The world’s two biggest publicly listed container shipping companies have defended plans to dish out multibillion-dollar payouts to shareholders, despite the threat of falling profits and pressure over low tax rates.

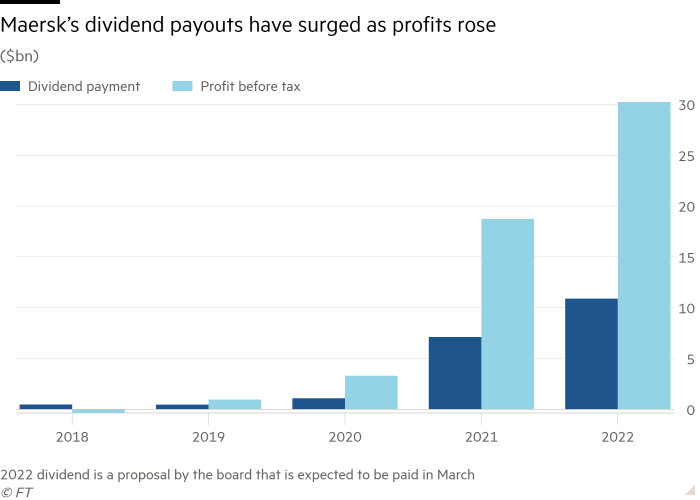

Danish group AP Møller-Maersk and German rival Hapag-Lloyd plan a combined $22.6bn dividend payout, more than 33 times the amount delivered in 2019.

Although the bumper payouts follow a record period for profits, earnings are expected to fall sharply this year as global trade declines because of the economic slowdown.

Both groups have forecast a roughly 70 per cent fall in profits for 2023, with their combined payout predicted to be at least 30 per cent higher than earnings this year.

Carrier profits have risen largely because of surging demand for online shopping during the height of the Covid-19 pandemic, as well as supply chain bottlenecks that sent the cost of delivering goods by sea soaring.

Maersk said its proposed dividend was equivalent to 37.5 per cent of its underlying profits for 2022, adding that this was “fully in line” with its policy of paying between 30 and 50 per cent of earnings.

Hapag-Lloyd’s chief financial officer Mark Frese, justifying the group’s planned €11.1bn dividend this month, insisted that the group still expected to maintain a net cash position.

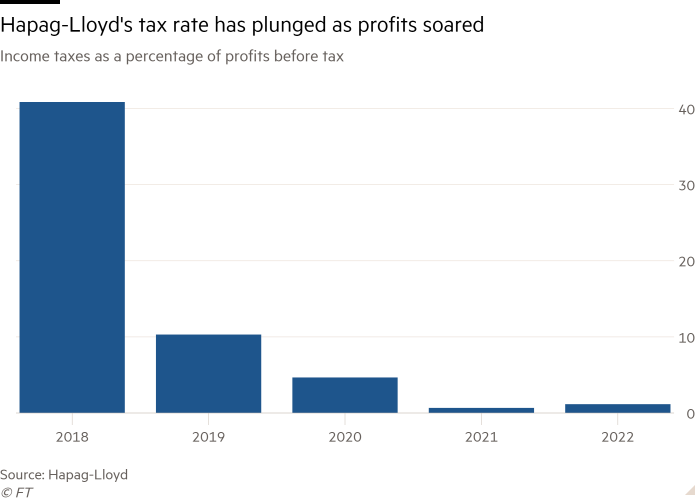

The payouts come amid criticism of the comparatively low tax rates the industry enjoys because of the way the levies are calculated.

Last year a group of French lawmakers proposed a 25 per cent tax on the “superprofits” accumulated by domestic carrier CMA CGM, privately owned by the billionaire Saadé family.

The calls by the lawmakers have resonance given oil majors ExxonMobil and Shell, which have been hit hard by windfall taxes, are forecast to pay out a combined $23.3bn this year, only a fraction above the combined dividends of Maersk and Hapag-Lloyd.

EU countries allowed shipping companies to be taxed on fleet capacity to stop them relocating to low-tax states. But this meant that as their profits soared, their effective tax rate plunged.

In 2022, Hapag-Lloyd’s tax payments were equivalent to just 1 per cent of its pre-tax profits compared with 10 per cent in 2019. Maersk’s effective tax rate fell from 49 per cent to 3 per cent over the same period.

“You could consider [this system] a tax subsidy, [but] it’s difficult to see the link between the tax subsidy and a societal benefit,” said Olaf Merk, a shipping researcher at the OECD’s International Transport Forum.

He pointed out that shipping had been exempted from an agreement on a global minimum 15 per cent corporate tax, decided during talks at the OECD, following lobbying by the industry.

“It blows my mind there’s such little taxation of the sector, so when they have these bumper profits they can just send them out to shareholders,” said Aoife O’Leary, chief executive of campaign group Opportunity Green.

Merk said more of the industry’s profits could have been invested in cutting emissions.

O’Leary said shipping groups “should be paying for their pollution”.

She added that the disappointing level of investment in greening the fleet was “not surprising”, given the absence of strong regulation forcing shipping to decarbonise.

Hapag-Lloyd’s Frese defended the tax system for shipping, saying it “works” and had supported the industry through difficult years when it struggled to turn a profit.

Maersk said tax rules were often up for discussion when profits were high, but added that shipping was a “cyclical industry” and it was the responsibility of politicians to make changes.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Business News Click Here