Introduction: Treasury to announce reduced energy support scheme for businesses

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

New measures to help UK firms cope with soaring energy bills are expected to finally be announced today, but the support is likely to be less generous than the current package.

The new package is due to be announced to MPs today, ahead of the expiry of the present support package at the end of March.

Since the start of October, the unit cost of electricity and gas for non-domestic customers has been capped to help them through the winter – which is expected to have cost over £18bn by the end of March.

Chancellor Jeremy Hunt warned UK businesses last week that the current level of energy bill support for firms is “unsustainably expensive” – a hint that support will be cut from April.

The new scheme is expected to offer a discount to wholesale costs, rather than a fixed energy price, and heavy energy users could get a larger discount. It is expected to run for 12 months, until March 2024.

As Tony Jordan, a senior partner at consultancy Auxilione, explains:

“There is an acceptance that the structure of the commercial energy market is very, very complex.

Energy suppliers simply do not have the data on which industries their customers are in to tailor the support.”

A decision on how to extend the support for businesses had been due before Christmas, but was postponed until the new year, which left businesses facing “an anxious and uncertain” festive period.

The extent of Hunt’s reduction will also be crucial, as our energy correspondent Alex Lawson explained last weekend:

It has been reported that support could be cut by as much as half, potentially pushing up the “government-supported price” beyond £400 per MWh for electricity and £150 per MWh for gas, he says here.

The good news for businesses is that warmer-than-usual winter weather in northern Europe has helped to pull down wholesale energy costs in recent weeks.

The warmer-than-seasonal weather continues in North West Europe, crushing natural gas demand. For now, forecasts suggest more mild weather ahead.

I have updated the chart showing the mean temperature deviation vs the 30-year average up to Jan 5, including 10-day ahead forecast. pic.twitter.com/Fi9uLoogib

— Javier Blas (@JavierBlas) January 6, 2023

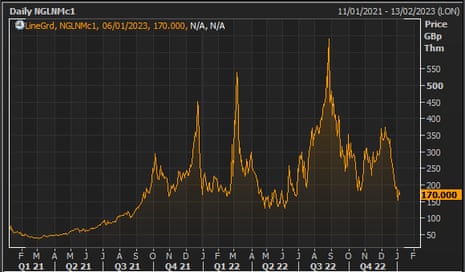

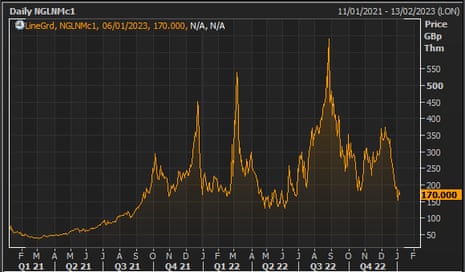

But wholesale gas prices are still over double their levels two years ago, despite dropping back from their highs after the Ukraine invasion last year.

Also coming up today

A leading thinktank has warned that British households are only halfway through a two-year cost of living crisis which will wipe over £2,000 off average incomes.

Typical disposable incomes for working-age family households are on track to fall by 3% in this financial year, and by 4% in the year to April 2024, according to the Resolution Foundation.

Resolution’s annual Living Standards Outlook for 2023 finds that only incomes of the very richest will rise, while middle-income households will struggle to make ends meet after an average £2,100 loss.

This income squeeze has fuelled industrial unrest across the UK in recent months, with strikes on the railways, in the civil service and within the NHS.

Ministers are set to hold a series of meetings with union leaders today. Rail minister Huw Merriman will hold talks with railway union bosses, who insist the Government is blocking a deal to end the long-running row over pay, jobs and conditions.

European stock markets are expected to open higher, as investors cling to hopes that the inflation squeeze may have peaked.

The agenda

Key events

Filters BETA

The government has announced new proposals to secure the future of Britain’s electricity supply, as it tries to meet peak demands and safeguard against the possibility of future blackouts.

It has outlined “significant proposals” to reform Great Britain’s Capacity Market (CM), in which competitive auctions are held to meet the country’s peak electricity needs.

The Department for Business, Energy & Industrial Strategy plans will ensure the Capacity Market is fit for a net zero future, by encouraging green energy, while ensuring the security of the electricity supply.

Energy and Climate Minister Graham Stuart says:

“The plans set out today will deliver this reliable energy and ensure the scheme that sits at the heart of Britain’s energy security is fit for the future.”

BEIS explains that the proposals are:

-

Incentivising greener, flexible technologies to compete in CM auctions by offering multi-year contracts for low carbon flexible capacity, such as smart ‘demand side response’ technologies and smaller-scale electricity storage, supporting the move towards delivering secure, clean and affordable British energy in the long term.

-

Ensuring a clear pathway for carbon intensive forms of capacity as the UK transitions to net zero and the capacity mix of the CM diversifies, by sending a clear signal to oil and gas generators about the timelines and requirements for emissions reduction in the 2030s and seeking evidence on mitigating any barriers this capacity may face in decarbonising.

-

Underpinning these efforts with a proposed new lower emissions limit in the Capacity Market which will kick in for new build plants from 1 October 2034, meaning all new oil and gas plants receiving long term agreements through the CM will be obliged to lower emissions, through decarbonising their capacity by introducing carbon capture, hydrogen and other low carbon methods into their generation and by reducing running hours.

Rolls-Royce Motor Cars hits record annual sales, as ‘bespoke commissions’ rise

Luxury carmarker Rolls-Royce has reported a record year for sales, a sign that the world’s wealthiest have not struggled through the cost of living crisis.

Rolls-Royce Motor Cars reports record 6,021 sales in 2022, an 8% increase on 2021’s record of 5,586, and the first in its 118-year history that annual sales have exceeded 6,000.

The value of “bespoke commissions” – from customers seeking to customise their new car – also hit record levels.

Torsten Müller-Ötvös, CEO of Rolls-Royce Motor Cars, says clients are making ever more imaginative and technically demanding requests, adding:

The unrivalled Bespoke creativity and quality achieved by our team here in Goodwood means that on average, our clients are now happy to pay around half a million Euros for their unique motor car.

Rolls-Royce says demand remains “exceptionally strong”, with advance orders secured far into 2023. It launched its first all-electric car, the Spectre, last year, which would set you back over £300,000.

Over 150 new jobs were created at the Goodwood plant, Müller-Ötvös adds, lifting the workforce to two and a half thousand people.

Rail minister Huw Merriman has arrived at the Department for Transport (DfT) headquarters in central London for today’s meeting with rail unions, PA Media report.

Ahead of those talks, the RMT union say they have exposed the government’s control of the rail dispute and are calling on the transport secretary, Mark Harper, to make a deal.

The RMT say that rather than being a ‘facilitator’ of negotiations between rail companies and the unions, the government that is in “complete control” of the dispute and can put an end to passengers’ misery by unlocking the negotiations.

The RMT have released a briefing document titled ‘The Secretary of State’s control of the National Rail Dispute’, which it says shows that:

-

Train companies have a duty to agree a Mandate for any negotiation with unions on any matter with the Secretary of State;

-

That the Train Companies must stay within this Mandate and cannot vary it without the government’s approval;

-

That the Train Companies must give complete control of any Dispute to the government;

-

Any failure to adhere to these conditions would mean that the companies might lose their indemnification money and have to carry the costs of the dispute themselves.

???? @RMTunion exposes government’s control of rail dispute and calls on Transport secretary to make deal:

Ahead of a meeting today with the Rail Minister, RMT urges government to put an end to passengers’ misery by unlocking the negotiations. ????#SupportRailWorkers #RailStrikes

— RMT (@RMTunion) January 9, 2023

RMT general Secretary, Mick Lynch says the government can end the dispute, by removing conditions “they put in to torpedo a resolution” and allow the companies make a deal.

“Today I want to see the government stop play-acting because the truth, written in black and white in their rail contracts, is that they’ve been in complete control of this dispute from day one.

“The train operators cannot move without government say so.

“Passengers, workers and businesses are suffering and even rail company managers are beginning to break ranks in despair at the government’s approach.

“The Minister cannot hide behind this fairy story that he is just a facilitator.

“His government can end this dispute today by taking out the conditions they put in to torpedo a resolution and let the companies make a deal.”

The briefing published ahead of todays meeting reveals that far from being a ‘facilitator’ of negotiations, it is the government that is in complete control of the dispute

The briefing document titled ‘The Secretary of State’s control of the National Rail Dispute’, shows that: ⬇️ pic.twitter.com/CFrzXunK3i— RMT (@RMTunion) January 9, 2023

The oil price has jumped almost 3% this morning, as China’s reopening is expected to increase demand for energy.

Brent crude has gained over $2 to $80.81 per barrel, recovering some of last week’s losses.

After the Ukraine invasion, Brent hit $130/barrel in March, but has been generally falling since last summer.

Ole Hansen, head of commodity strategy at Saxo, says oil remains volatile amid “China’s chaotic reopening”.

The first week of 2023 was tough for crude oil, driven by global growth concerns, a very mild winter across the Northern Hemisphere dampening demand, and a mixed outlook for China.

Despite removing most virus-related restrictions, a surge in cases across the country has hit the short-term demand outlook while at the same time setting the economy on a path to recovery.

Meanwhile, the IMF warned that a third of the global economy could be in recession in 2023.

FTSE 100 index hits highest since 2019

Energy companies have helped to drive the UK’s major share index to its highest level in over three years.

The blue-chip FTSE 100 index jumped as high as 7723 points in early trading, up 0.3%, led by commodity producers. That’s its highest level since July 2019.

BP and Shell are up around 1.4% this morning, having both rallied over 40% during 2022 due to the surge in oil and gas prices. Mining companies Antofagasta and Glencore have gained 2% this morning.

Stock markets are being lifted by China’s decision to reopen its borders, with quarantine requirements for inbound travellers being lifted. Data last Friday showing a slowdown in pay growth in the US has also cheered investors, as it could lead to a slowdown in interest rate rises.

Victoria Scholar, head of investment at interactive investor, says:

“The FTSE 100 is extending gains this morning having hit a three-year high on Friday. Miners like Antofagasta, Glencore and Anglo American are outperforming, thanks to a rally in China overnight as Beijing continues to ease its covid-era restrictions.

European currencies are also strengthening on the back of a weaker US dollar thanks to a pickup in sentiment towards the US economy. Friday’s December US jobs report outpaced analysts’ expectations while wage growth was below forecasts, sparking a rally on Wall Street, lifting the major averages by more than 2% each with US futures pointing to a higher open at lunchtime.

The CEO of restaurant group Gusto says the company’s energy bill has doubled this year, despite the price cap over the winter.

Matt Snell told Radio 4’s Today programme that Gusto’s energy bill is forecast to be £1.5m this year, up from £750,000 in a typical year.

Snell says:

The support that the government put in place over the last six months has not really touched the sides.

He explains that Gusto, which has 14 sites around the UK, can’t simply adapt to a 100% increase in energy bills, at a time when food and wage costs are up 20%.

And he criticises energy companies for demanding “ridiculous deposits” from business customers to enter into energy contracts. Gusto, he says, had to pay £150,000 just to enter a contract.

He says hospitality firms are looking for a “fair deal” from energy companies, who he says did not help businesses through the crisis.

There is a view in the industry, and I share it, that they’ve profiteered from this.

Snell points out that the price cap announced last autumn did not cover additional costs, such as delivery costs which can push up the cost of gas sharply.

Snell adds that energy regulator Ofgem should get involved to regulate such costs.

UK manufacturers fear blackouts and job losses

Almost two-thirds of manufacturers in Britain fear blackouts this winter amid the fallout from the energy crisis, according to an industry survey.

Trade body MakeUK said the impact from sky-high energy costs on manufacturers showed no sign of abating, as concern grows about government plans to cut financial support for businesses.

According to a survey of more than 200 senior manufacturing industry bosses by MakeUK and the accountancy firm PwC, almost three-quarters of companies (70%) expect their energy costs to increase this year, with two-thirds saying they expect to cut production or jobs as a result.

The industry group, which represents 20,000 UK manufacturers, said that cutting financial support would exacerbate job losses and reduce factory output, hurting the economy.

More here:

Natasha Clark of The Sun has more details of today’s upcoming announcement on energy support for businesss:

New – Jeremy Hunt to reveal another £5bn of energy help for businesses for another year. Will today set out new system for after April.

But will be sharp drop in support, and not tapered down. Some will see cash drop to 60pc of current level. More for energy intensive industry

— Natasha Clark (@NatashaC) January 9, 2023

Firms will receive a discount on each unit of gas and electricity – rather than the current system which sees a set price per unit

Helped by wholesale prices falling

Gov insiders privately feel it won’t be enough and Hunt could have to offer more in future

— Natasha Clark (@NatashaC) January 9, 2023

And long term post 2024 system all yet to be decided depending on how prices go

— Natasha Clark (@NatashaC) January 9, 2023

Introduction: Treasury to announce reduced energy support scheme for businesses

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

New measures to help UK firms cope with soaring energy bills are expected to finally be announced today, but the support is likely to be less generous than the current package.

The new package is due to be announced to MPs today, ahead of the expiry of the present support package at the end of March.

Since the start of October, the unit cost of electricity and gas for non-domestic customers has been capped to help them through the winter – which is expected to have cost over £18bn by the end of March.

Chancellor Jeremy Hunt warned UK businesses last week that the current level of energy bill support for firms is “unsustainably expensive” – a hint that support will be cut from April.

The new scheme is expected to offer a discount to wholesale costs, rather than a fixed energy price, and heavy energy users could get a larger discount. It is expected to run for 12 months, until March 2024.

As Tony Jordan, a senior partner at consultancy Auxilione, explains:

“There is an acceptance that the structure of the commercial energy market is very, very complex.

Energy suppliers simply do not have the data on which industries their customers are in to tailor the support.”

A decision on how to extend the support for businesses had been due before Christmas, but was postponed until the new year, which left businesses facing “an anxious and uncertain” festive period.

The extent of Hunt’s reduction will also be crucial, as our energy correspondent Alex Lawson explained last weekend:

It has been reported that support could be cut by as much as half, potentially pushing up the “government-supported price” beyond £400 per MWh for electricity and £150 per MWh for gas, he says here.

The good news for businesses is that warmer-than-usual winter weather in northern Europe has helped to pull down wholesale energy costs in recent weeks.

The warmer-than-seasonal weather continues in North West Europe, crushing natural gas demand. For now, forecasts suggest more mild weather ahead.

I have updated the chart showing the mean temperature deviation vs the 30-year average up to Jan 5, including 10-day ahead forecast. pic.twitter.com/Fi9uLoogib

— Javier Blas (@JavierBlas) January 6, 2023

But wholesale gas prices are still over double their levels two years ago, despite dropping back from their highs after the Ukraine invasion last year.

Also coming up today

A leading thinktank has warned that British households are only halfway through a two-year cost of living crisis which will wipe over £2,000 off average incomes.

Typical disposable incomes for working-age family households are on track to fall by 3% in this financial year, and by 4% in the year to April 2024, according to the Resolution Foundation.

Resolution’s annual Living Standards Outlook for 2023 finds that only incomes of the very richest will rise, while middle-income households will struggle to make ends meet after an average £2,100 loss.

This income squeeze has fuelled industrial unrest across the UK in recent months, with strikes on the railways, in the civil service and within the NHS.

Ministers are set to hold a series of meetings with union leaders today. Rail minister Huw Merriman will hold talks with railway union bosses, who insist the Government is blocking a deal to end the long-running row over pay, jobs and conditions.

European stock markets are expected to open higher, as investors cling to hopes that the inflation squeeze may have peaked.

The agenda

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here