Representative Image, Courtesy: Emil Kalibradov, Unsplash

The Economic Affairs Department of the Ministry of Finance issued a Gazette notification on 16 May 2023 announcing amendments in the Foreign Exchange Management Act (FEMA) rules. These amendments brings the overseas spending done with the help of Credit Cards under RBI’s Liberalized Remittances Scheme (LRS). This meant that the Credit Card transactions done on Foreign Trips and while buying Goods and Services from Foreign Merchants, these transactions would be liable to tax collected at source (TCS) at applicable rates.

This sent Twitter into frenzy with many users expressing their displeasure on the government’s decision and ‘TCS’ started trending on Twitter. Twitter users claimed that the new tax would add more burden to the middle class, which pay the highest taxes in India. A user shared FAQ section of DCB that says TCS cannot be refunded if the reversal or cancellation has not happened on the same date of transaction.

In this article, we will understand what the new law says and what will be its impact on your pockets.

What Does the New Rules Mean?

The Gazette Notification released on 16 May, Omits the Rule 7 of the Foreign Exchange Management (Current Account Transactions) or FEM (CAT) Rules, 2000. Rule 7 exempted Credit Card transactions made abroad by Indians from LRS. Thus, the new notification removes this exemption.

To understand what it means we must first understand what Liberalized Remittance Scheme (LRS) is. Under LRS, all resident individuals, including minors are allowed to remit up to USD 250000 per financial year (April – March) for any permissible current or capital account transaction or a combination of both.

The government observed that due to above exemption, credit card transactions exceeded the limit of USD 250000 set by LRS. Thus, this move will keep a check on such transactions. Additionally, the government wanted to end differential treatment on overseas payments using Debit Cards/ATM Cards and Credit Cards. Debit Cards were already covered under LRS and now Credit Cards will also be covered thus ending this differential treatment.

The Finance Ministry also clarifies that TCS is not final tax and can be reclaimed by an Individual while filing their Income Tax Return (ITR). The Finance Ministry says, “If the TCS payee is a taxpayer they can claim credit on their TCS as their tax payment against regular income and adjust it against the advance tax, etc. payments accordingly.” For TCS payees who are not taxpayers, the ministry says, “the 20% rate on such presumed income is not high. The tax rate slabs of 20% in the new regime starts for incomes over Rs.12 lacs and 30% for incomes over Rs.15 lacs.”

Consequently, the government’s argument is that if you pay taxes, you are eligible to claim credit for the TCS. However, if you do not pay taxes but spend a significant amount on foreign trips, the government assumes you to be a high net income individual (HNI) and considers the 20% tax to be manageable for you.

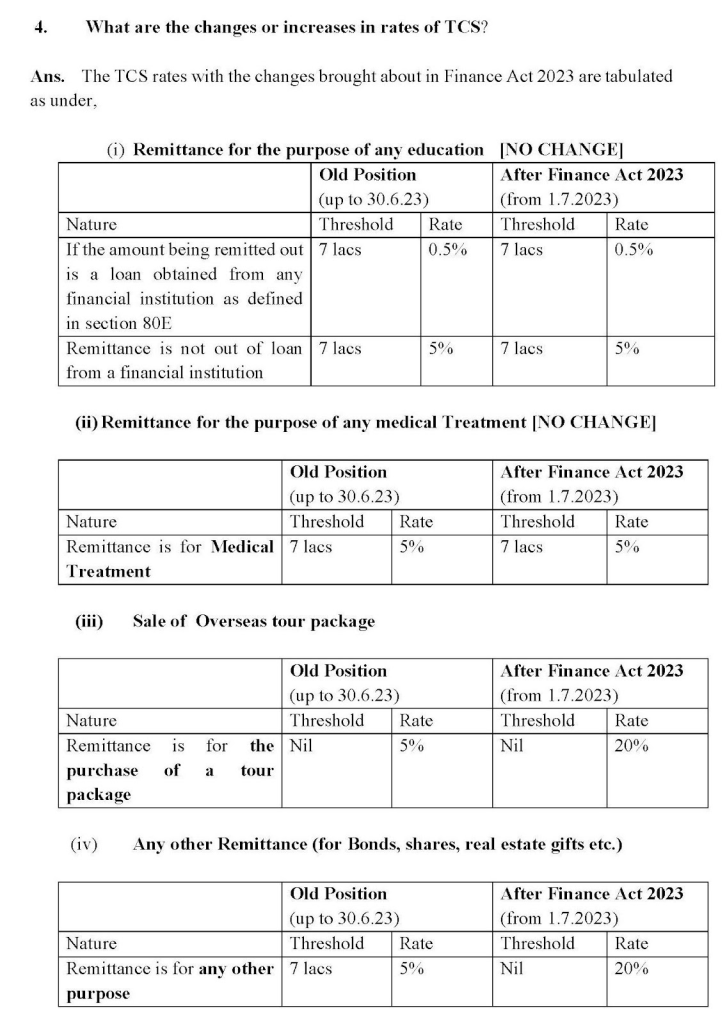

The ministry further clarifies on what transactions TCS will be levied. There has been no change in the rates of TCS on expenses done for the purpose of education and medical reasons. The TCS will be applied for expenses on overseas tour package and on buying bonds, shares, real estate, gift, etc internationally. You can see the changes in detail in the table given below.

For further clarification from the Finance Ministry, you can refer to the detailed explanation provided in the Twitter thread linked below.

What Could Be the Consequences of these changes?

As per an article published by Finshots, the new rules have the potential to create issues for the banking sector. The banks will now be required to monitor every transaction made by an account holder abroad, regardless of how small they may be. This includes even minor purchases such as a cup of coffee or a pack of chewing gum. Consequently, this move could intensify the burden on the banking sector, as they will now have to meticulously track both small and large transactions to ensure that the tax is collected systematically.

For instance, if you spend Rs. 250,000 while shopping abroad, you will be obligated to pay an additional Rs.50, 000 as TCS, resulting in a total expenditure of Rs. 300,000. However, you can reclaim this amount while filing your Income Tax Return (ITR), although it may take some time for the refunded amount to be credited back to you. Meanwhile, the government can utilize this cash until it is refunded to you. For individuals who are not considered High Net worth Individuals (HNIs), this amount holds significant value. Additionally, it is crucial to note that the refund may be partial, as it depends on the income tax slab under which you fall. If your annual income exceeds Rs. 12 lakh, you will not receive any refund since you already fall under the 20% tax slab.

These changes can also affect parents whose children are studying abroad as the remittances made towards their expenses can be subject to taxation under the law. In an article for the Indian Express, T.V. Mohandas Pai, the Chairperson of Manipal Global Education and former CFO of Infosys highlights that a significant portion of these remittances is meant for children’s education. This means that individuals who have accumulated savings over the years may need to make a substantial payment, even if they are not taxpayers themselves.

Furthermore, if you intend to purchase a product or service using a currency other than Indian rupees, you are likely to be charged a 20% TCS, even if the transaction is being conducted from within India.

In conclusion, the recent amendments in the Foreign Exchange Management Act (FEMA) rules regarding overseas spending through credit cards have sparked controversy and concern. The government intends to keep a check on international transactions and end the differential treatment met to Debit Card payments. However, these changes have prompted concerns about the potential strain on the middle class and the need to navigate the refund process and income tax slabs. As the new rules take effect, their consequences and implications for individuals and the banking sector will become clearer.

Title:Understanding the New TCS Rules and its Impact on International Transactions Using Credit Cards

Fact Check By: Harish Nair

Result: Explainer

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Fact Check News Click Here