Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

UK house prices have posted their strongest year since 2006, thanks to high demand, the stamp duty tax break, and a shortage of homes on the market.

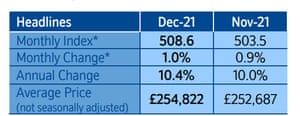

Lender Nationwide has reported that annual house price growth increased to 10.4% in December, up from 10.0% in November. That’s the fastest growth in a calendar year since 2006.

Prices jumped by 1% in December. The price of a typical UK home has now hit £254,822 for the first time on Nationwide’s index. That’s an increase of nearly £24,000 over the year; the largest rise seen in a single year, in cash terms.

Prices are now 16% higher than before the pandemic struck in early 2020, says Robert Gardner, Nationwide’s chief economist.

“Demand has remained strong in recent months, despite the end of the stamp duty holiday at the end of September.

Mortgage approvals for house purchase have continued to run above pre-pandemic levels, despite the surge in activity seen earlier in the year. Indeed, in the first 11 months of 2021 the total number of property transactions was almost 30% higher than over the same period of 2019.

At the same time, the stock of homes on the market has remained extremely low throughout the year, which has contributed to the robust pace of price growth.

Separate data from Halifax overnight has shown that the “race for space” between homebuyers has pushed up prices in some UK towns by about a fifth this year, with Taunton topping a list of areas with the biggest increases.

Also coming up today

European stock markets are set for a subdued start, as the surge in Omicron cases weighs on investors’ minds.

IGSquawk

(@IGSquawk)European Opening Calls:#FTSE 7412 -0.11%#DAX 15842 -0.07%#CAC 7161 0.00%#AEX 797 +0.14%#MIB 27353 +0.03%#IBEX 8668 -0.07%#OMX 2420 +0.06%#SMI 12932 +0.04%#STOXX 4289 +0.09%#IGOpeningCall

Yesterday, the UK’s FTSE 100 hit a 22-month high, finally returning to its levels before the crash in February 2020 as trading resumed after the Christmas break.

On Wall Street, the S&P 500 index hit its 70th record close of 2021, as the traditional Santa Rally lifted stocks.

Naeem Aslam of Avatrade says:

Futures in the United States are trading flat, while those in Europe are down, and major stock market indices are on track to end the year on a high note. Investors are pleased that Santa Claus blessed the markets this year, allowing the Dow and S&P 500 to close yesterday’s session at all-time highs.

Overall, investors are overjoyed that we are ending 2021 on a high note after a brutal 2020. Although the appearance of the Omicron variant initially alarmed investors, the situation is now likely under control thanks to breakthrough COVID-19 vaccinations and a better understanding of the virus.

However, the Federal Reserve’s aggressive tapering of quantitative easing measures to keep inflation in check could be a major factor driving volatility in stock markets in 2022.

The final US weekly jobless claims data of 2021 will show the health of America’s labour market.

The agenda

- 7am GMT: Nationwide house price index for December

- 8am GMT: Spanish inflation data for December

- 1.30pm GMT: US weekly jobless data

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here