Introduction: UK house prices rise in April after seven consecutive falls

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

UK house price growth picked up in April, building society Nationwide reports this morning, with the first monthly increase in seven month.

Average house prices rose by 0.5% last month, Nationwide’s data shows, following seven consecutive falls going back to last September.

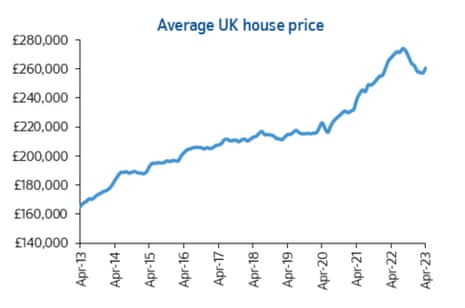

The average price increased to £260,441, up from £257,122 in March.

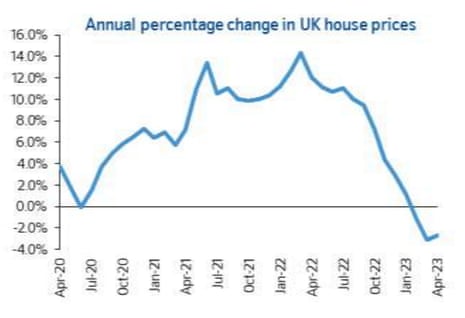

This has lifted the annual rate of house price growth to -2.7%, from -3.1% in March (the biggest fall since 2009), as calm returned to the markets after the chaos of last autumn’s min-budget.

Robert Gardner, Nationwide’s chief economist, reports there were “tentative signs of a recovery” in the market last month, although this still leaves prices 4% below their August 2022 peak.

Gardner explains:

“Recent Bank of England data suggests that housing market activity remained subdued in the opening months of 2023, with the number of mortgages approved for house purchase in February nearly 40% below the level prevailing a year ago, and around a third lower than pre-pandemic levels.

However, in recent months industry data on mortgage applications point to signs of a pickup.

Last month, Rightmove reported that asking prices were at record levels:

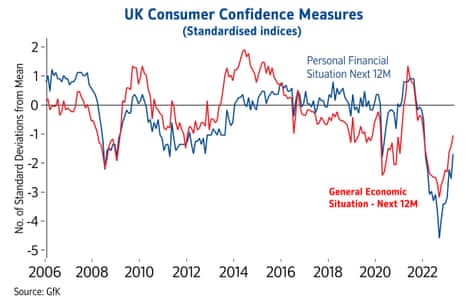

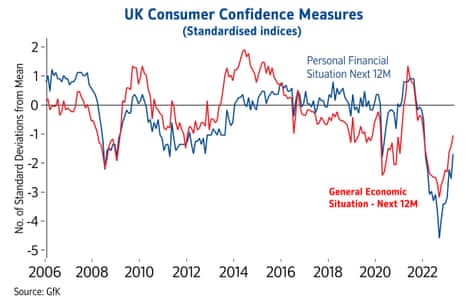

Gardner says the recent pick-up in UK consumer confidence may be helping the housing market, but cautions that….

….any upturn is likely to remain fairly pedestrian, as it will take time for household finances to recover, since average earnings have been failing to keep pace with inflation, and by a wide margin over the last few years.

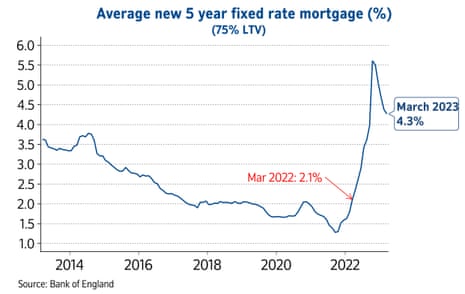

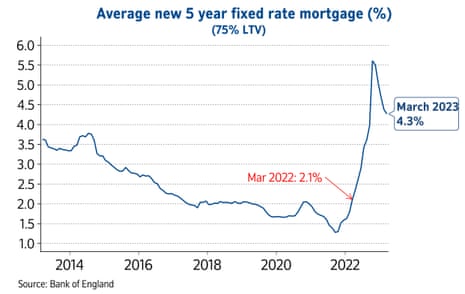

Mortgage interest rates are also likely to act as a headwind. While they are well below the highs seen in the wake of the mini-Budget last year, rates are still more than double the level prevailing a year ago.

Also coming up today

Britain’s biggest supermarkets are facing calls for the UK’s competition watchdog to investigate claims of profiteering amid the cost of living crisis, as food price inflation soared to a record high in April.

Overnight, Australia’s central bank has surprised investors by raising interest rates again.

The RBA board raised its cash rate 25 basis points to 3.85% at its monthly meeting on Tuesday, defying investors who had bet the central bank would extend its pause for a second month.

Higher interest rates lift profits at banks….. such as HSBC, which has reported a three-fold jump in earnings in the last quarter, On a constant currency basis, HSBC’s profit before tax increased by $9.0bn to $12.9bn, leading the bank to launch up to $2bn of share buybacks and a 10 cent-per-share dividend.

BP has defied an easing in energy prices to post one of the largest first-quarter profits in its history, reigniting a debate over windfall gains by oil and gas firms.

The energy giant said its underlying profits hit $5bn (£4bn) in the first three months of the year, outstripping analysts’ forecasts. More on this shortly…

The latest factory PMI reports will show how manufacturers in the UK and the eurozone fared in April. That follows a surprise contraction in China’s factory output, reported on Sunday.

We get the latest eurozone inflation report this morning, with prices expected to have risen by 7% in the 12 months to April, up from 6.9%. Core inflation could stick at 5.7%, worryingly high for the European Central Bank.

The agenda

-

7am BST: Nationwide house price index for April

-

9am BST: Eurozone manufacturing PMI for April

-

9.30am BST: UK manufacturing PMI for April

-

10am BST: Eurozone core inflation rate on April

-

3pm BST: US Factory Orders for March

Key events

European financial markets have made a subdued start to the new month.

The FTSE 100 index was slightly higher in early trading, led by rallying housebuilders (see earlier post), and HSBC (up 4.3% after announcing a share buyback following a jump in profits).

UK interest rates could rise up to 4.75% this year, economist predicts

The surprise rise in UK house prices in April is reigniting interest in how high the Bank of England may raise interest rates this year.

Professor Costas Milas, of the Management School at University of Liverpool, argues that the BoE could lift interest rates to 4.75% this year.

In a new blogpost, Professor Milas explains that high public expectations of inflation have the potential of putting additional pressure on current inflation through demand for higher wages.

But this prediction is conditional on financial stress not escalating further. If, instead, financial stress worries take over, UK interest rates might end up below 4% by the end of 2023, he suggests.

Professor Milas says:

In fact, there is growing expectation that the Chancellor of the Exchequer will increase the level for guaranteed UK deposits, from £85,000 currently. This suggests to me that UK regulators are somewhat worried that we have not fully escaped the risk of a financial/banking crisis.

Therefore, I do not rule out the possibility that the BoE will cut UK interest rates below 4 per cent by the end of the year.

JPMorgan’s move (over the weekend) to acquire most of failed US bank First Republic is a (constant) reminder that financial stress is not over.

The full blogpost is here:

Housebuilder shares rally

Shares in UK housebuilders have jumped this morning, after Nationwide reported an unexpected increase in UK house prices last month.

Persimmon are up 5.8% in early trading, with Barratt Development (+2.5%) and Taylor Wimpey (+2.5%) and Berkeley Group (+2%) also in the top FTSE 100 risers.

BP’s ‘heinous’ profits of almost $5bn (£4bn) in the last quarter show the need for a permanent ‘polluters tax’, says Global Justice Now, the campaign group:

“Today’s heinous profits from BP are another kick in the teeth to the millions of people who can’t afford to heat their homes.

BP has also quietly lowered its already weak climate targets, leaving us all to suffer even more from their climate damages whilst they line their pockets in a cost-of-living crisis.

We need a permanent polluters tax on big oil to account for this rampant profiteering and their continuing unabashed role in the climate crisis.”

Here’s our news story on BP’s profits:

BP shares fall 4.5% despite bumper profits

In the City, shares in BP have dropped by 4.5% in early trading despite the oil giant reporting bumper profits of aroudn $5bn for the last quarter.

BP made $4.963bn on its favoured profit measure in January-March, up from $4.8bn in October-December 2022, but lower than the $6.245bn in Q1 2022 when the Ukraine war drove up prices.

That was ahead of expectations for $4.3bn, and BP’s second-best result since 2012 thanks to strong oil and gas trading.

Bernard Looney, BP’s chief executive officer, says Q1 was “a quarter of strong performance and strategic delivery”, adding:

And importantly we continue to deliver for shareholders, through disciplined investment, lowering net debt and growing distributions.

But investors, somewhat ungratefully, seem disappointed that BP has cut its share buyback programme. The company plans to spend another $1.75bn buying up its stock, lower than the $2.75bn share buyback announced after the last quarter of 2022.

Share buybacks are a way of funnelling cash to investors; Joseph Evans, researcher at IPPR, argues they should be taxed in the UK:

“BP continues to profit from the cost-of-living crisis. While some UK households spent the winter facing the bleak choice between heating or eating, BP continued to exploit geopolitical fallout from war in Ukraine – driving up prices and profits.

“Instead of using these profits to invest in net-zero or reduce costs for consumers, BP is transferring an outrageous sum of wealth from ordinary households to their investors. The USA and Canada have already taken action on excessive shareholder payouts: it’s long overdue for the government to follow suit by introducing a tax on share buyback schemes.”

BP has just announced profits of £4 billion for the last quarter + a new round of share buybacks, transferring £1.4 billion ($1.75 billion) to shareholders.@evansjoseph_ says BP are “driving up prices and profits” at the expense of households. pic.twitter.com/w2pCWxRZEx

— IPPR (@IPPR) May 2, 2023

UK housing market ‘may have troughed’, but affordability still very challenging

Today’s Nationwide house price data is another sign that weakness in the housing market “may have troughed”, reports Martin Beck, chief economic advisor to the EY ITEM Club.

Beck says:

“One month does not make a trend and, given the degree of volatility in house price measures, April’s rise in the Nationwide gauge could prove short-lived. But it’s consistent with other signs that weakness in the market may have bottomed out. The Halifax measure of prices rose in each of the first three months of 2023. While mortgage approvals were still very low in February, they increased for the first time since last summer.

And survey evidence on new buyer interest and the availability of homes for sale has recently shown signs of life. On top of that, the economy may be turning a corner, aided by falling energy prices, with job creation continuing at a solid pace and consumer confidence recovering.

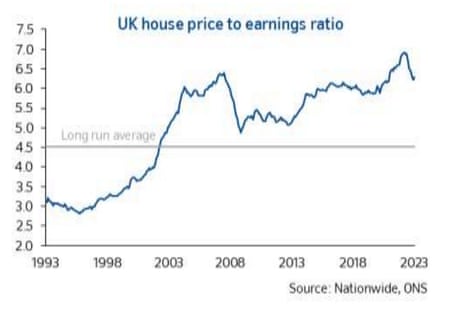

But, house prices remain very high on most measures of affordability, Beck points out:

Mortgage rates have seen a significant rise over the last year, with the average rate on a new mortgage increasing to 4.26% in February from 1.60% 12 months earlier. Borrowing costs could increase further if, as the EY ITEM Club expects, the Bank of England raises interest rates again this month.

And while the prospect of rapidly falling inflation should reduce financial strains facing households, real incomes are likely to still fall over most of this year. Therefore, the risk of a sustained correction in house prices hasn’t gone away.”

Hopes that the Bank of England may soon stop raising interest rates are supporting demand for home purchases, reports Victoria Scholar, head of investment at interactive investor:

Over the past eight months, the housing market has been attempting to regain a sense of normality after the chaos around September’s mini budget which sent mortgage rates soaring and potential homeowners fleeing from the market.

With mortgage rates since easing, the Bank of England near the peak of the rate hiking cycle, consumer sentiment improving, and inflation seen easing this year, mortgage applications have started to pick up again with buyers cautiously coming back.

Spring tends to be a seasonally busy period for housing market activity as the improved weather brightens demand and draws in more sellers ahead of the summer holiday lull.”

The BoE is widely expected to lift Bank Rate again this month, from 4.25% to 4.5%, with rates seen approaching 5% before the end of this year. But they are then forecast to drop in 2024.

April breaks 7 consecutive months of house price falls with a 0.5% subdued “spring” in its step. Despite this house price growth remains negative at -2.7% in April, leaving prices 4% below their Aug 22 peak @AskNationwide pic.twitter.com/FXtV7pBRxM

— Emma Fildes (@emmafildes) May 2, 2023

Matt Thompson, head of sales at Chestertons, reports that April was a busy month.

“Savvy house hunters used the Easter holidays to continue their search online and enquire about properties to arrange a viewing as soon as possible. April has therefore been a busy month; particularly as buyers are a lot more aware of today’s competitive market conditions.

As a result, most buyers have also been preparing their paperwork as much as they could in order to make an offer and secure a property before the summer.”

‘Reverberations from the mini-Budget are fading’

April’s rise in UK house prices shows that the reverberations from the mini-Budget that shook the UK property market are fading, says Tom Bill, head of UK residential research at Knight Frank:

Price declines are bottoming out and many buyers have accepted the new normal for mortgage rates as stability returns to the lending market.

Boosted by savings accumulated during the pandemic, record levels of housing equity and a strong jobs market, activity has been solid without being spectacular this year. Supply is rising, which will increase downwards pressure on prices but the market is returning to earth rather than falling off a cliff. Properties that tick all the right boxes will hold their value but some of the pandemic froth has disappeared so asking prices will come under pressure.

Bill predicts that after a general election, successive lockdowns, a stamp duty holiday and the mini-Budget, the UK housing market should have its most predictable year since 2018.

However, we don’t expect widespread standoffs over price because of lingering economic uncertainty and a growing realisation that next year’s general election may shake things up again. Switched-on buyers and sellers are acting now while things are relatively uneventful.”

UK house prices: the key charts

Here are the key charts from Nationwide’s house price report, showing the first monthly rise in prices since last August.

Introduction: UK house prices rise in April after seven consecutive falls

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

UK house price growth picked up in April, building society Nationwide reports this morning, with the first monthly increase in seven month.

Average house prices rose by 0.5% last month, Nationwide’s data shows, following seven consecutive falls going back to last September.

The average price increased to £260,441, up from £257,122 in March.

This has lifted the annual rate of house price growth to -2.7%, from -3.1% in March (the biggest fall since 2009), as calm returned to the markets after the chaos of last autumn’s min-budget.

Robert Gardner, Nationwide’s chief economist, reports there were “tentative signs of a recovery” in the market last month, although this still leaves prices 4% below their August 2022 peak.

Gardner explains:

“Recent Bank of England data suggests that housing market activity remained subdued in the opening months of 2023, with the number of mortgages approved for house purchase in February nearly 40% below the level prevailing a year ago, and around a third lower than pre-pandemic levels.

However, in recent months industry data on mortgage applications point to signs of a pickup.

Last month, Rightmove reported that asking prices were at record levels:

Gardner says the recent pick-up in UK consumer confidence may be helping the housing market, but cautions that….

….any upturn is likely to remain fairly pedestrian, as it will take time for household finances to recover, since average earnings have been failing to keep pace with inflation, and by a wide margin over the last few years.

Mortgage interest rates are also likely to act as a headwind. While they are well below the highs seen in the wake of the mini-Budget last year, rates are still more than double the level prevailing a year ago.

Also coming up today

Britain’s biggest supermarkets are facing calls for the UK’s competition watchdog to investigate claims of profiteering amid the cost of living crisis, as food price inflation soared to a record high in April.

Overnight, Australia’s central bank has surprised investors by raising interest rates again.

The RBA board raised its cash rate 25 basis points to 3.85% at its monthly meeting on Tuesday, defying investors who had bet the central bank would extend its pause for a second month.

Higher interest rates lift profits at banks….. such as HSBC, which has reported a three-fold jump in earnings in the last quarter, On a constant currency basis, HSBC’s profit before tax increased by $9.0bn to $12.9bn, leading the bank to launch up to $2bn of share buybacks and a 10 cent-per-share dividend.

BP has defied an easing in energy prices to post one of the largest first-quarter profits in its history, reigniting a debate over windfall gains by oil and gas firms.

The energy giant said its underlying profits hit $5bn (£4bn) in the first three months of the year, outstripping analysts’ forecasts. More on this shortly…

The latest factory PMI reports will show how manufacturers in the UK and the eurozone fared in April. That follows a surprise contraction in China’s factory output, reported on Sunday.

We get the latest eurozone inflation report this morning, with prices expected to have risen by 7% in the 12 months to April, up from 6.9%. Core inflation could stick at 5.7%, worryingly high for the European Central Bank.

The agenda

-

7am BST: Nationwide house price index for April

-

9am BST: Eurozone manufacturing PMI for April

-

9.30am BST: UK manufacturing PMI for April

-

10am BST: Eurozone core inflation rate on April

-

3pm BST: US Factory Orders for March

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here