The clock is ticking for Uma Valeti. Several years ago, the cardiologist turned entrepreneur had promised to celebrate his daughter’s high school graduation with fried chicken made by his lab-grown meat start-up.

Valeti is now a step closer to fulfilling his promise thanks to a decision from the US Food and Drug Administration last month that Upside Meat’s chicken fillet was safe for human consumption. The company still has to jump through other regulatory hoops, but Valeti believes this will revolutionise his industry after years of scepticism about such products.

Several other lab-grown meat products are undergoing reviews by US and Singaporean food authorities, according to alternative protein advocacy group Good Food Institute, and investors and entrepreneurs are hopeful that Upside’s approval will lead to new types of meat entering a seemingly lucrative market. Consultants at McKinsey forecast the category to be worth $25bn by 2030 while Barclays predicts it will be valued at $450bn by 2040.

“Cultured” or “cultivated” meat can only be legally sold to consumers in Singapore at present after the first beef burger was produced in 2013 in the UK.

Greater consumption of plant-based produce made from soyabeans and peas, and lab-grown meat and insects, could contribute to a more sustainable food system. Traditional meat and dairy industries account for the bulk of emissions that come from food and agriculture.

The regulatory nod, however, comes as consumer interest for plant-based meat appears to have waned, with sales growth slowing down.

“Plant-based meat has been disappointing in terms of taste and texture and they’ve also generally been too expensive compared to [real meat],” said Alastair Cooper at venture capital firm ADM Capital, whose investment portfolio includes lab-grown and plant-based meat start-ups. “Consumers have also been put off by some plant-based products which they perceive to be highly processed,” he added.

Sales growth of plant-based meat, which soared by more than 40 per cent in 2020 in both the US and UK, have lost some momentum, according to consumer data groups Spins and Kantar. Retail sales by value fell 1.6 per cent in the first 10 months of 2022 in the US. In the UK they rose by 5 per cent compared with 14 per cent the year before.

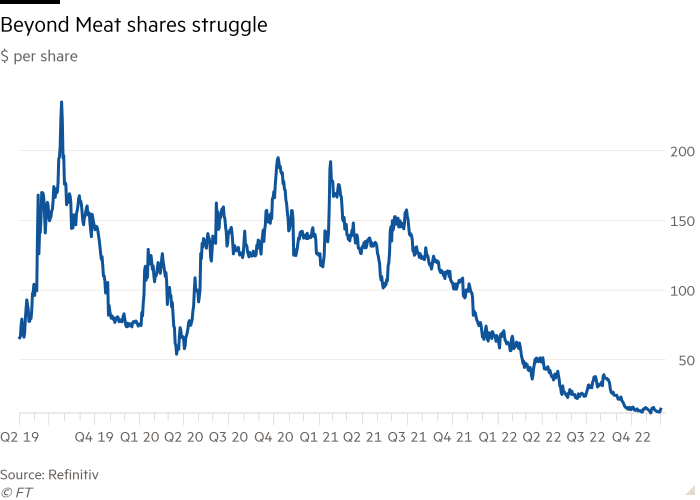

News from the sector has also been discouraging. Shares in Beyond Meat, the Nasdaq listed plant-based meat group have sunk as it downgraded its revenue outlook in the face of sluggish sales. Its stock price, once as high as $239.70, is now trading at around $15.

Meanwhile, JBS, a leading meat group headquartered in Brazil, closed its US plant-based meat business Planterra, while Canada’s Maple Leaf reduced the size of its venture, too.

A growing number of food-tech investors believe that lab-grown meat will help improve the current offering as well as enhance the taste of plant-based products, boosting their popularity. “Its technology can transform an average plant-based product,” said Rosie Wardle, co-founder of food-tech VC Synthesis, which backs Upside and plant-based meat company Redefine Meat.

“We don’t see 100 per cent cultivated meat being the mainstream,” she added. “The way things are going to is hybrid products. [Adding] just 5-10 per cent of cultivated meat makes a difference to a plant-based product.”

US start-up Eat Just’s chicken product, which is commercially available in Singapore, is 75 per cent lab-grown meat with the rest plant-based, while Dutch company Meatable is set to work with Singapore based Love Handle to research cultivated and hybrid meats.

While food companies wait for sweeping regulatory approval in the US, many are relying on diversifying their products with techniques like 3D printing.

The Israeli start-up Redefine Meat has developed a 3D printed plant-based meat range which includes steak and pulled pork, and is collaborating with upmarket eateries in Israel and Europe. Its products are being offered at about 1,000 outlets, including one London restaurant, where its realistic plant-based steak costs £32.50 a plate.

“We need to have more versatile products and a wider offer,” said Edwin Bark, Redefine’s senior vice-president. For new food products, “it’s never [a path] of linear growth”, said Bark, a former Nestlé executive who was in charge of its plant-based offering in Europe. He stresses the urgency of creating more alternative meat products as the world’s population and demand for meat grows.

Food industry experts are also cautious about how consumers will respond to meat grown in laboratories, with some executives concerned they might be put off by it. “Humans don’t eat technology,” said Julian Mellentin, director of consultancy New Nutrition Business. The investment community might be excited by innovation but “when it comes to putting things in their bodies, [technology] is a barrier [for consumers],” he added.

Consumer acceptance concerns loom large for Unilever’s ice-cream executives who are working with start-ups Remilk, Perfect Day and Algenuity. These companies create lab-grown protein using precision fermentation methods, where microbial hosts such as yeast are used as “cell factories” for producing ingredients such as dairy proteins.

The multinational, whose plant-based products account for 10 per cent of overall ice-cream sales, expects to launch synthetic dairy ice cream under one of its international brands — which include Magnum, Ben & Jerry’s and Wall’s — within one to two years.

Matt Close, president of the group’s ice cream division, which is the world’s largest maker of ice creams, said: “We’ve really got to think hard about how we position this industry to consumers, so that they see it as a positive choice and a force for good rather than . . . some kind of Frankenstein scientific monster,” he said.

According to some surveys, several respondents had thought that plant-based meat from the likes of Beyond Meat were lab-grown, said Alex Frederick, an analyst at corporate data group PitchBook.

Close agreed that a key challenge was marketing the products in the right way. “There is a positioning challenge. And I don’t mean [that] consumers don’t like the thought of it, but consumers don’t really know what it is.”

Even after significant growth in 2019 and 2020, plant-based meat is a small fraction of the overall market. If the cultivated meat industry meets projected growth for production capacity of up to 450,000 tonnes in five years, it will still constitute less than 0.1 per cent of global meat production, said Frederick.

Consumer acceptance and the ability to scale production is going to limit the growth of plant-based and lab-grown meats, some analysts believe. “This market is likely to be a premium for quite some time and is going to be niche,” said Mellentin. “It just takes people a long time to take on board really new foods.”

Backers of alternative proteins are unfazed. “This is a whole food system transformation that is going to happen over the next decade. It’s not going to happen overnight,” said Wardle.

Over at Upside, Valeti is eager to introduce the start-up’s products to consumers. Initially he plans to sell the cultured meat through restaurants then moving to retailers in three to five years.

“If we get this right, cultivated meat has unlimited upside potential,” he said.

Stay connected with us on social media platform for instant update click here to join our Twitter, & Facebook

We are now on Telegram. Click here to join our channel (@TechiUpdate) and stay updated with the latest Technology headlines.

For all the latest Health & Fitness News Click Here