UK manufacturing loses more steam as output growth grinds to near-halt

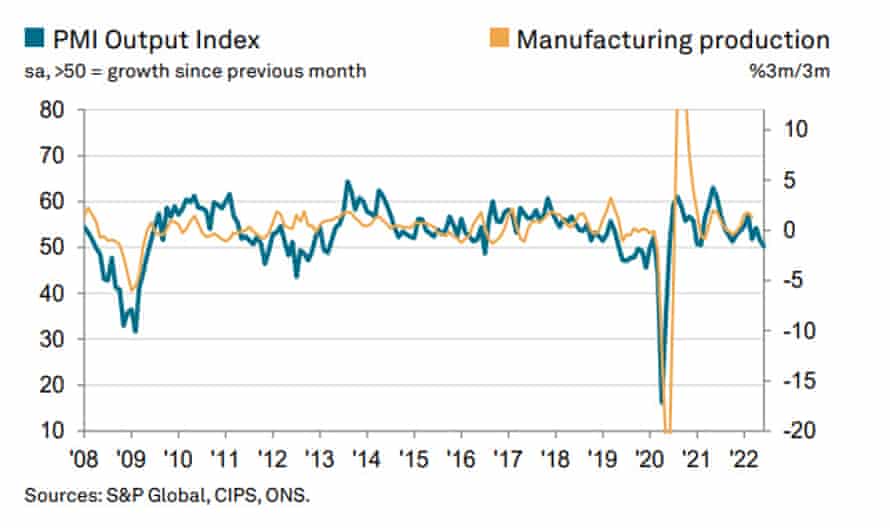

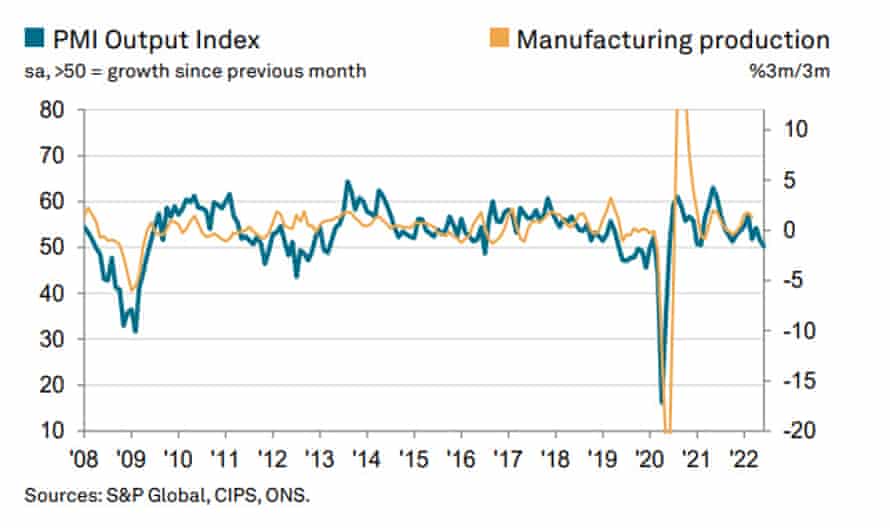

Output growth at UK manufacturers ground to a near standstill in June, the latest sign that the economy is slowing as consumers cut back.

The closely-watched S&P Global / CIPS UK Manufacturing PMI report has also found that business optimism hit a two-year low last month.

Activity rose at the slowest pace in two years, as new orders fell for the first time since January 2021.

And the consumer goods sector was especially hard hit, as household demand suffered a steep retrenchment on the back of the cost-of-living crisis.

???????? Growth in the UK’s manufacturing sector slowed in June with the #PMI at a 2-year low of 52.8 (May: 54.6). Weaker economic outlook, the war in Ukraine and raw material shortages led to a reduction in demand. Read more: https://t.co/MxsAa9RScr pic.twitter.com/AVAw3zeLTm

— S&P Global PMI™ (@SPGlobalPMI) July 1, 2022

The healthcheck on UK factories found that:

- Output growth slows to near-stagnation pace…

- …as new order intakes fall for the first time since January 2021

- Price inflation remains elevated despite further easing

Companies blamed the fall in new business on a range of problems — including the weaker economic outlook, reduced new export order intakes, slower growth of domestic demand, the war in Ukraine, raw material shortages and the slowdown in China.

New export orders contracted for the fifth month running in June — with some firms saying ongoing Brexit-related difficulties and weaker growth had hit orders from the EU.

This pulled the manufacturing PMI down to 52.8 from 54.6 in May. That’s worse than the preliminary “flash” reading of 53.4 taken during June, and nearer the 50-point mark showing stagnation.

Rob Dobson, director at S&P Global Market Intelligence, said:

Domestic market conditions became increasingly difficult and foreign demand fell sharply again, stifled by Brexit, transport disruption, the war in Ukraine and a global economic slowdown.

Business confidence took a hit as a result, dipping to its gloomiest since mid-2020. Jobs growth also slowed sharply amid the increasingly uncertain outlook and recent surge in energy costs.

Dobson warns that economic conditions may worsen:

“There were some welcome signs that supply-chain constraints and cost inflationary pressures may have passed their peaks. However, with these constraints still elevated overall and demand headwinds rising, it is likely that UK manufacturing will see the economic backdrop darken further in the second half of the year.”

Supermarket fuel retailers have stopped cutting pump prices to encourage customers into their stores, motorists have been warned, after petrol and diesel hit new highs yesterday (see earlier post).

RAC fuel spokesman Simon Williams said the rise in the price of petrol to 191.4p illustrates “the biggest retailers’ resistance to reduce their pump prices in line with the lower wholesale cost of unleaded”.

“Rather than passing on some of the savings they are benefiting from, they are clearly banking on the wholesale market moving up again which is disappointing for drivers who are desperate to see an end to ever-rising prices.

“Sadly, there no longer seems to be any appetite among the big four supermarkets to drive customers into their stores with lower pump prices.

“We question whether we will ever see much competition between supermarkets over fuel again, let alone a so-called ‘price war’.”

The planned sale of the Kohl’s department store chain is off, as volatile markets sink another deal.

Kohl’s entered exclusive talks early this month with Franchise Group, the owner of Vitamin Shop and other retail outlets, on a deal worth about $8bn.

But with stock prices still under pressure, inflation rising, and consumer confidence weak, negotiations are off.

“Given the environment and market volatility, the Board determined that it simply was not prudent to continue pursuing a deal,” said Kohl’s Chairman Pete Boneparth.

Despite a concerted effort on both sides, the current financing and retail environment created significant obstacles to reaching an acceptable and fully executable agreement.”

Americans have grown more cautious with their spending with repeated economic signals that suggest the economy is slowing.

Shares of Kohl’s, based in Wisconsin, have fallen over 18% in premarket trading.

Earlier this week Walgreens Boots Alliance abandoned a sale of Britain’s biggest chemist, Boots, blaming global financial market conditions which meant potential buyers were struggling to fund an acceptable offer.

UK consumers borrow more, save less, amid squeeze

Financially squeezed households deposited less money into accounts in May than in April, the latest Bank of England data shows.

Around £5.7bn was saved in banks, building societies and NS&I accounts in May, down from a net flow of £6.3bn in April.

With inflation at 40-year highs, and food and energy bills soaring, households have been left with less spare cash to save (unlike during lockdowns, when forced saving jumped)

Consumers also borrowed an additional £800m in consumer credit last month, including £400m more on credit cards.

That’s below the pre-pandemic level, and also less than economists expected. Consumer credit often rises during good economic times, as people are confident they can borrow more.

But it can also be a sign that households are struggling, needing to put essential purchases on credit.

Poland’s manufacturing sector suffered a sharp fall in output last month.

High inflation and ongoing geopolitical turbulence led to a noticeable drop off in new orders, leading to a sharp contraction in production.

Jobs were cut, whilst business confidence sank to its lowest level since the height of the first Covid-19 pandemic wave in 2020, the latest survey of purchasing managers shows.

Poland’s manufacturing PMI dropped to 44.4 in June, a level only previously seen during the global financial crisis and the pandemic… (1/4) pic.twitter.com/StDVMeG7dz

— S&P Global PMI™ (@SPGlobalPMI) July 1, 2022

…manufacturers are reporting that the war in Ukraine and high inflation is eroding purchasing power, but the loss of momentum in June was startling…(2/4) pic.twitter.com/UN1u2OWxZf

— S&P Global PMI™ (@SPGlobalPMI) July 1, 2022

…although, despite remaining elevated, there are signs that supply-chain inflation is dissipating…(3/4)

— S&P Global PMI™ (@SPGlobalPMI) July 1, 2022

July hasn’t brought much cheer to the markets, with factory growth slowing, and inflation soaring.

After a choppy morning, the FTSE 100 index is down 0.3% or 20 points at 7,148 points.

The pan-European Stoxx 600 has lost 0.5%, after Asia-Pacific markets were pulled down by disappointing factory growth data.

A market indicator measuring how investors are positioned held at “extremely bearish” levels for a third consecutive week, as investors pulled more cash out of equities and bonds, BoFA Securities said in a weekly note

Outflows from European equity funds extended into its twentieth week, while emerging market debt has now seen outflows for the past 12 weeks, BoFA said citing EPFR data.

In a sign that inflationary expectations have not yet peaked, inflows into inflation-adjusted bond funds saw their biggest inflows in 12 weeks.

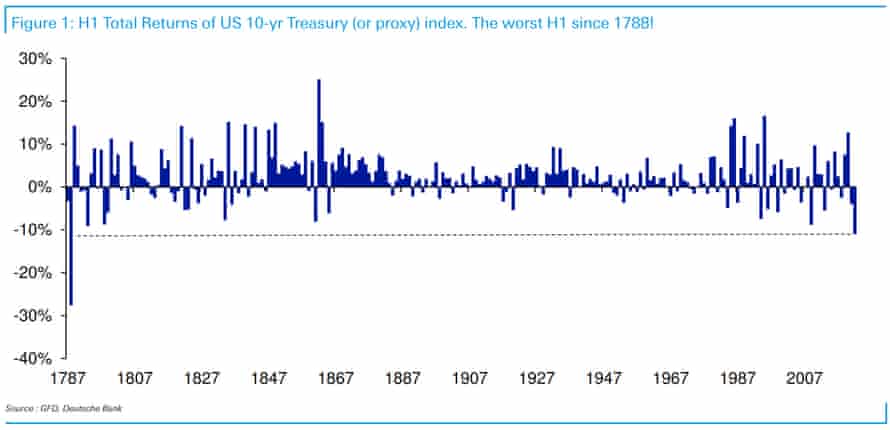

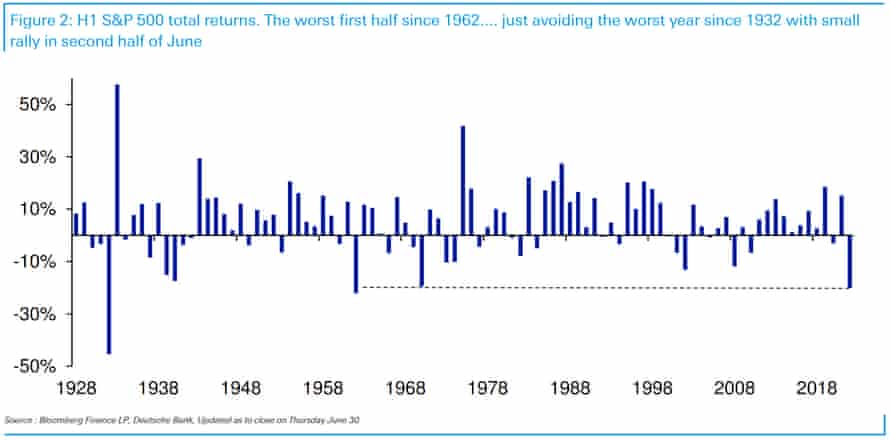

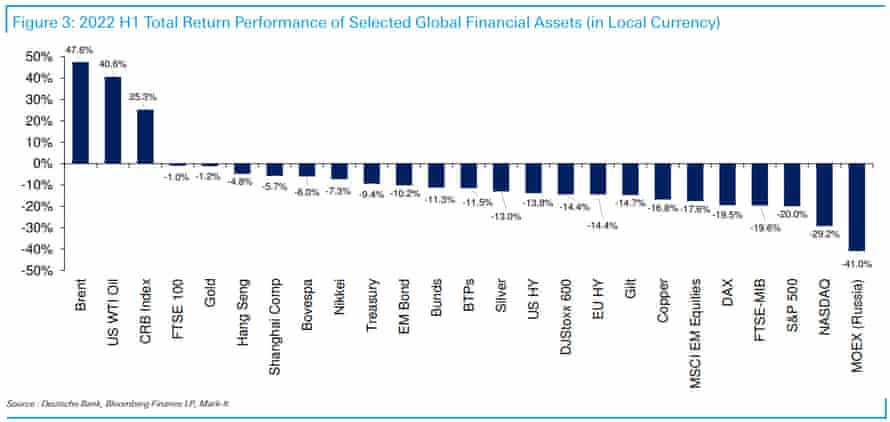

Jim Reid of Deutsche Bank has kindly sent round two charts showing just how badly US shares and government bonds, fared in the first half of the year.

They show that US 10 year Treasuries (normally a solid safe-haven asset) had their worst first-half to a year since 1788, in spite of a sizeable late June rally,

Secondly, the S&P 500 index of US stocks saw the worst H1 total return since 1962 after a rally last week just pulled it back from being the worst since 1932.

Reid’s team have had a ‘deluge of reguests’ for these charts (perhaps because asset managers are keen to show they weren’t the only ones having a bad time?):

I’ve found through my career that these type of charts are always the most demanded as investors want to put their performance in context.

Petrol and diesel prices rise again

UK petrol and diesel prices have hit record highs again, as June ended with more pain at the pumps.

The average price of a litre of unleaded rose to 191.43p on Thursday, up from Wednesday’s record of 191.25p, Experian Catalyst data shows.

Diesel headed towards the £2/litre mark for the first time, at 199.05p

June was a month of regular price hikes which show no signs of offering relief heading into the weekend, warns the AA.

Jack Cousens, head of roads policy at the AA, urges drivers not to abuse staff at petrol stations, where it now costs over £105 to fill a 55-litre family car:

“With Wimbledon well underway, drivers may be forgiven for borrowing the iconic rant from John McEnroe as they pull up to the pump – YOU CANNOT BE SERIOUS?!

“However, with some reports of aggressive behaviour towards forecourt staff we urge people to channel the zen-like mentality of Roger Federer when refuelling and not abuse staff. It is not their fault which is why the AA is directly challenging the government, retailers and the CMA to find a quick and effective solution.

“The wholesale price of fuel continues to fall, yet drivers and businesses are seeing the price go in the opposite direction. Some drivers are now making two payments per tank as self-service pumps cut out at £99.

“A potential ‘substantial’ cut in fuel duty, which we called for weeks ago, cannot come soon enough. While the retailers keep lobbing the price up, the rest of the nation is desperate to see the price smashed.”

The UK’s summer of strike action continues, with hundreds of bus drivers and other workers agreeing to stage industrial action in a row over pay from Monday.

Members of Unite employed by Stagecoach in Merseyside will walk out on July 4, 15, 18, 20, 22, 25, 28 and 29.

Matt Davies, managing director at Stagecoach Merseyside, said the company had made a ‘substantial’ pay offer:

“Bus users will be angered that the bus services that they depend on to access work, education, the high street, and keep in touch with their families are being deliberately targeted by the union in this way.

“The fact is that even in these difficult times, we have offered a substantial pay increase of more than 10% to our employees that would make them the highest paid bus drivers in Merseyside from July.

But Unite general secretary Sharon Graham said its members deserved a decent wage:

“Stagecoach makes money hand over fist. Our members are making it abundantly clear that they will not accept being underpaid by this wealthy company any longer.

“Stagecoach can easily afford to pay its workers a decent wage but its repeated refusal to do so is why these strikes will go ahead.

Eurozone inflation at record: What the experts say

It may be a difficult day in the office for ECB policymakers after inflation soared to 8.6%, more than four times the 2% target, says Alastair George, chief investment strategist at Edison Group:

But low-income consumers face even more diffulties, given 40% increases in energy prices, George adds:

We believe the ECB faces an unenviable task. The supply shock in terms of energy is enormous and likely to worsen as winter approaches and Russia uses energy supplies as a political weapon.

This is putting massive pressure on the eurozone consumer and economic momentum is weakening with PMI indices for new orders already indicating contraction.

In hindsight, the ECB is likely to be seen as hiking rates into a recession.

Fawad Razaqzada, market analyst at City Index and FOREX.com, says stagflation is the key risk facing the Eurozone:

This means the euro is going struggle to shine much even as the ECB has paved the way for aggressive 75 basis point rate hikes in July and September.

Additionally, the fact that inflation has been diverging across the eurozone means the ECB will have a tough time with its anti-fragmentation tool and may make a bigger mess out of the whole situation.

Pushpin Singh, economist at the CEBR, says there will be “significant knock-on effects on the Eurozone economy” if the ECB starts raising interest rates in July, amid the energy crisis.

This comes amid a mounting possibility of a severe gas crisis in Europe, with Russia using gas exports as a means to counter sanctions against it.

Consequently, gas shortages have led to Germany and the Netherlands triggering their own emergency plans to moderate gas usage and supply.

It is likely that if a gas shortage hits the currency bloc, economies will seek to close off supplies to industry first, thereby heralding a drop-off in output in sectors such as manufacturing. In turn, this could result in a reduction in aggregate economic activity and bring recessionary pressures.

At 8.6%, eurozone CPI has now matched the US’s record inflation rate in May.

But while the Federal Reserve has already raised interest rates three times this year, the ECB has signalled that its first rise will come this month.

June’s accelerated inflation could raise the case for the ECB to kick off with a 50-basis point rise, rather than a ‘typical’ 25bp increase.

But the UK is still suffering higher inflation, at 9.1% in May.

And earlier this week, the governor of the Bank of England warned Britons should expect to suffer a more severe bout of inflation than other major economies.

No escaping the big picture that inflation is a global phenomenon. France, and now Germany, are the one countries where governments, not central banks, managed to lower inflation pressures temporarily. pic.twitter.com/0mjVvvHLsl

— Frederik Ducrozet (@fwred) July 1, 2022

Core inflation across the eurozone was broadly stable at 3.7% — if you strip out volatile (but essential!) factors such as energy and food, plus alcohol and tobacco.

???????? Good news: euro area core HICP inflation surprised to the downside for the first time this year.

Bad news: this was due to government measures in Germany, and offset by upside surprises in other countries on the back of energy and reopening boost. pic.twitter.com/IQI97b27g3— Frederik Ducrozet (@fwred) July 1, 2022

That’s almost twice the ECB’s target, but lower than in the US or the UK….

Core inflation (stripping out energy/ food) gives a measure of how much inflation is in domestic system – Bank of England questioning why it was notably larger here than US and €zone at latest rate decision.

Latest figures for May:

????????€area: 3.8%

????????US PCE: 4.7%

????????UK core: 5.9% pic.twitter.com/qjj4xI60Jb— Faisal Islam (@faisalislam) July 1, 2022

Eurozone inflation hits record 8.6%

Eurozone inflation has hit yet another record high, as Europe’s cost of living crisis deepened.

Consumer prices surged by 8.6% in the year to June, data body Eurostat estimates, accelerating from the 8.1% inflation recorded in May, and higher than forecast.

This latest surge increasing the pressure on the European Central Bank to start raising interest rates from record lows this month.

NEW: Eurozone reports annual inflation of 8.6% in the month of June, a record high.

— Alex Salvi (@alexsalvinews) July 1, 2022

The increase was driven primarily by energy prices, but food, goods, and services costs also kept rising.

Energy is expected to have the highest annual rate in June (41.9%, up from 39.1% in May), followed by food, alcohol & tobacco (8.9%, up from 7.5%), non-energy industrial goods (4.3%, up from 4.2%) and services (3.4%, down from 3.5% in May).

Inflation has risen steadily for more than a year now, initially fuelled by post-pandemic supply shocks and now by energy prices on the fallout of Russia’s war on Ukraine.

It’s now four times as high as the ECB’s target.

OOPS! Eurozone #inflation surged to 8.6% in June form 8.1% in May, a fresh record, surpassing expectations of 8.5% & bolstering calls for an aggressive ECB hike. Data reflect an escalating squeeze on households across Eurozone, where France, Italy & Spain reported new ATH this wk pic.twitter.com/Cfhj5QRK4M

— Holger Zschaepitz (@Schuldensuehner) July 1, 2022

Brexit trade frictions added to UK factory woes in June, says Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply:

New order levels fell for the first time since January 2021 and interest particularly from export markets faded away for the fifth month in a row.

Supply chain managers reported that ports and paperwork were their undoing in June with Brexit a thorn in the side of manufacturers combined with weaker domestic demand, inefficient performance in supply chains and an overall shaky UK economy.

The consumer goods sector took the brunt of the shortfall overall as the mounting cost of living crisis affected spend for manufactured goods. One bright spot remained job creation as businesses played catch-up after lockdowns and disruptions but hires will soon reach peak levels without a steady pipeline of work to keep the machines turning.

UK manufacturing loses more steam as output growth grinds to near-halt

Output growth at UK manufacturers ground to a near standstill in June, the latest sign that the economy is slowing as consumers cut back.

The closely-watched S&P Global / CIPS UK Manufacturing PMI report has also found that business optimism hit a two-year low last month.

Activity rose at the slowest pace in two years, as new orders fell for the first time since January 2021.

And the consumer goods sector was especially hard hit, as household demand suffered a steep retrenchment on the back of the cost-of-living crisis.

???????? Growth in the UK’s manufacturing sector slowed in June with the #PMI at a 2-year low of 52.8 (May: 54.6). Weaker economic outlook, the war in Ukraine and raw material shortages led to a reduction in demand. Read more: https://t.co/MxsAa9RScr pic.twitter.com/AVAw3zeLTm

— S&P Global PMI™ (@SPGlobalPMI) July 1, 2022

The healthcheck on UK factories found that:

- Output growth slows to near-stagnation pace…

- …as new order intakes fall for the first time since January 2021

- Price inflation remains elevated despite further easing

Companies blamed the fall in new business on a range of problems — including the weaker economic outlook, reduced new export order intakes, slower growth of domestic demand, the war in Ukraine, raw material shortages and the slowdown in China.

New export orders contracted for the fifth month running in June — with some firms saying ongoing Brexit-related difficulties and weaker growth had hit orders from the EU.

This pulled the manufacturing PMI down to 52.8 from 54.6 in May. That’s worse than the preliminary “flash” reading of 53.4 taken during June, and nearer the 50-point mark showing stagnation.

Rob Dobson, director at S&P Global Market Intelligence, said:

Domestic market conditions became increasingly difficult and foreign demand fell sharply again, stifled by Brexit, transport disruption, the war in Ukraine and a global economic slowdown.

Business confidence took a hit as a result, dipping to its gloomiest since mid-2020. Jobs growth also slowed sharply amid the increasingly uncertain outlook and recent surge in energy costs.

Dobson warns that economic conditions may worsen:

“There were some welcome signs that supply-chain constraints and cost inflationary pressures may have passed their peaks. However, with these constraints still elevated overall and demand headwinds rising, it is likely that UK manufacturing will see the economic backdrop darken further in the second half of the year.”

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here