the shock for firms and households. Steeper increases in energy + food costs drove consumer-price growth to 6.5% in June from 5.8% in May. pic.twitter.com/Y2vpUAmkiK

— Special Situations ???? Newsletter (Jay Singh III) (@SpecialSitsNews) June 30, 2022

Markets fall as global downturn worries rattle investors.

European stock markets are ending the month in the red, as recession worries continue to swirl.

The FTSE 100 index of blue-chip shares has lost all this week’s gains, shedding 125 points or over 1.7% to 7189.

Nearly every stock is down, led by discount retailer B&M (-5.3%), luxury fashion group Burberry (-4.6%) and online grocery technology business Ocado (-4.5%).

Housebuilders are also weaker, a sign of concerns over the UK’s economic outlook.

Germany’s DAX and France’s CAC have both fallen over 1.8%, as stocks stumble.

???? European Opening Bell ????

???????? FTSE 100 Down 1.5%

???????? STOXX 50 Down 1.4%

???????? STOXX 600 Down 0.9%

???????? DAX Down 1.7%

???????? CAC 40 Down 1.7% pic.twitter.com/0KyWeWFRQ6

— PiQ (@PriapusIQ) June 30, 2022

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, says:

‘’A sense of foreboding is again gripping financial markets, with anxiety rising that by attacking inflation, central banks risk severely weakening economies.

Following fresh falls on Wall Street, Asian markets retreated and European indices also opened lower. The FTSE 100 slid 1.8% with risers very few and far between.

As worries about a global downturn have increased, oil has dipped amid expectations of lower demand, with Brent Crude falling slightly to below $116 a barrel. But it’s still at an eye-watering level, up 51% since the start of the year due to intense supply pressures.

Japan’s worst factory output slump in two years

Japan’s factory’s posted the biggest monthly drop in output in two years in May, as China’s COVID-19 lockdowns and semiconductor and other parts shortages hit manufacturers.

Factory output slumped by 7.2% in May, from the previous month, official data showed on Thursday.

Production of items such as cars as well as electrical and general-purpose machinery dropped sharply.

???? #Economy -Strong rise in the Chinese PMIs in June pointng to activity rebound. However, given the collapse of Japan’s industrial output in April (-1.5%) and May (-7.2% mom!), it is clear that China’s anti-covid measures have had serious repercussions abroad pic.twitter.com/BzLt9VLu1L

— ENGIE EnergyScan (@Energyscan_egm) June 30, 2022

The decline — the biggest since a 10.5% tumble in May 2020 — was much bigger than a 0.3% fall expected by economists in a Reuters poll.

The slump shows that the world’s third-largest economy is being hit by supply disruptions and persistently high prices of raw materials and energy — factors which are threatening a global slowdown.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here