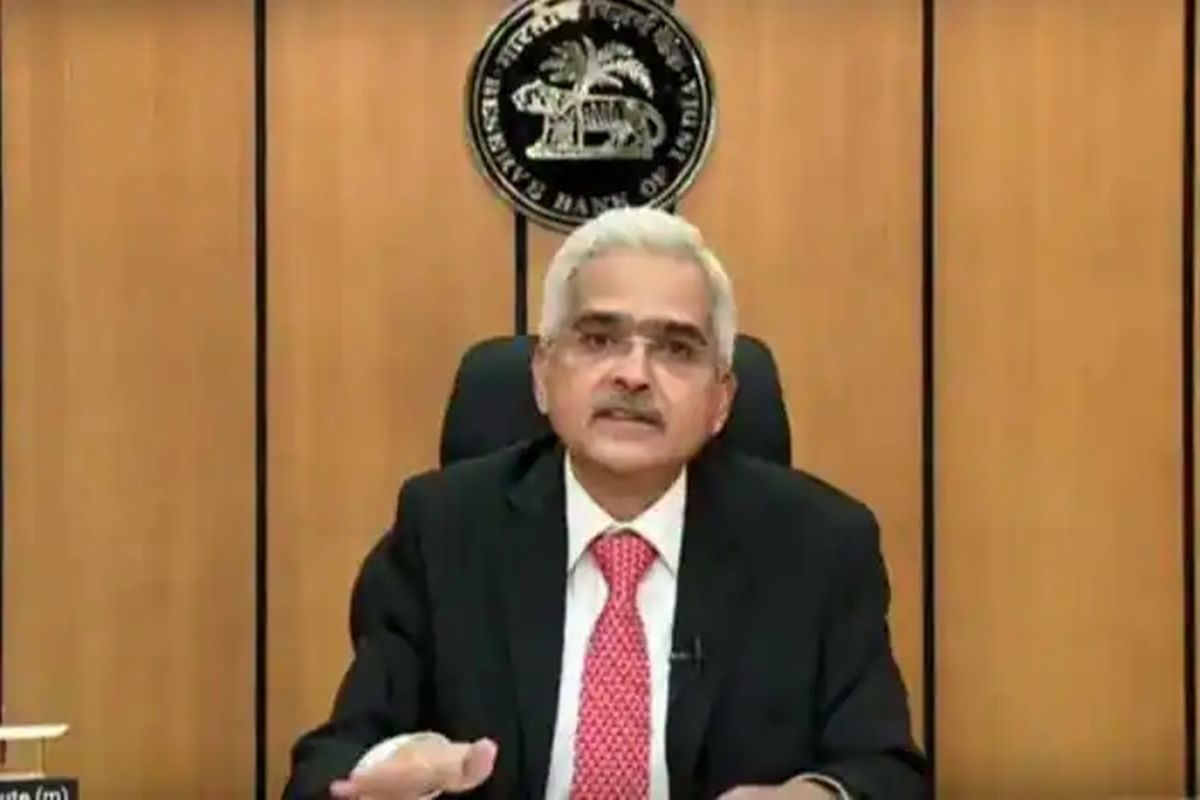

RBI Monetary Policy Latest Update: While making monetary policy announcements earlier in the day, RBI Governor Shaktikanta Das on Thursday said the RBI Digital Rupee will be launched in the year 2022-23. However, he added that the central bank cannot give a definite timeline as to when Digital Rupee will be released while cautioning investors that such assets have no underlying whatsoever, not even a tulip.Also Read – Home Loan, EMI, Fixed Deposit: How Will RBI’s Monetary Policy Impact Common Man | Explained

“We can’t predict a timeline for its release yet. Cryptocurrency is privately created and it is a threat to financial stability,” Das said. Also Read – RBI Monetary Policy: Key Takeaways From Announcements Made By Governor Shaktikanta Das

Saying that private cryptocurrencies are a threat to macroeconomic stability and financial stability, Das said they will undermine the RBI’s ability to deal with issues of financial stability and macroeconomic stability. He further added that it is his duty to caution investors, and told them to keep in mind that they are investing at their own risk. Also Read – RBI Leaves Repo Rate Unchanged at 4%, Projects Real GDP Growth at 7.8% FY 2022-23 | 10 Points

Notably, the digital rupee, being developed by the Reserve Bank, would be able to trace all transactions, unlike the current system of mobile wallet offered by private companies. However, the exact regulation governing this Central Bank Digital Currency (CBDC) is yet to be finalised.

How digital rupee different from normal rupee?

Talking about the digital rupee and the normal rupee, the RBI governor said that there would be no difference between the digital rupee and the normal currency. “There’ll be no difference between the Digital Rupee and the normal rupee,” he said.

During her Budget 2022 presentation on February 1, Finance Minister Nirmala Sitharaman had said that the Digital Rupee will be introduced by RBI using blockchain technology starting from 2022-23.

As per updates, the CBDC is a digital currency, but is not comparable to the private virtual currencies or cryptocurrencies that have mushroomed over the last decade. Moreover, the private virtual currencies do not represent any person’s debt or liabilities as there is no issuer.

Earlier in the day, the RBI kept the benchmark interest rate unchanged at 4 per cent and decided to continue with its accommodative stance in the backdrop of an elevated level of inflation. This is the tenth time in a row that the Monetary Policy Committee (MPC) headed by RBI Governor Shaktikanta Das has maintained the status quo.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here